Business

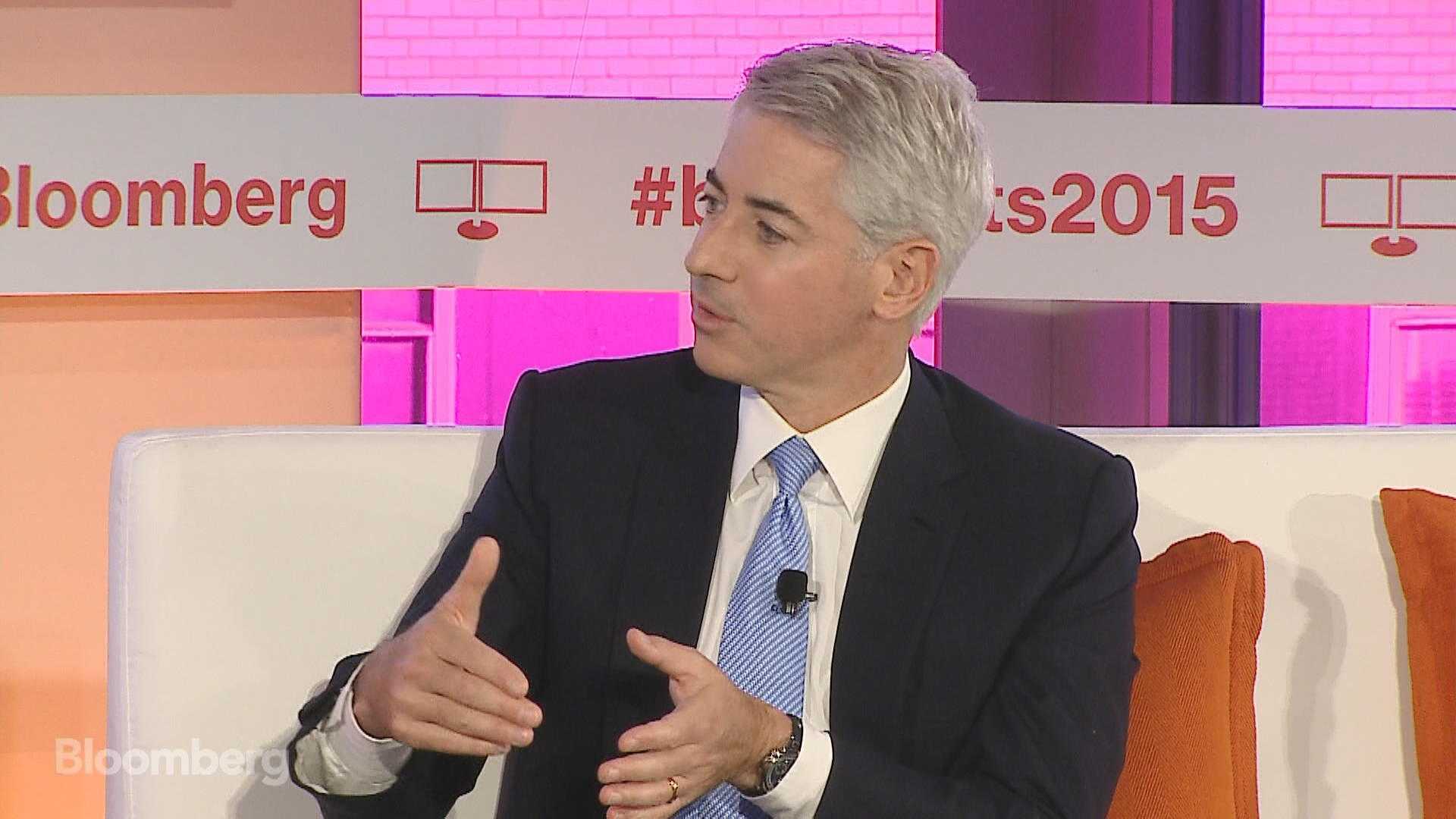

Bill Ackman Raises Howard Hughes Takeover Bid to $90 per Share

NEW YORK, Nov. 28, 2023 — Bill Ackman, CEO of Pershing Square Capital Management, has increased his offer to acquire Howard Hughes Corporation, proposing $90 per share to current shareholders. This new offer reflects a rise from the previous bid of $85 per share announced in January. If successful, Ackman’s firm will hold a 48% stake in the Texas-based real estate developer.

The announcement comes amidst mixed market reactions; shares of Howard Hughes fell nearly 5% in extended trading after the news broke, despite closing up 6.8% at $80.60 earlier in the day. Ackman, who aims to assume the roles of chairman and CEO at Howard Hughes, emphasized a long-term investment strategy, stating that Pershing Square intends to retain all acquired shares.

“We will make available the full resources of Pershing Square to HHH to build a diversified holding company, or one could say, a modern-day Berkshire Hathaway,” Ackman wrote on social media platform X. His ambition for the new Howard Hughes includes acquiring controlling interests in both private and public companies that meet Pershing Square’s standards for business quality.

Ackman referenced the career trajectory of Berkshire Hathaway CEO Warren Buffett, known as the “Oracle of Omaha,” who transitioned from being an activist investor to controlling a massive conglomerate. Today, Berkshire Hathaway boasts a valuation exceeding $1 trillion, holding diverse businesses in sectors such as insurance, energy, and retail, along with significant cash reserves.

On the development front, Ackman assured that Howard Hughes would continue its focus on creating and managing master-planned communities, including The Woodlands in Houston and Summerlin in Las Vegas. “Owning small and growing MPCs that will eventually become large cities in pro-business markets is a great long-term business,” he stated. He added, “It’s a lot better than a dying textile company,” highlighting the strategic shifts he envisions for Howard Hughes.