Business

Bitcoin Poised to Hit New All-Time High Amid US Presidential Election and Monetary Policy Expectations

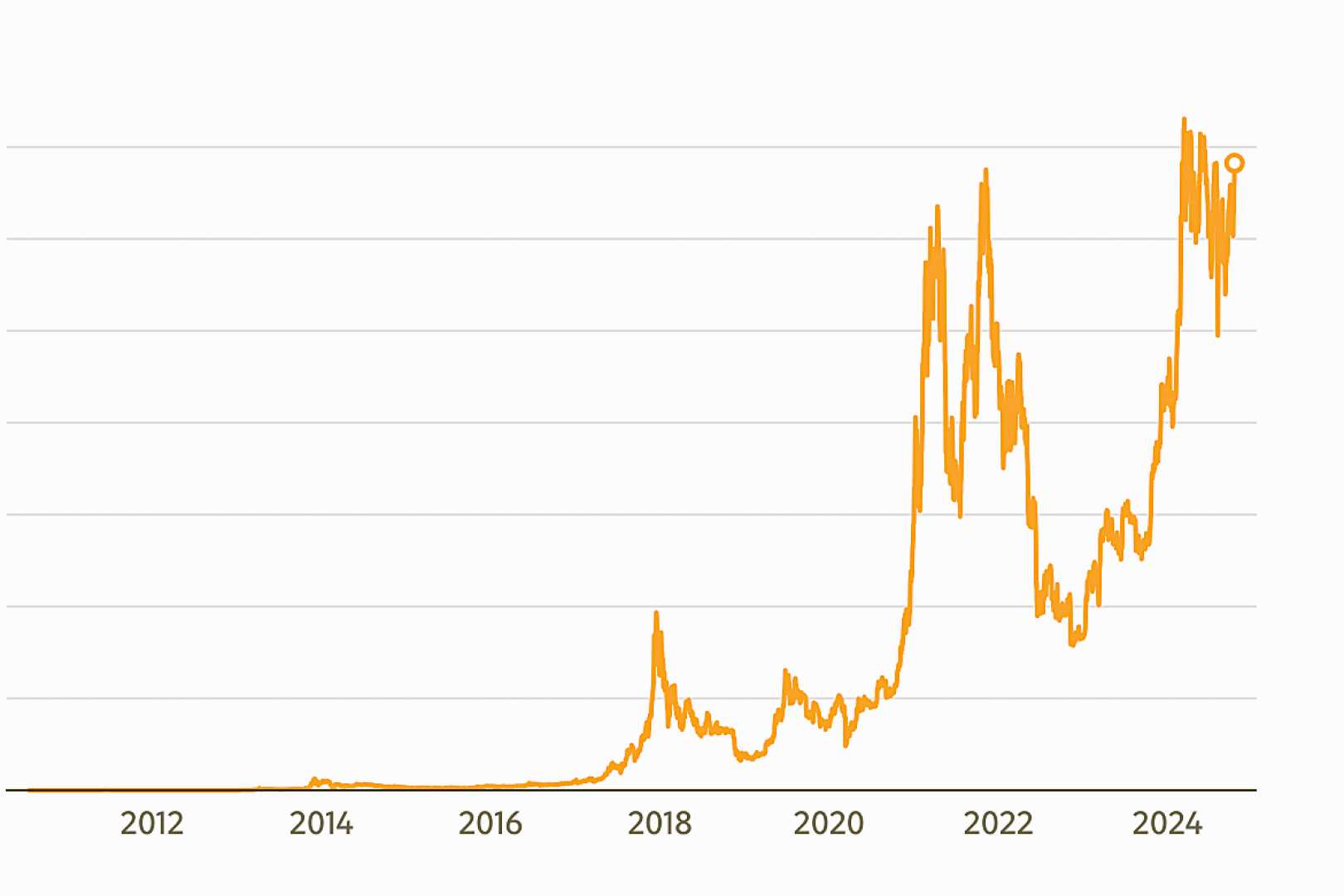

The price of Bitcoin is on the verge of reaching a new all-time high, driven by several key factors including the upcoming US presidential election and anticipated monetary policy adjustments. According to digital asset fund manager Merkle Capital, Bitcoin has a strong chance to hit a new record high this month, supported by expectations of further US policy rate reductions by the Federal Reserve in November and December.

As of the latest updates, Bitcoin has been trading near $70,000, with a brief surge to $70,522.84 earlier this week. This is just 5% off its all-time high of $73,797.68. The cryptocurrency saw a 3% increase to $70,053.56 on Tuesday, influenced by a rise in stocks and anticipation of the election results.

The US presidential election is a significant factor, with investors closely watching the outcome. A victory for former President Donald Trump is seen as potentially favorable for Bitcoin, as he has expressed public support for the crypto market. In contrast, a win for Vice President Kamala Harris might lead to short-term volatility and potential downside moves, although long-term growth is still expected.

Technical analysis suggests that Bitcoin needs to hold crucial support levels, such as the $69,000 zone, to aim for a new all-time high. If this level holds, the market could see a significant rally. However, a breakdown could lead to a correction towards the $64,000 level.

Institutional investors have been increasingly confident in crypto, with Bitcoin investment rising by more than $2.8 billion last month. This confidence, coupled with the expectation of a crypto-friendly regulatory environment under a Trump presidency, could further boost the market.

The broader crypto market, including Ethereum and other assets, is also expected to benefit from these factors. Ethereum’s price has risen 13% this month, and its spot exchange-traded fund has soared by more than 30%, driven largely by institutional investors.

Despite the short-term volatility expected around the election, analysts believe that Bitcoin’s long-term outlook remains strong. Historical data shows that Bitcoin has seen significant returns in the 90 days following past presidential elections, partly due to Federal Reserve policy shifts and the halving of Bitcoin supply.