Business

Average Mortgage Rates Decline Amid Economic Concerns

WASHINGTON, D.C. — Average mortgage rates have dipped slightly, providing some relief for prospective homebuyers facing high housing costs. As of June 5, 2025, the average 30-year fixed-rate mortgage rate is now 6.97 percent, down from 7.02 percent a week prior.

This decline comes as the U.S. economy shows signs of strain, particularly in the labor market. Analysts are closely watching economic indicators, including the upcoming jobs report, which may offer further insights into employment trends. New tariffs on steel and aluminum imports, which went into effect recently, could also impact various consumer prices, creating additional uncertainty in the market.

In recent months, home prices have reached record highs, with the National Association of Realtors reporting a median national price of $414,000 in April. As mortgage rates hover around 7 percent, many potential buyers are finding themselves priced out. Lawrence Yun, chief economist at NAR, noted, “Pent-up housing demand continues to grow, though not realized.”

For those considering refinancing, average rates for a 30-year fixed refinance mortgage stand at 6.89 percent, a slight decrease from previous weeks. Homeowners looking to lower their monthly payments or change their loan terms may benefit from refinancing in the near future.

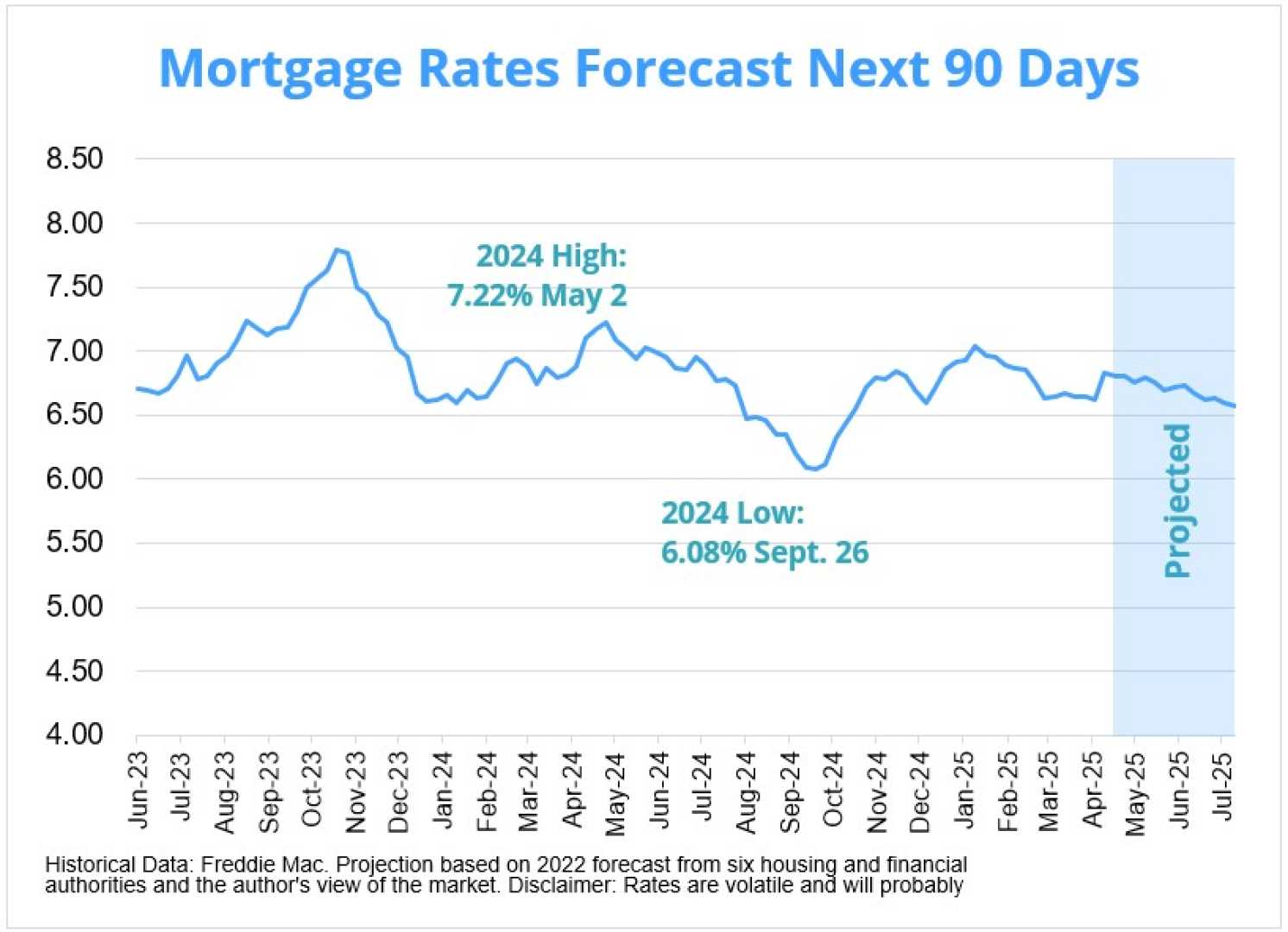

Moving forward, economists predict that while rates may fluctuate, they are likely to remain between 6 percent and 7 percent for the foreseeable future. Borrowers are encouraged to shop around and compare offers from various lenders for the best possible rates.