Business

Bitcoin Miners Shift Focus to AI Amid Market Volatility

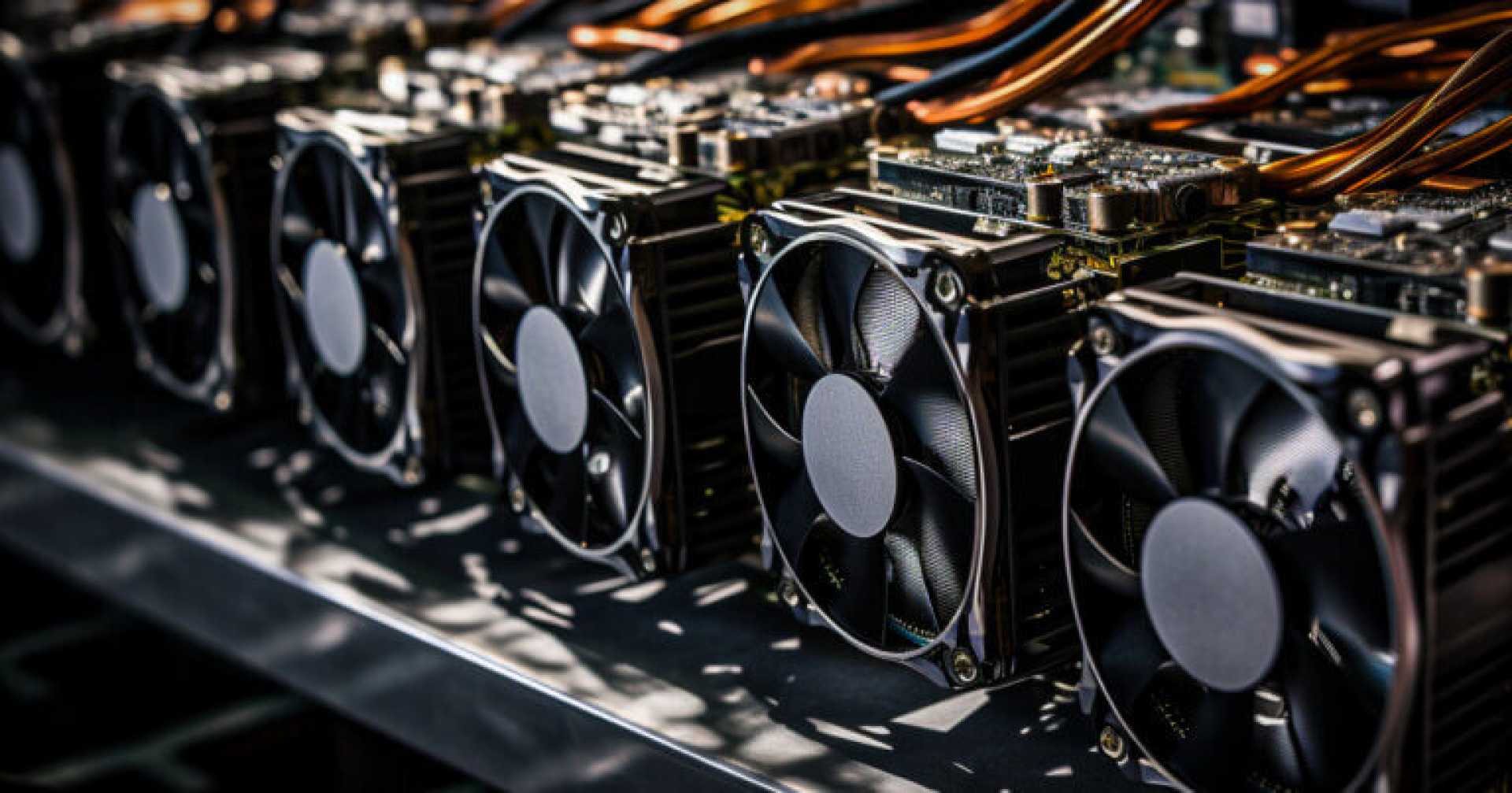

NEW YORK, NY — As the cryptocurrency landscape shifts, several Bitcoin mining companies are pivoting towards artificial intelligence (AI) to generate revenue amid declining profits. The trend began as the Bitcoin reward halving cut block rewards to 3.125 Bitcoin in early 2024.

Some firms cautiously entered the AI space, while others committed significant resources, retooling mining rigs and signing multi-million dollar contracts. Reports indicate this shift has helped some companies survive the increasingly tough market.

Core Scientific, for example, filed for bankruptcy in late 2022 but emerged in early 2024, transitioning from Bitcoin mining to offering colocation services for AI companies. In June 2024, Core Scientific signed a 12-year deal to host CoreWeave‘s high-performance computing operations.

However, the company faced financial challenges, reporting Q1 revenue of $79.5 million—down from $179.3 million a year prior. Core Scientific attributed its losses to the Bitcoin halving and its operational shift. Despite these issues, rising Bitcoin prices have somewhat eased its financial burden.

Hut 8 also made significant investments in AI, launching a new subsidiary called Highrise AI in September 2024. The firm purchased over 1,000 specialized Nvidia chips to bolster its AI cloud services. By Q1 2025, Hut 8’s Bitcoin mining output had dropped to 716 BTC, with CEO Asher Genoot emphasizing a strategic focus on expanding their AI offerings.

Meanwhile, Iren, an Australian crypto miner, introduced Nvidia GPUs for AI capabilities, generating $3.6 million in AI cloud revenue by mid-2025. They are also developing a new liquid-cooled AI data center in Texas.

Hive, another player in the market, has been ramping up AI efforts since 2023 and reported $10.1 million in revenue from AI and high-performance computing hosting in 2025. This figure tripled from the previous year.

Despite these advancements, major miners like Riot Platforms and MARA Holdings are exploring a shift towards AI and high-performance computing but still lean heavily on Bitcoin mining for revenue stability. Riot Platforms mined significantly more Bitcoin in early 2025, generating $142.9 million in Q1 alone.

While some companies are successfully exploring new avenues, others, like Canaan, remain focused solely on mining hardware development as the AI hype continues to resonate throughout the sector.

As the intersection of Bitcoin mining and AI expands, the true impact and viability of these ventures remain to be seen in the ever-evolving market.