Business

Bitcoin Hits Record $109,000 Ahead of Trump Inauguration

NEW YORK, N.Y. — Bitcoin (BTC) surged to an all-time high of $109,333 during Asian trading hours on Monday, Jan. 20, 2025, as investors anticipated Republican Donald Trump‘s inauguration later that day. The cryptocurrency’s record-breaking performance coincided with gains in the U.S. stock market and the launch of memecoins tied to Trump and his wife, Melania.

Trump, who has been a vocal supporter of cryptocurrencies during his campaign, highlighted Bitcoin’s rise in a statement. “Since the election, the stock market has surged and small business optimism has soared a record 41 points to a 39-year high. Bitcoin has shattered one record high after another,” he said.

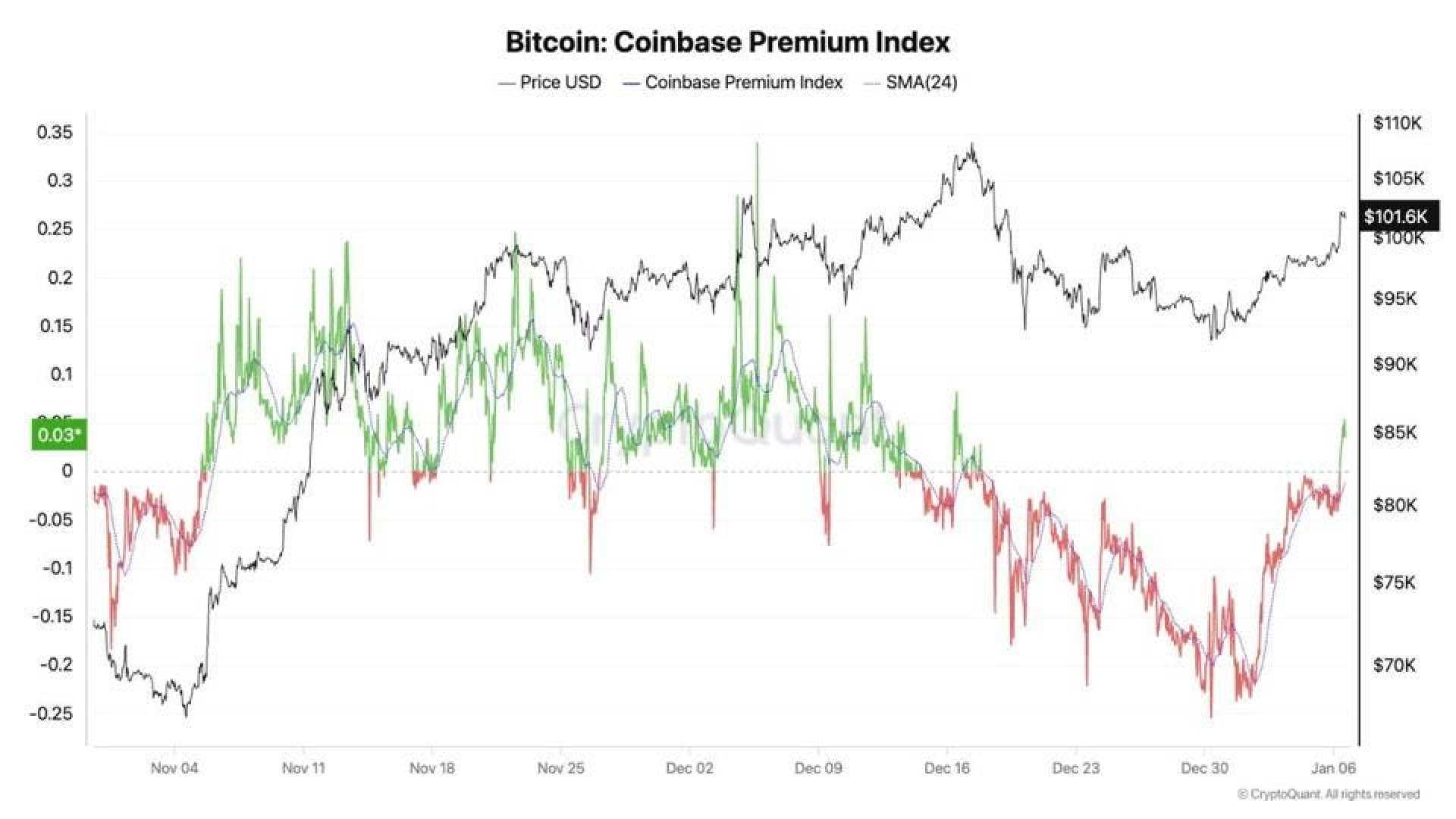

The cryptocurrency initially dipped to nearly $100,000 earlier in the day, down from a high of over $102,000 on Sunday, as Melania Trump‘s memecoin drew liquidity away from major assets. However, Bitcoin quickly reversed its losses, fueled by investor optimism surrounding Trump’s pro-crypto policies.

Ben El-Baz, Managing Director of HashKey Global, noted, “Bitcoin reached $108K while other cryptocurrencies have rapidly pumped on the eve of the U.S. presidential inauguration, with hopes that new policies and regulators will send the price of BTC much further this year as the U.S. economy continues to show strength in the long term.”

Jeff Mei, COO at BTSE, added, “Designating crypto as a national priority and launching TRUMP coin over the past few days have been strong, positive signals. As the main bellwether for the industry, Bitcoin’s surge was expected and is likely to continue through the week.”

Bitcoin’s dominance in the cryptocurrency market has also risen, approaching 60%, its highest level since Dec. 20. The gap between Bitcoin and Ethereum (ETH) has widened significantly, with a $1.75 trillion market cap differential — the largest ever recorded.

Analysts predict Bitcoin could reach as high as $250,000 by the end of the year, driven by continued investor confidence and Trump’s commitment to making the U.S. the “crypto capital of the planet.”