Business

Berkshire Hathaway, Streaming Stocks Shift as Market Reacts

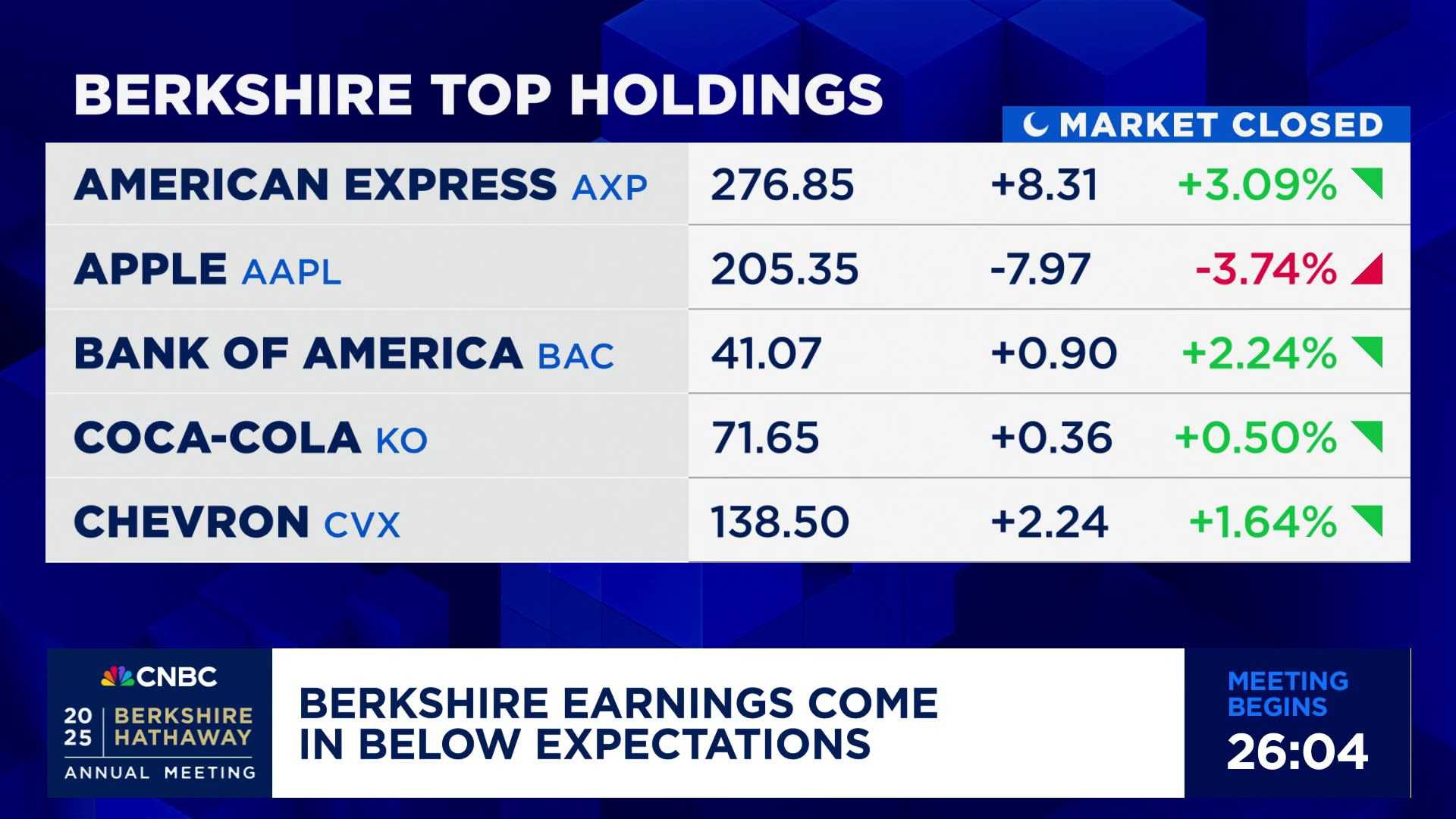

OMAHA, Neb. — Shares of Berkshire Hathaway fell more than 1% in premarket trading on Monday after the conglomerate reached a record high last Friday. This decline followed a report of a 14% decrease in operating earnings for the first quarter, largely due to a significant 48.6% drop in insurance-underwriting profit.

At Berkshire’s annual meeting over the weekend, CEO Warren Buffett, 94, announced his plans to step down by the end of the year. The board appointed Greg Abel as president and CEO starting January 1, 2026, while Buffett will remain as chairman.

In other market news, streaming companies experienced a downturn after President Donald Trump proposed a 100% tariff on foreign-produced movies in a post on Truth Social, aiming to revive the American film industry. Netflix shares dropped by 5%, Disney saw a 3% decrease, and Warner Bros. Discovery, Paramount, and Amazon experienced declines of 2%, 1%, and 1%, respectively.

United Airlines stock dipped by 1%, erasing part of Friday’s 7% gain. The airline announced it would reduce some flights from Newark, N.J., due to staffing and technology challenges at the airport.

Conversely, Howard Hughes Holding‘s stock surged by 8% after activist investor Bill Ackman‘s Pershing Square revealed plans to purchase 9 million newly issued shares at $100 each, marking a 48% premium over Friday’s closing price.

Shares of Sunoco fell nearly 1% following its announcement of plans to acquire Parkland Corp. in a deal worth $9.1 billion, which includes assumed debts.

Wolfspeed‘s stock rose 7%, extending its previous day’s rally of 24%. This increase came after the company reaffirmed its third-quarter guidance amid the announcement of CFO Neill Reynolds‘ departure.

Loews reported first-quarter earnings of $1.74 per share, lower than last year’s $2.05, but its revenue increased by 6% to $4.49 billion from $4.23 billion in the same period last year, boosting its stock by 0.6%.

Skechers USA’s stock surged approximately 26% in premarket trading after agreeing to be acquired by 3G Capital for $63 per share, marking a deal valued at more than $9 billion that will take Skechers private.