Business

Calls for Salary Cuts Amid Rising CEO Pay in U.S. Corporate Sector

WASHINGTON, D.C. — Sarah Anderson, the director of the Global Economy Projects at the Institute for Policy Studies, believes U.S. CEO salaries could be reduced without harming productivity. “I think you can still motivate people to get out of bed in the morning and go to work and do a good job,” Anderson said. She emphasized that while executives should be fairly compensated, they could work effectively for less.

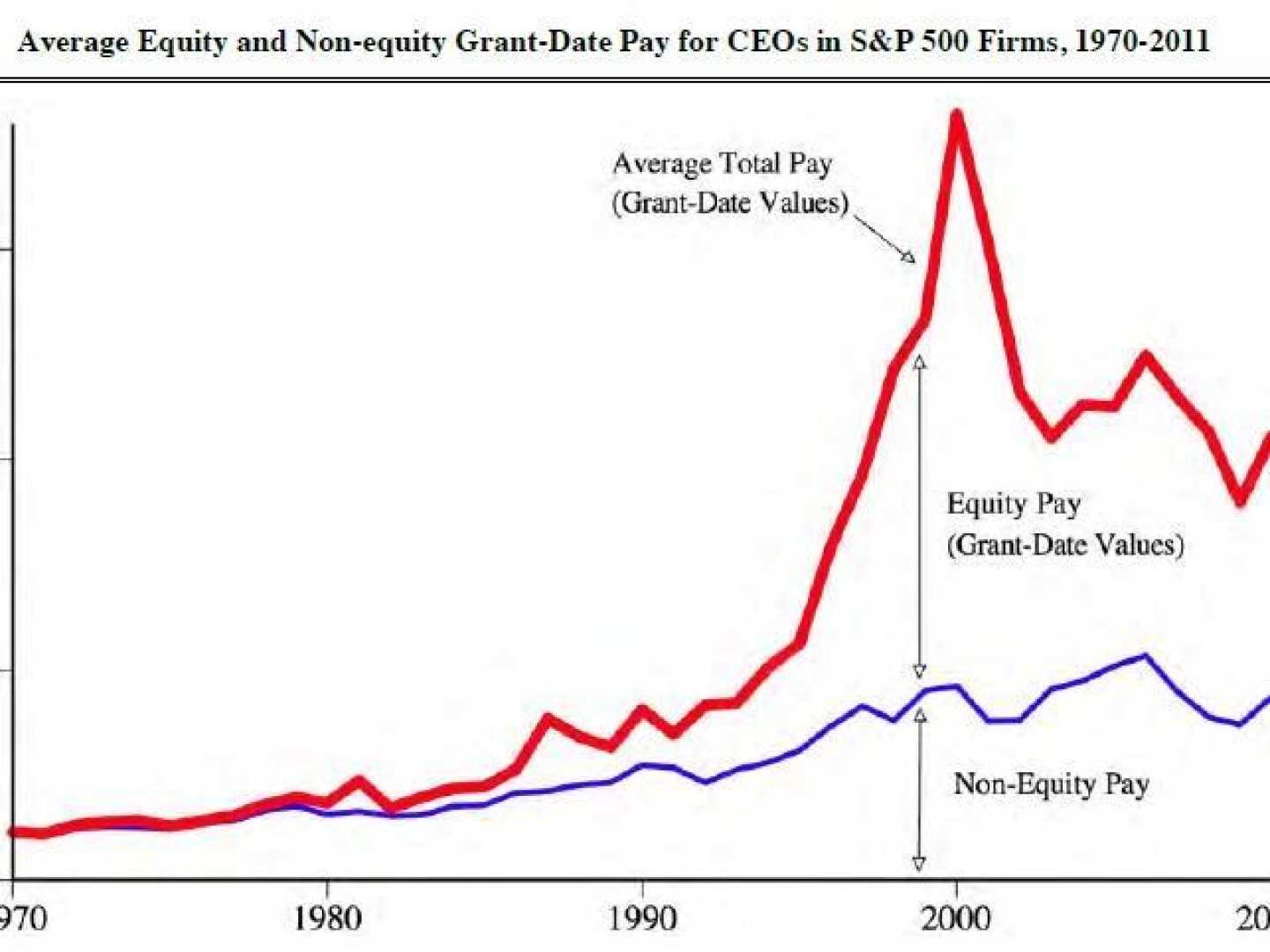

CEO pay has been a controversial topic, with reports indicating that compensation packages continue to climb. According to a recent study by Institutional Shareholder Services, median CEO pay at 320 S&P 500 companies increased by 7.5% to $16.8 million in 2024. For some companies that raised salaries, the median pay jumped to 13.2%. In contrast, private sector wages rose only 3.6%, adjusted for inflation, highlighting a growing disparity.

James Reda of Gallagher‘s Compensation Consulting noted that company boards often prioritize executives they trust when determining compensation. “They ask themselves, ‘Have I got the right person? If the answer is yes, then I have to make them happy,'” Reda said.

The gap between executive compensation and average worker salaries has sparked a national debate about income inequality. Anderson pointed out, “When that happens, CEOs get made whole, while workers do not get made whole.” This sentiment resonates particularly in the media sector, where high executive pay exists alongside significant job cuts and industry instability.

In a striking example, David Zaslav, CEO of Warner Bros. Discovery (WBD), enjoyed a pay package of approximately $50 million in 2023, raising concerns among employees and shareholders alike, particularly as WBD’s stock has dropped over 60% since the company’s merger in April 2022.

As discussions around CEO pay continue, the outlook for the 2024 compensation structure remains uncertain. “Shareholders are not going to be happy with exorbitant pay,” predicted Reda. He noted that the substantial CEO packages established at the beginning of the year may clash with current market conditions.