Business

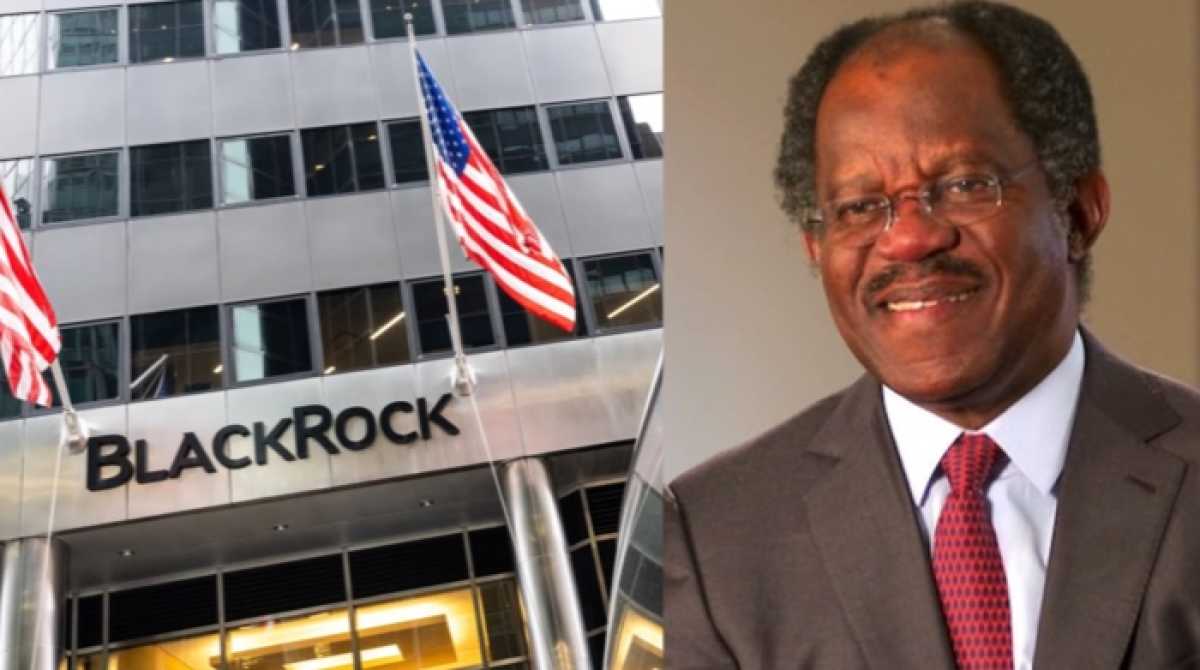

BlackRock Acquires Global Infrastructure Partners in $12.5bn Deal

BlackRock, the biggest asset management company in the world, has announced its acquisition of Global Infrastructure Partners (GIP) in a $12.5bn deal, founded by Nigerian investment banker Adebayo Ogunlesi. This move makes Ogunlesi and five other co-founders the second biggest shareholders in BlackRock, with the company paying $3bn in cash and offering them 12 million shares. The transaction aligns with BlackRock’s goal to become a key player in the private and alternative asset market.

The completion of the deal will see Adebayo Ogunlesi join BlackRock’s board as chairman and CEO. The combined businesses, with over $150 billion in assets, will provide clients with a broader range of services and expertise across equity, debt, and solutions. This acquisition enables BlackRock to enhance its origination and asset management capabilities.

Infrastructure assets under BlackRock’s ownership will include airports in England and Australia, wastewater services in France, and liquefied natural gas in the US. As institutional investors seek long-term investments in digital infrastructure and low-carbon energy, the need for such assets has grown substantially.

BlackRock’s CEO, Larry Fink, stated that infrastructure is an exciting opportunity due to ongoing structural shifts in the global economy. This acquisition comes as BlackRock looks for game-changing investments to boost revenues after facing challenges to its corporate governance and environmental practices in the US.

A change in BlackRock’s management team was also announced, with Stephen Cohen taking over as chief product officer and Salim Ramji leaving the position of global head of iShares and index investments. The company is forming a new global business organization led by Rachel Lord, encompassing Europe, the Middle East, India, and Asia Pacific.

Following the acquisition’s completion, GIP Chairman Bayo Ogunlesi and five other founding partners will become directors of BlackRock, further strengthening the company’s leadership.

Goldman Sachs CEO David Solomon confirmed that Ogunlesi will resign from the Goldman Sachs board following his move to BlackRock. CFRA analyst Cathy Seifert mentioned that this transaction brings new contenders to potentially succeed Larry Fink, who has not yet named a successor at the age of 71.

This news article was written by Ozioma Samuel-Ugwuezi.