Business

BlackRock Hits Record $11.6 Trillion in Assets Amid 21% Profit Surge

NEW YORK — BlackRock, the world’s largest asset manager, reported a record $11.6 trillion in assets under management in the fourth quarter of 2023, marking a 21% jump in profits fueled by stronger equity markets and strategic acquisitions.

The New York-based company saw its assets grow to $11.55 trillion, up from $10.01 trillion a year earlier and $11.48 trillion in the previous quarter. Net income rose to $1.67 billion, or $10.63 per share, compared to $1.38 billion, or $9.15 per share, in the same period last year.

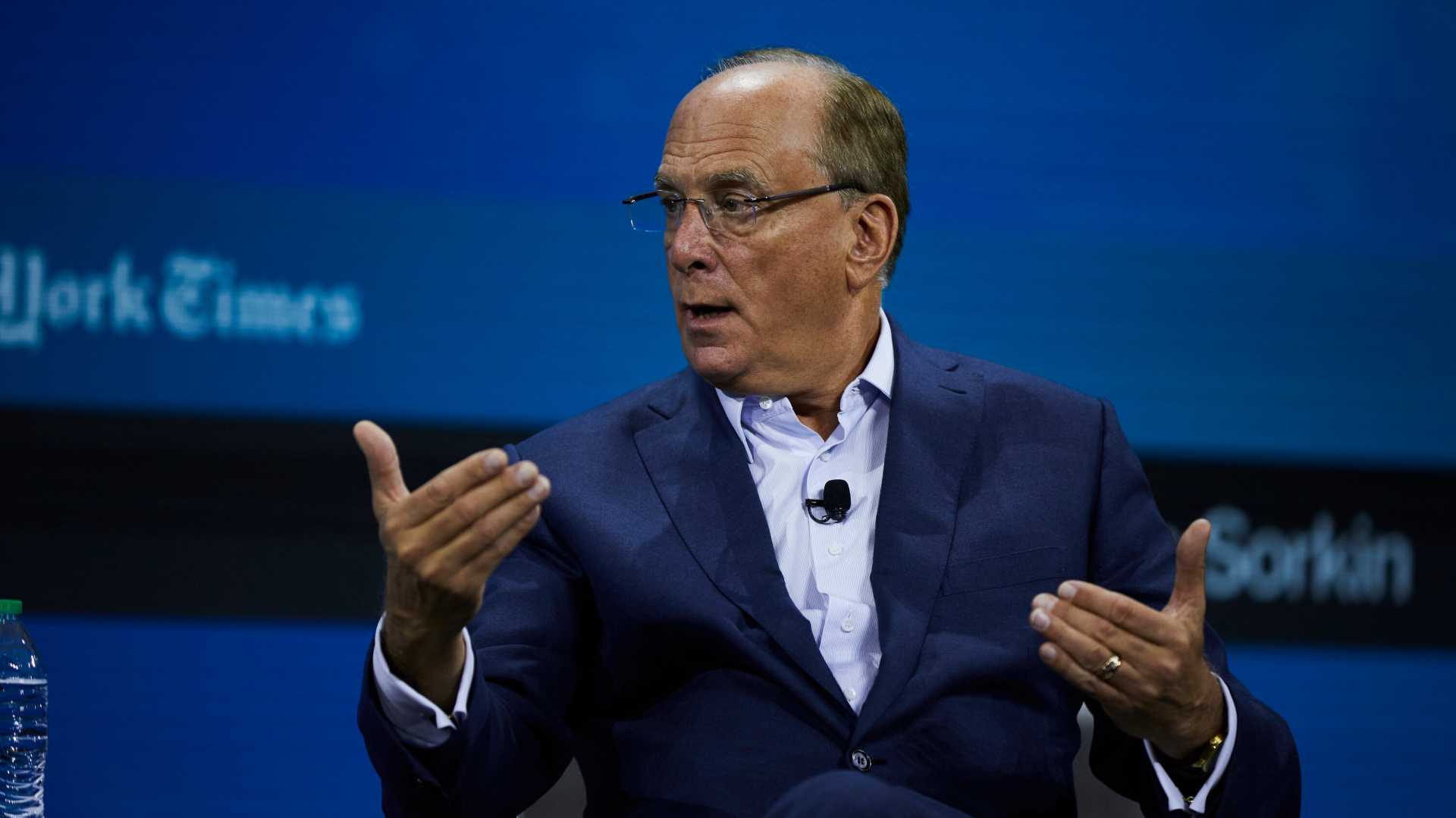

The surge in client assets was driven by a rally in U.S. stock markets following Donald Trump‘s presidential election victory in November, as investors anticipated lower corporate taxes and deregulation. “Our results reflect the strength of our diversified platform and our ability to deliver for clients in a dynamic market environment,” said Larry Fink, Chairman and CEO of BlackRock.

BlackRock’s quarterly results capped a strong year for the firm, which has aggressively expanded its presence in private markets. In 2023, the company invested approximately $25 billion in acquisitions, including infrastructure investment fund Global Infrastructure Partners and private credit business HPS Investment Partners.

The firm’s fee income also benefited from improved equity market performance, with the S&P 500 gaining nearly 25% over the year. BlackRock’s focus on technology and analytics has further strengthened its position, enabling it to attract both institutional and retail investors.

“We continue to see strong demand for our investment solutions, particularly in alternatives and technology-driven strategies,” Fink added. The company’s iShares ETF platform also saw significant inflows, contributing to its overall growth.

Looking ahead, BlackRock plans to deepen its investments in private markets and expand its global footprint. The firm’s strategic acquisitions and focus on innovation position it well to navigate evolving market conditions and capitalize on emerging opportunities.