Business

California Approves State Farm’s Emergency Insurance Rate Hike

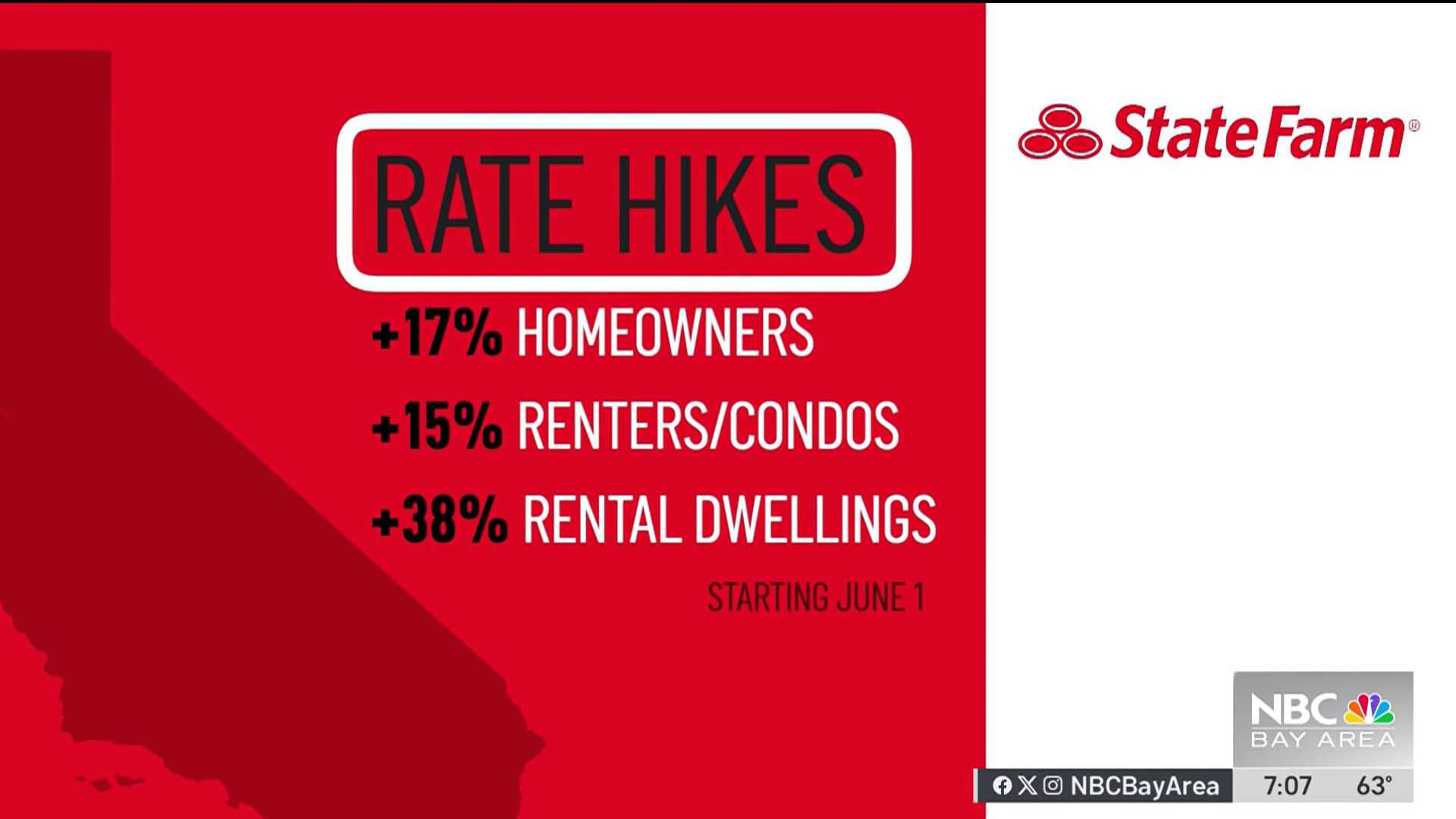

OAKLAND, California — Starting June 1, millions of Californians will face increased property insurance premiums as State Farm has received approval from the state’s insurance commissioner. The hikes, which could go as high as 17% for homeowners and 15% for renters, follow considerable losses from recent wildfires.

The decision comes after a hearing on April 8, where State Farm’s actuary testified that the necessary calculations to justify such increases were not completed. Nevertheless, an administrative judge under the California Department of Insurance approved the emergency rate hikes, sparking disappointment among consumer advocates.

Carmen Balber, Executive Director of Consumer Watchdog, expressed concern, saying, ‘It’s a huge disappointment for consumers that the judge has suggested consumers should pay now but allow State Farm to wait months before proving their rate hike.’

The increase is part of State Farm’s response to financial difficulties exacerbated by wildfires that destroyed over 16,000 structures in California. Throughout this period, State Farm has asserted that it requires these hikes to maintain operations and stabilize its finances.

Many customers in the Bay Area are alarmed at the news, particularly those on fixed incomes. ‘I just retired and this will definitely affect me,’ said Jody Kasamoto, who resides in Pinole. Others echoed these sentiments, fearing the burden of rising insurance costs during an already challenging economic climate.

State Farm’s rate increase marks their second hike since March 2024. In October, a formal hearing will explore the justification for this increase. Meanwhile, the California Department of Insurance has mandated that State Farm justify its financial standing and present a recovery plan.

‘We are in a statewide insurance crisis affecting millions of Californians,’ said California Insurance Commissioner Ricardo Lara. ‘Taking this on requires tough decisions.’

The approval allows State Farm to receive $400 million from its parent company to address immediate financial concerns. With claims exceeding $3.5 billion related to the wildfires, projections suggest homeowners could pay an estimated $468 more per year.

California’s insurance market has seen growing instability, with consumer advocates warning that this could set a precedent for other insurers to seek similar rate hikes without adequate justification.