Business

Bristol-Myers Squibb Stock: Recent Performance, Analyst Recommendations, and Future Outlook

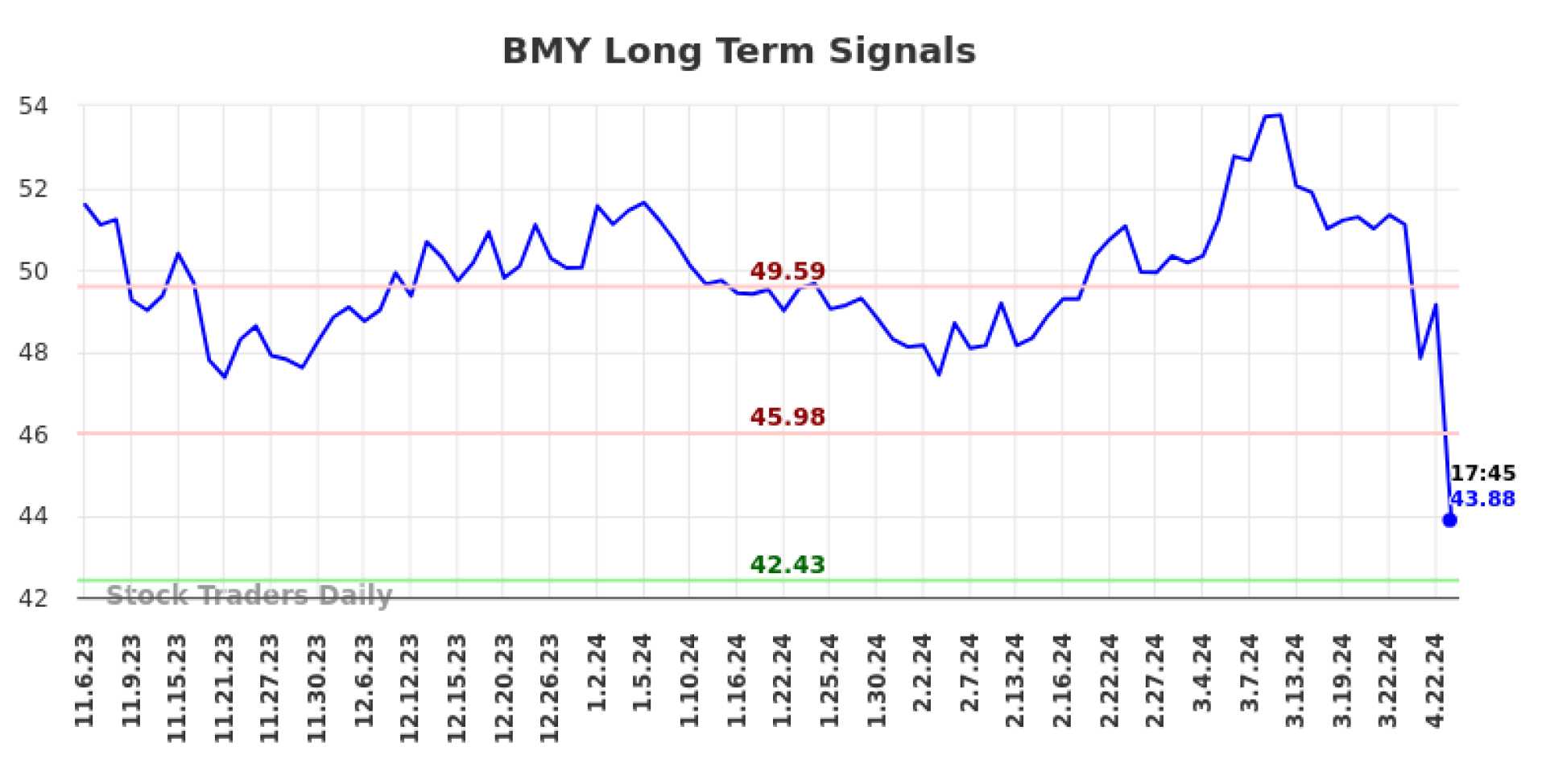

Bristol-Myers Squibb (NYSE:BMY) has been under the spotlight recently due to its latest financial performance and analyst recommendations. As of November 11, 2024, the stock is trading at $54.14, showing a stable trend with minimal price volatility over the past three months compared to the broader market.

In the third quarter of 2024, Bristol-Myers Squibb reported strong earnings, with an EPS of $1.80, surpassing analysts’ consensus estimates of $1.49. The company also saw an 8.4% year-over-year increase in quarterly revenue, reaching $11.89 billion, which exceeded expectations of $11.26 billion.

Analysts have mixed views on the stock. Deutsche Bank recently maintained its hold recommendation but raised the price target from $48 to $55. Other firms, such as UBS Group and Jefferies Financial Group, have also adjusted their price targets, with UBS lifting its target to $54 and Jefferies to $51. However, Citigroup downgraded the stock from a “buy” to a “neutral” rating and lowered the price target from $75 to $55.

The consensus rating among analysts is “hold,” with a median target price of $53.00. The stock has received 1 sell rating, 13 hold ratings, and no strong buy ratings in the last twelve months.

Sigma Planning Corp, an investment firm, has also shown confidence in Bristol-Myers Squibb by increasing its stake in the company by 20.9% during the third quarter, purchasing an additional 9,746 shares.

Bristol-Myers Squibb continues to offer a diverse portfolio of biopharmaceutical products and has a strong global market presence. However, the company faces challenges such as regulatory pressures, market volatility, and competition from other pharmaceutical companies, which could impact its future growth prospects).