Business

Bitcoin Market Sees Short-Term Losses, Potential Buying Opportunity

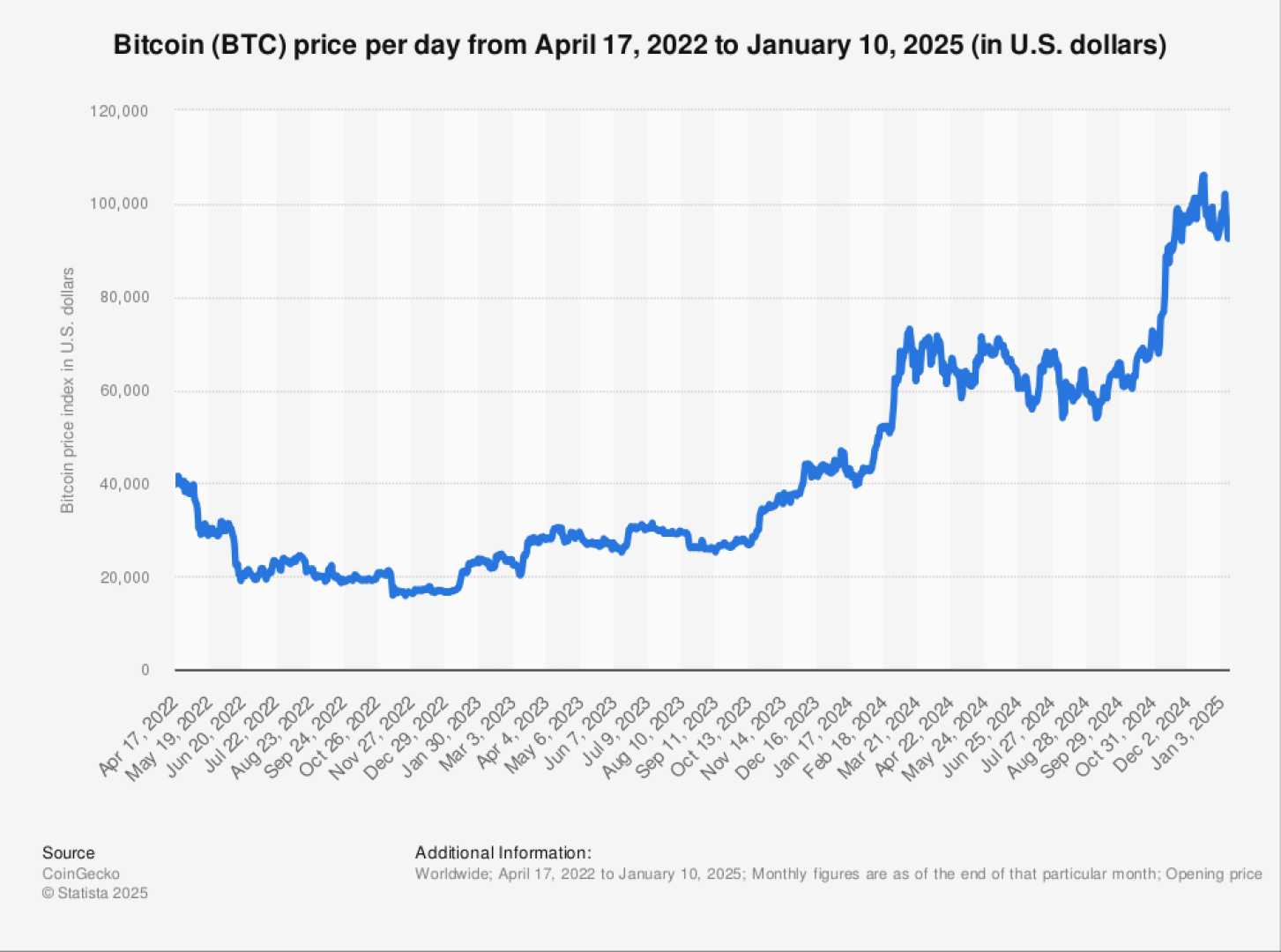

Bitcoin (BTC) experienced a volatile week, with prices fluctuating between $90,000 and $120,000, as economic data and profit-taking dampened an early rally. Onchain data reveals that Bitcoin’s Spent Output Profit Ratio (SOPR) has risen to 0.987, indicating that short-term investors are selling at a loss. Historically, such scenarios have often preceded price recoveries, suggesting a potential buying opportunity for long-term investors.

According to CryptoQuant contributing analyst Mac_D, short-term investor pain often creates favorable conditions for accumulation. “If there is further decline from the current price, smart investors will likely accumulate the coins sold cheaply by short-term investors,” Mac_D said. Other indicators, such as the Market Value to Realized Value (MVRV) ratio and the Puell Multiple, also suggest that the market has not yet peaked, with a short-term investor ratio of 60% pointing to continued bullish potential.

SOPR measures the profit or loss of spent Bitcoin outputs by comparing their value when last moved to their value when spent again. A short-term SOPR value below 1 often signals capitulation or a market bottom, potentially indicating a good time to buy. Meanwhile, MVRV compares Bitcoin’s market cap to its “realized cap,” which values each Bitcoin at the price it last moved, helping to gauge whether the asset is overbought or oversold.

Bitcoin’s price neared $95,000 on Friday morning in Europe after a slump in U.S. trading hours sent it to near $90,000 late Thursday, marking a 10% drop from its weekly high above $120,000. The decline followed a surge in U.S. treasury yields, driven by stronger-than-expected economic data, including the Institute for Supply Management (ISM) report on U.S. service providers. The report showed the prices-paid measure reaching its highest point since early 2023, leading to a drop in equities and risk assets like Bitcoin.

Traders are now awaiting the release of U.S. non-farm payrolls (NFP) data later Friday, which could influence market sentiment. Strong NFP numbers typically indicate a robust economy, potentially leading to interest rate hikes that are unfavorable for risk assets like Bitcoin.

Despite the volatility, long-term holders appear to be holding steady, with 86.53% of coins transferred to exchanges being under a day old, according to recent data. This intense short-term trading activity highlights the resilience of long-term investors and underscores the potential for market stability as short-term traders exit their positions.