News

California Exploring Alternatives as Gas Tax Revenue Declines

California, like many other states, is facing a significant decline in gas tax revenue, prompting a search for alternative funding sources to maintain and improve its infrastructure. The state’s gas tax, which is a crucial component of the Road Repair and Accountability Act (SB 1), generates approximately $5 billion annually. However, with the increasing adoption of electric and hybrid vehicles, the traditional gas tax model is becoming less effective.

The decline in gas tax revenue is exacerbated by recent regulatory changes. The California Air Resources Board has approved new fuel standards that are expected to drive up gas prices in the state. This move, while aimed at reducing carbon emissions, may further reduce gas tax revenues as consumers opt for more fuel-efficient or alternative vehicles.

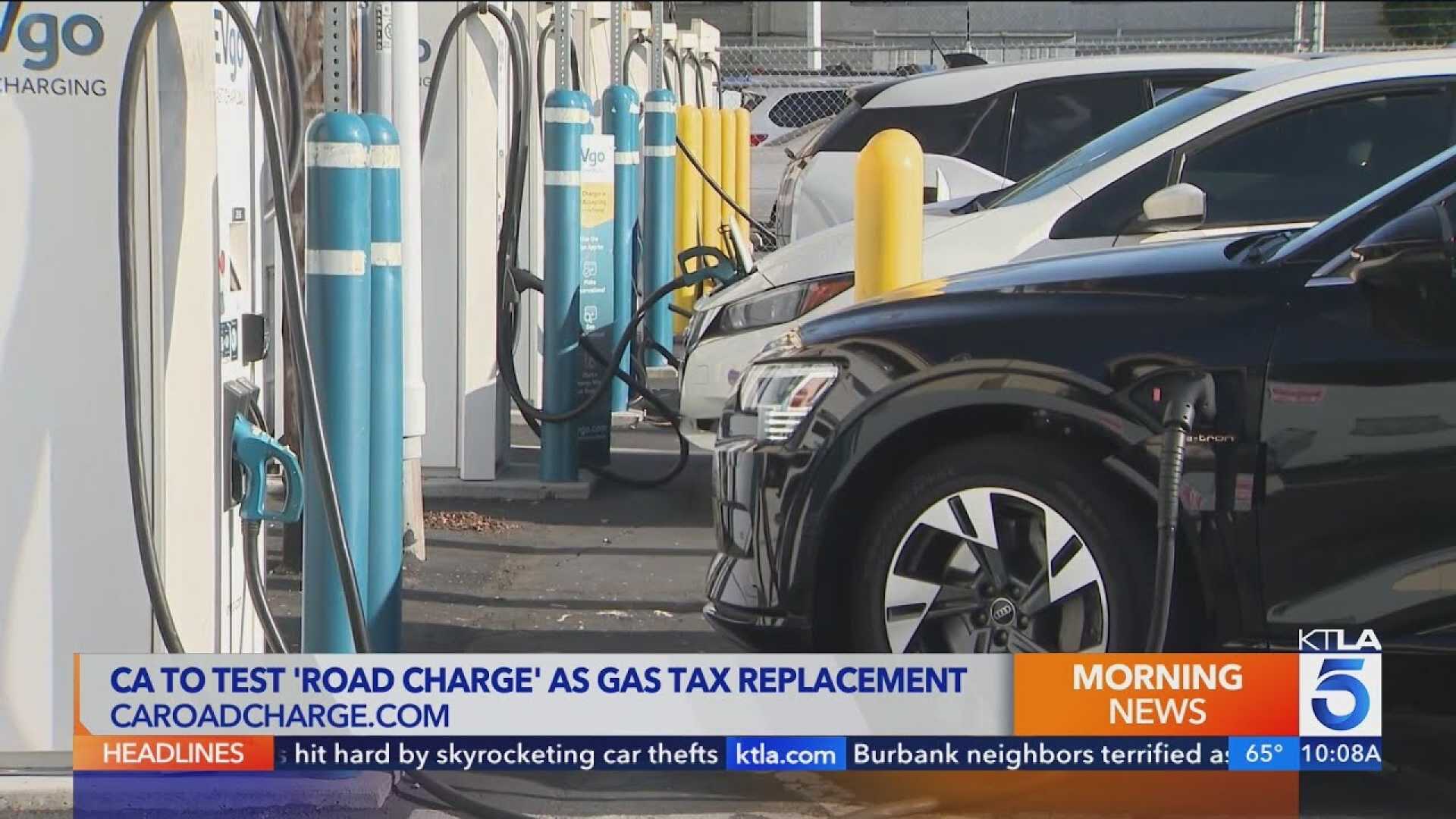

In response to these challenges, California is exploring various alternatives to ensure continued funding for its infrastructure projects. This includes considering mileage-based user fees, which would charge drivers based on the number of miles they drive rather than the amount of fuel they consume. Such measures are part of a broader strategy to adapt to changing transportation trends and maintain the state’s infrastructure.

California’s $3.8 billion infrastructure push, which includes key projects funded by SB 1, highlights the importance of securing stable revenue streams. These projects are critical for the state’s economic development and public safety, making the need for innovative funding solutions more urgent than ever.