Business

Berkshire Hathaway Doubles Investment in Constellation Brands

OMAHA, Nebraska — Berkshire Hathaway announced on May 15 that it has more than doubled its stake in Constellation Brands, the maker of Corona beer, as part of a strategic shift in its investment portfolio. The conglomerate disclosed the change in a regulatory filing detailing its stock holdings as of March 31.

Berkshire’s investment in Constellation grew to about 12 million shares valued at approximately $2.2 billion, up from 5.6 million shares at the end of 2024. This increase gives Berkshire a 6.6% stake in the company, causing Constellation’s shares to rise 2.7% after the announcement.

In contrast, Berkshire divested its stake in Citigroup after holding it for three years. It also reduced its investment in Bank of America from 1.03 billion shares last July to 632 million shares. Additionally, the company trimmed its stake in Capital One, which is set to acquire credit card issuer Discover Financial Services this weekend.

Berkshire’s quarterly stock disclosures typically do not attribute specific trades to Warren Buffett or his investment managers, Todd Combs and Ted Weschler, who usually manage smaller investments. It is known that Buffett has delegated more responsibilities to Greg Abel as he prepares for eventual succession.

Throughout the first quarter, Berkshire bought $3.18 billion and sold $4.68 billion in equities, marking the 10th consecutive quarter it has been a net seller of stocks. The company ended March with $347.7 billion in cash and cash equivalents.

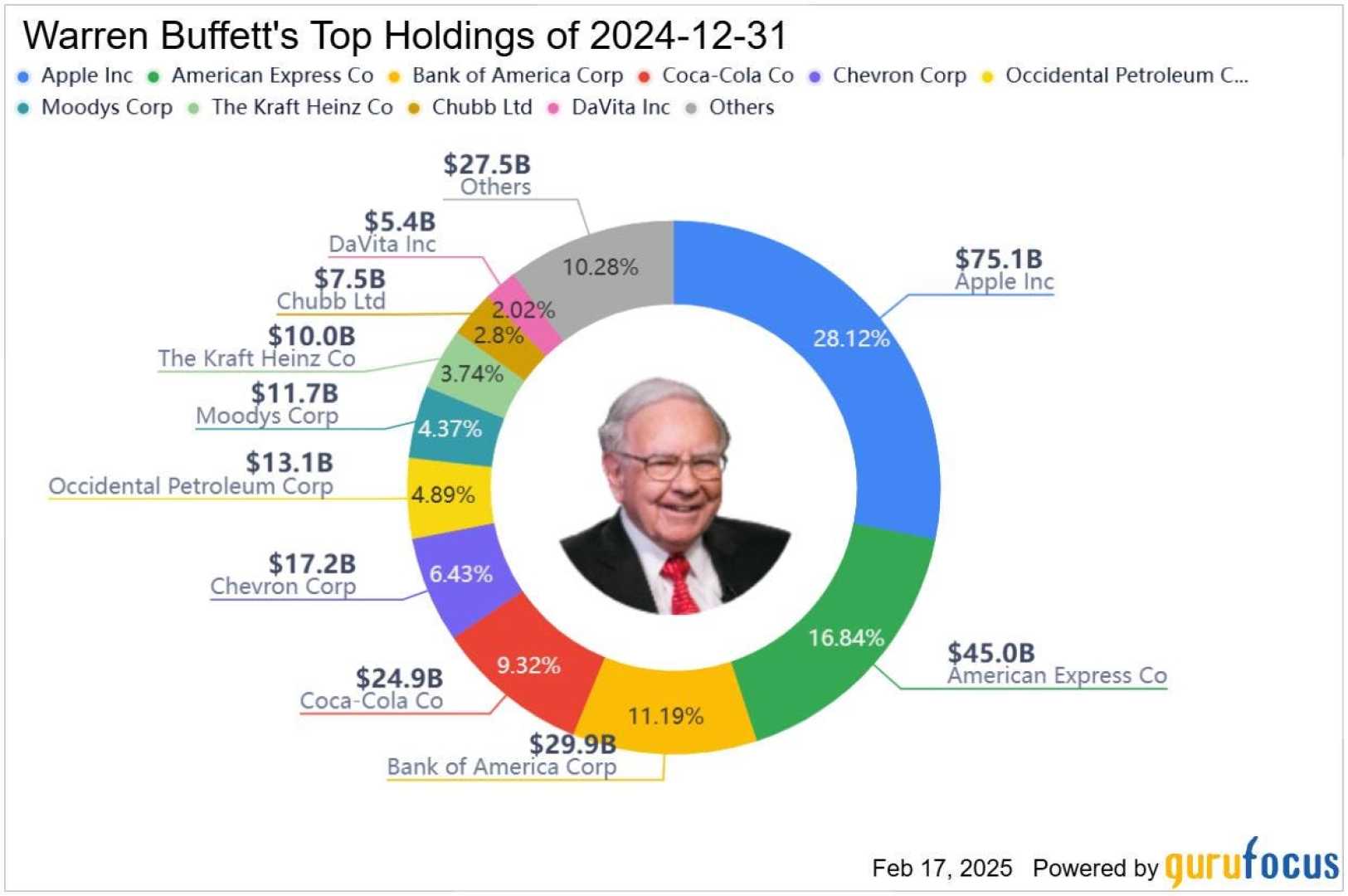

Berkshire maintained its largest position with 300 million shares of Apple, valued at $66.6 billion. The company also has investments in five Japanese trading houses.

During Berkshire’s annual shareholder meeting on May 3, Buffett addressed concerns about having excess cash, stating, ‘We have made a lot of money by not wanting to be fully invested at all times.’

Founded in Omaha, Nebraska, Berkshire Hathaway owns nearly 200 companies, including Geico, BNSF railroad, and various energy and retail businesses. Buffett, 94, is recognized globally as a leading investor, currently ranking as the world’s fifth-richest person with a fortune of $157.8 billion according to Forbes.

Greg Abel, now 62, is expected to succeed Buffett as CEO on January 1, 2026, while Buffett continues as chairman.