News

UK Banks Experience Major Online Banking Issues on Payday

LONDON, UK — Thousands of UK customers faced significant disruptions to their online banking services on Friday, coinciding with many individuals’ payday. Nationwide, Lloyds, Halifax, TSB, First Direct, and Bank of Scotland acknowledged issues that left users unable to access their accounts or make payments.

The problems began at approximately 7:40 a.m. GMT, as reports of outages surged on the Downdetector website, peaking with thousands of users unable to log into their banking apps. The strains experienced primarily involved mobile banking access, although some customers also reported complications with payment transactions.

Lloyds Banking Group, which encompasses Lloyds, Halifax, and Bank of Scotland, stated that it was aware of the issues affecting some customers’ access to online banking and apologized for the inconvenience. “We’re sorry for this, and we’re working to have everything back to normal,” a spokesperson said.

Nationwide confirmed that “some incoming and outgoing payments are delayed at the moment” but reassured customers that direct debits and standing orders were still operational. The bank urged customers not to resend payments, explaining that all transactions were queued and would be processed shortly.

One user took to social media, expressing anxiety over potential late fees for their credit card payment due to the banking outages. “Lloyds Bank being down on payday is not a fun combo,” they shared.

First Direct reported that it had resolved its issues by 9:50 a.m. GMT, allowing customers to resume normal payment activity. In contrast, analysts indicated that Lloyds customers were still experiencing access problems, impacting their ability to manage their accounts effectively.

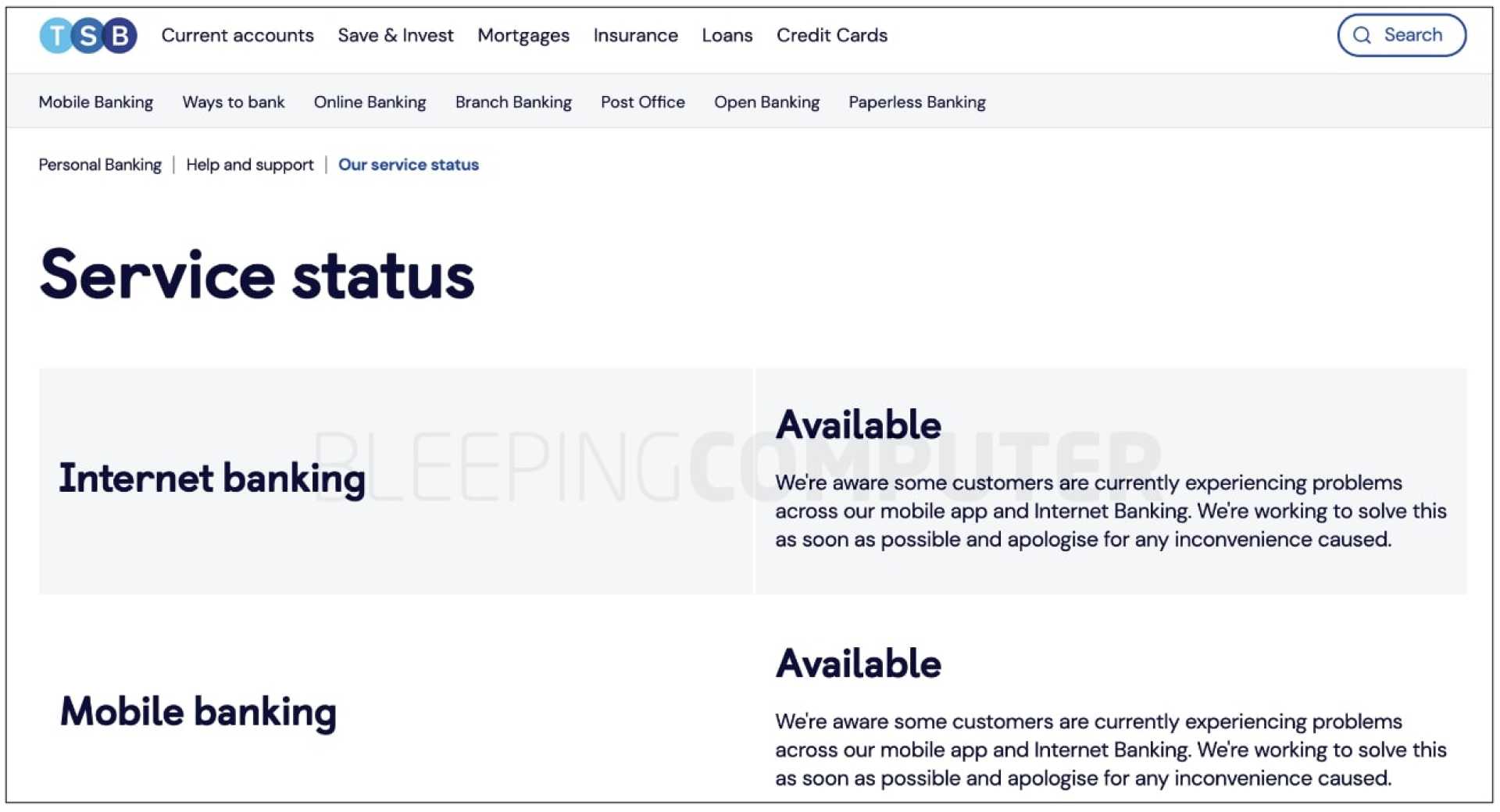

As the situation continued to unfold, multiple bank representatives acknowledged the disruptions or focused on resolving the issues. TSB issued a statement, noting that they were aware of widespread glitches with their mobile app and internet banking. “We apologize for this and are working hard to resolve it,” the bank said.

The persistent disruptions occurred amid scrutiny from the Treasury Committee, which has recently pressed major UK banks for explanations regarding prior IT failures. Committee members sought detailed responses on the impact of such outages, including how banks are managing to prevent future incidents.

Barclays and other banks had faced similar challenges in recent months, with industry experts suggesting that these repeated outages could be attributed to the high volume of transactions that coincides with payday alongside technological updating processes banks undertake during off-peak hours.

In the wake of continued banking problems, reports indicated that more than 4,000 users registered issues with Lloyds, while Halifax experienced over 3,000 reports. The affected banks emphasized that they are actively working to restore their services to normal operations.