Business

BlackRock’s Bitcoin ETF Sees Record $4.2 Billion Trading Volume

New York, NY — BlackRock‘s spot Bitcoin ETF, IBIT, achieved a record-breaking $4.2 billion in trading volume on April 22, 2025, coinciding with Bitcoin’s price rally to $91,739, its highest in a month.

According to data from Barchart, IBIT traded 81,098,938 shares, closing at $52.08. The surge in trading volume came as Bitcoin rose above $91,000 for the first time since early March. This price increase follows a low of $75,603 on April 8.

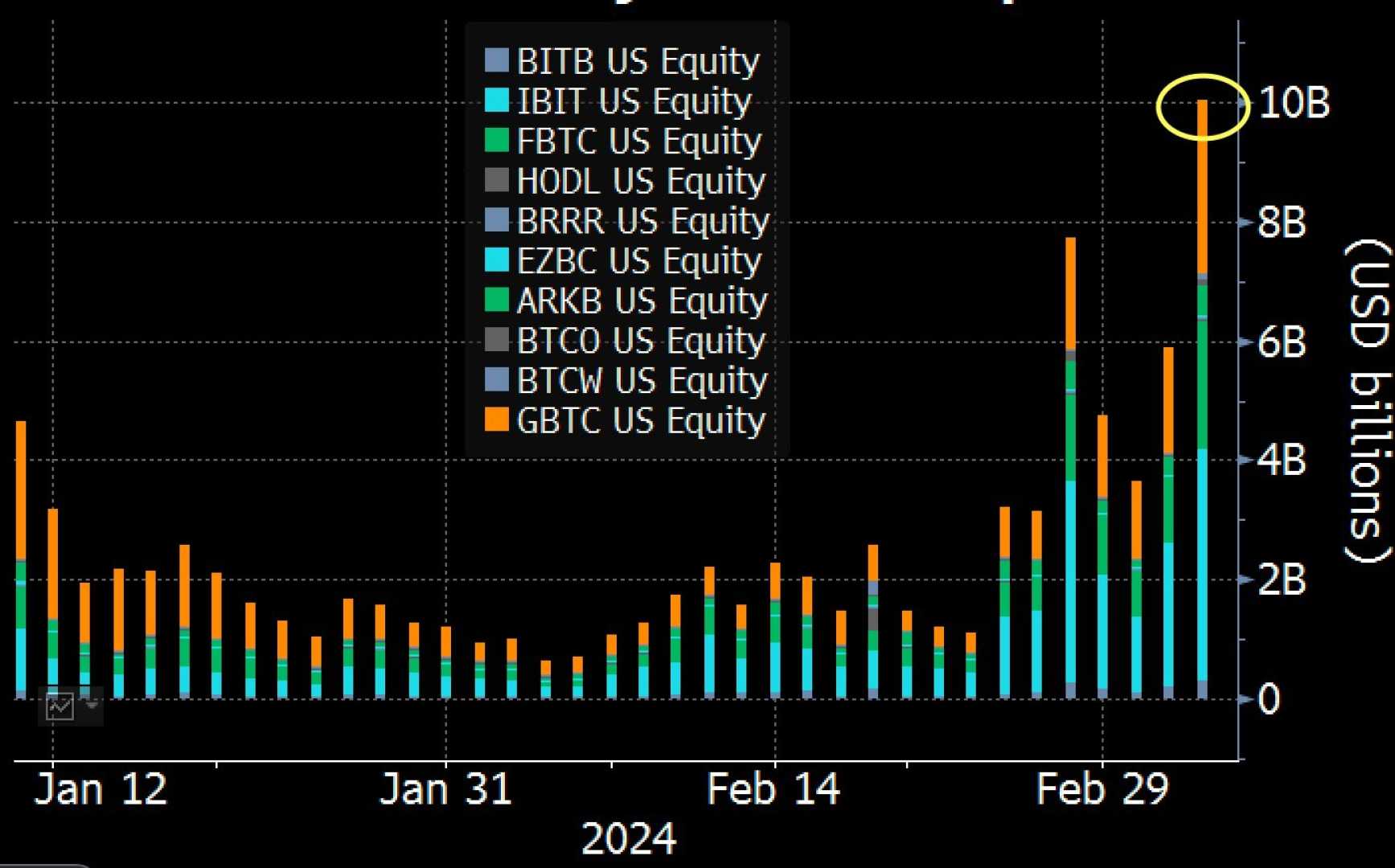

The rising activity in the ETF market points to renewed buying pressure, especially from institutional investors. Other notable ETFs also experienced significant trading, with Fidelity‘s spot Bitcoin ETF, FBTC, recording $425.17 million in volume, Grayscale‘s GBTC at $250.91 million, Ark Invest‘s ETF with $170 million, and Bitwise‘s fund at $120 million.

Earlier in the day, IBIT also reached an all-time high when compared to the Nasdaq index, showcasing growing investor confidence in both the ETF and Bitcoin itself. High trading days like this often reflect strong inflows, although exact net inflow figures will be published later in the day.

The surge in price and trading volume is not only driven by retail speculation but also by fundamental demand from institutional buyers. Public companies are increasingly treating Bitcoin as a reserve asset. Notably, Michael Saylor‘s MicroStrategy recently acquired 6,556 more BTC.

Other companies, such as Semler Scientific, are also embracing the trend, holding over 1,100 BTC and raising another $500 million for further acquisitions. GameStop is entering the Bitcoin market, raising $1.5 billion for a treasury strategy known as “Project Rocket.”

These corporate moves are further amplifying demand, pushing Bitcoin’s price upward. The combination of institutional buying and corporate adoption suggests a powerful feedback loop may be forming, reinforcing Bitcoin’s position as a valuable investment asset and long-term store of value.