Business

Bitcoin Hits $100,000 as Trump Pushes National Crypto Reserve

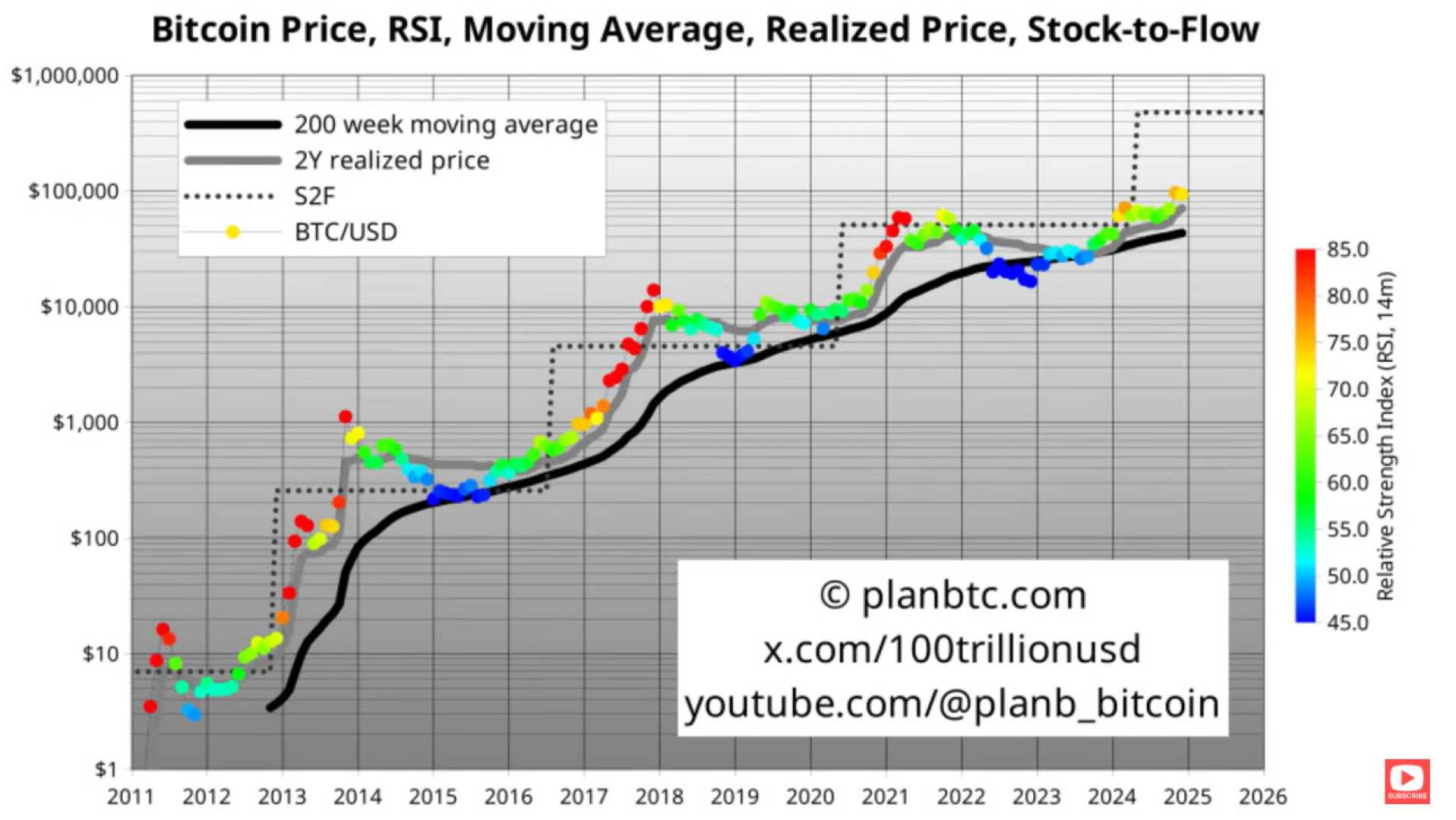

WASHINGTON, D.C. — Bitcoin surged past $100,000 per coin this week, reaching a new all-time high as President Donald Trump‘s administration moves forward with plans to establish a national cryptocurrency reserve. The milestone comes amid growing speculation about bitcoin’s potential to rival gold as a global economic standard.

Brian Armstrong, CEO of Coinbase, one of the largest cryptocurrency exchanges, has predicted that bitcoin’s market capitalization could surpass gold’s $18 trillion valuation within the next decade. “Any country with gold reserves should be holding at least 11% of that amount in bitcoin reserves,” Armstrong stated on social media platform X. “I believe in the next five to 10 years, bitcoin’s market cap will likely surpass gold.”

Trump’s administration has prioritized cryptocurrency policy reform, forming a working group to explore the creation of a national digital asset stockpile. The group will evaluate the potential for a reserve derived from cryptocurrencies seized by federal law enforcement. The U.S. currently holds over 200,000 bitcoin, valued at approximately $21 billion, alongside smaller amounts of other cryptocurrencies.

In a recent interview with CNBC, Trump emphasized the importance of leading in the digital economy. “We’re gonna do something great with crypto because we don’t want China, or anybody else, to get ahead,” he said. “Others are embracing it, and we want to be ahead.”

Armstrong has endorsed the idea of a U.S. bitcoin reserve, calling it a pivotal step toward global economic freedom. “The next global arms race will be in the digital economy, not space,” he wrote. “Bitcoin could be as foundational to the global economy as gold and will become central to national security.”

Speaking at the World Economic Forum in Davos, Armstrong predicted that bitcoin’s price could reach “multiple millions” as other G20 nations follow the U.S. lead. “If the U.S. took that path, probably the rest of the G20 would follow,” he said. “Bitcoin is going to be the new gold standard, but crypto is really much bigger than that too.”