Business

BigBear.ai Faces Challenges Amid AI Market Growth

WASHINGTON, D.C. — BigBear.ai, a software specialist focused on AI solutions, is experiencing a challenging period in a rapidly expanding market. As of October 3, 2025, its stock is priced at $7.18, a decrease of 1.24% from the previous day.

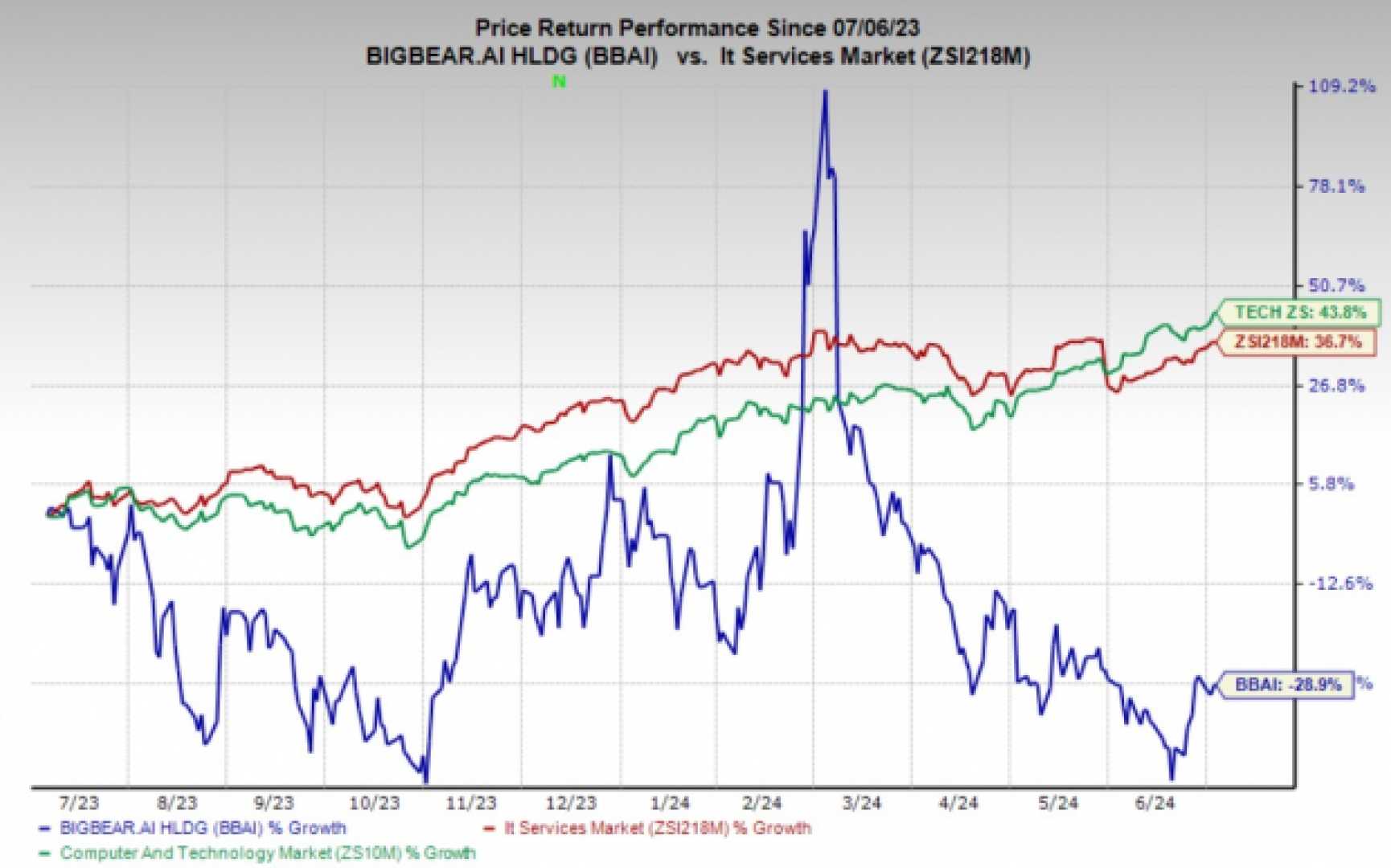

Despite a volatile stock ride this year, BigBear.ai has seen a 57% increase in value year-to-date. However, it remains 28.5% lower than its 52-week high achieved in mid-February, prompting investors to consider whether this decline presents a buying opportunity.

Similar to Palantir Technologies, BigBear.ai offers software that aims to enhance operational efficiency and productivity. Their product range includes tools for data analytics, cybersecurity, enterprise IT solutions, digital twins, and digital identity.

The demand for AI software is predicted to soar, with IDC estimating the market will generate $153 billion by 2028, up from $27.9 billion in 2023. Unfortunately, BigBear.ai’s recent earnings report shows a different reality, with revenue declining by 18% year-over-year to $32.5 million, leading to a doubled adjusted EBITDA loss of $8.5 million in the second quarter.

Although BigBear.ai boasts a revenue backlog of $380 million — a 43% increase from the previous year — concerns linger. Most of this backlog comes from government contracts, and only 4% is funded. The rest relies on customer discretion, reducing revenue visibility going forward. Additionally, the company has cut its full-year revenue forecast by 19%, suggesting the stock may remain under pressure.

The company has recently had some positive news, such as the deployment of its enhanced passenger processing solution at Nashville International Airport, which gives investors a glimmer of hope for increased business. However, the impact on financial performance remains uncertain.

Currently, BigBear.ai’s 12-month median price target of $6 indicates a potential drop of 7% from its current price. This estimate aligns with revised growth predictions that have significantly dipped. The stock is trading at 12 times sales, much higher than the Nasdaq Composite index’s ratio of 5, making it seem overvalued amid declining sales forecasts for the year.