Business

Broadcom, TSMC Explore Deals to Split Intel Amid Financial Struggles

February 15, 2025, BENGALURU, India – Major competitors in the semiconductor industry, Taiwan Semiconductor Manufacturing Co. (TSMC) and Broadcom, are reportedly considering potential deals that could lead to a breakup of the iconic U.S. chipmaker Intel, according to a Wall Street Journal report published on Saturday.

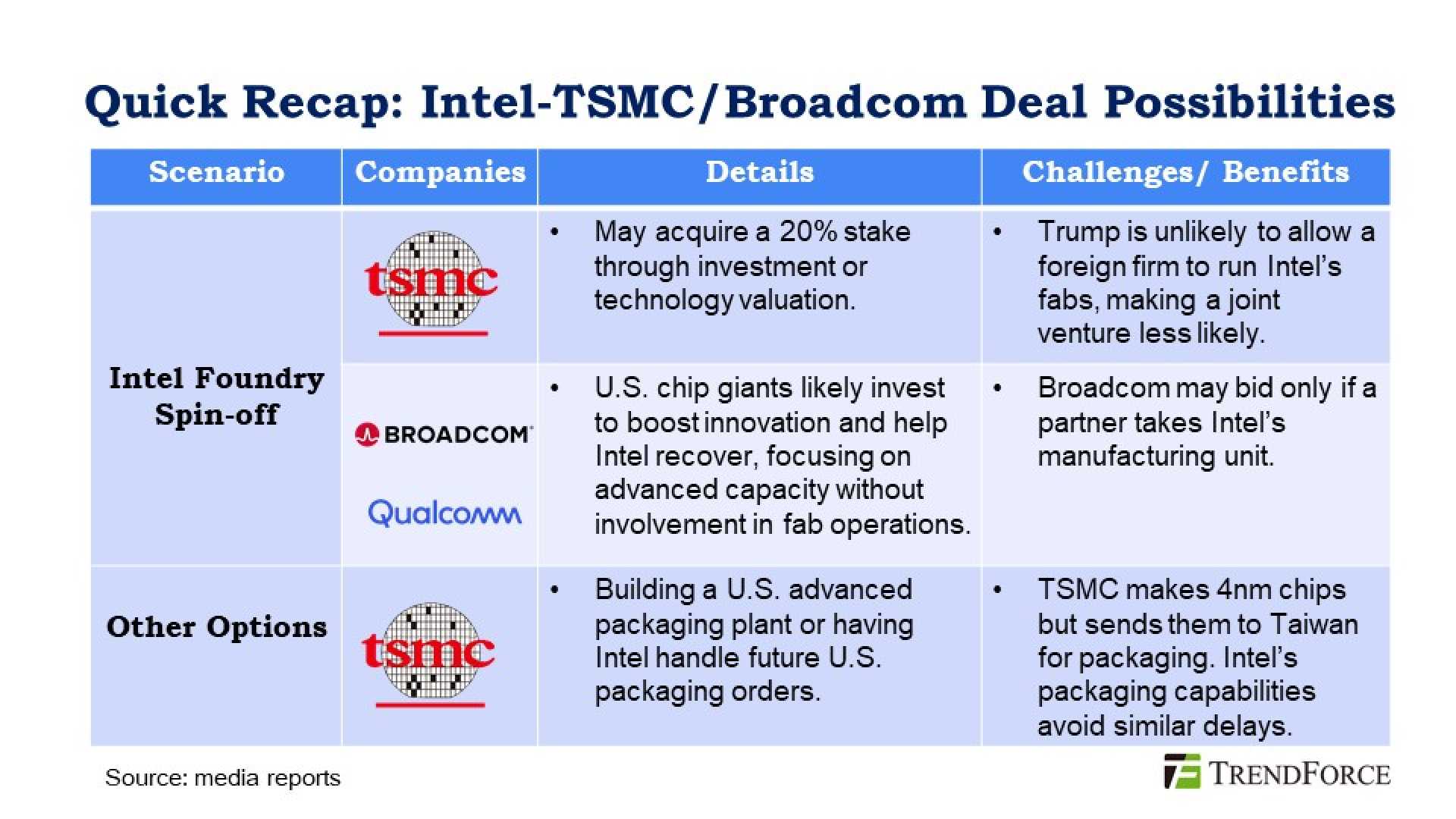

The discussions come at a time when Intel has been under significant financial strain. Broadcom is particularly interested in Intel’s chip design and marketing business and has engaged in informal talks regarding a possible bid. However, the company is expected to move forward only if it can secure a partner for Intel’s manufacturing operations, the Journal reported.

Meanwhile, TSMC, the largest contract chipmaker in the world, is exploring the possibility of acquiring some or all of Intel’s manufacturing facilities. This move might involve creating an investor consortium or another business structure. Both companies are operating independently, and discussions are still in preliminary stages.

Frank Yeary, Intel’s interim executive chairman, is reportedly leading the negotiations with potential buyers, while also liaising with officials from the Trump administration, who view Intel as critical to national security. Yeary has been communicating his primary focus on maximizing shareholder value during these discussions.

Intel, Broadcom, and TSMC have not provided immediate comments regarding the report. Sources familiar with the matter indicate the Trump administration is unlikely to approve a foreign entity operating Intel’s U.S. manufacturing facilities, following insights from a White House official.

In recent negotiations, Bloomberg reported that the administration encouraged the idea of a partnership between Intel and TSMC. This comes against the backdrop of substantial U.S. government backing for domestic semiconductor manufacturing, a key priority for the Biden administration.

Intel has been struggling to rebound from significant losses over the past year, including a reported $13.4 billion deficit in 2024. Former CEO Pat Gelsinger set ambitious targets for the company’s growth, including a push into AI technologies; however, these aspirations have yet to translate into profitable contracts.

TSMC’s market valuation is approximately eight times that of Intel, and it boasts a robust clientele including AI chip leader Nvidia and AMD, a direct competitor to Intel in the PC and server space. As the semiconductor landscape evolves, the potential split of Intel could have far-reaching implications for the industry.