Business

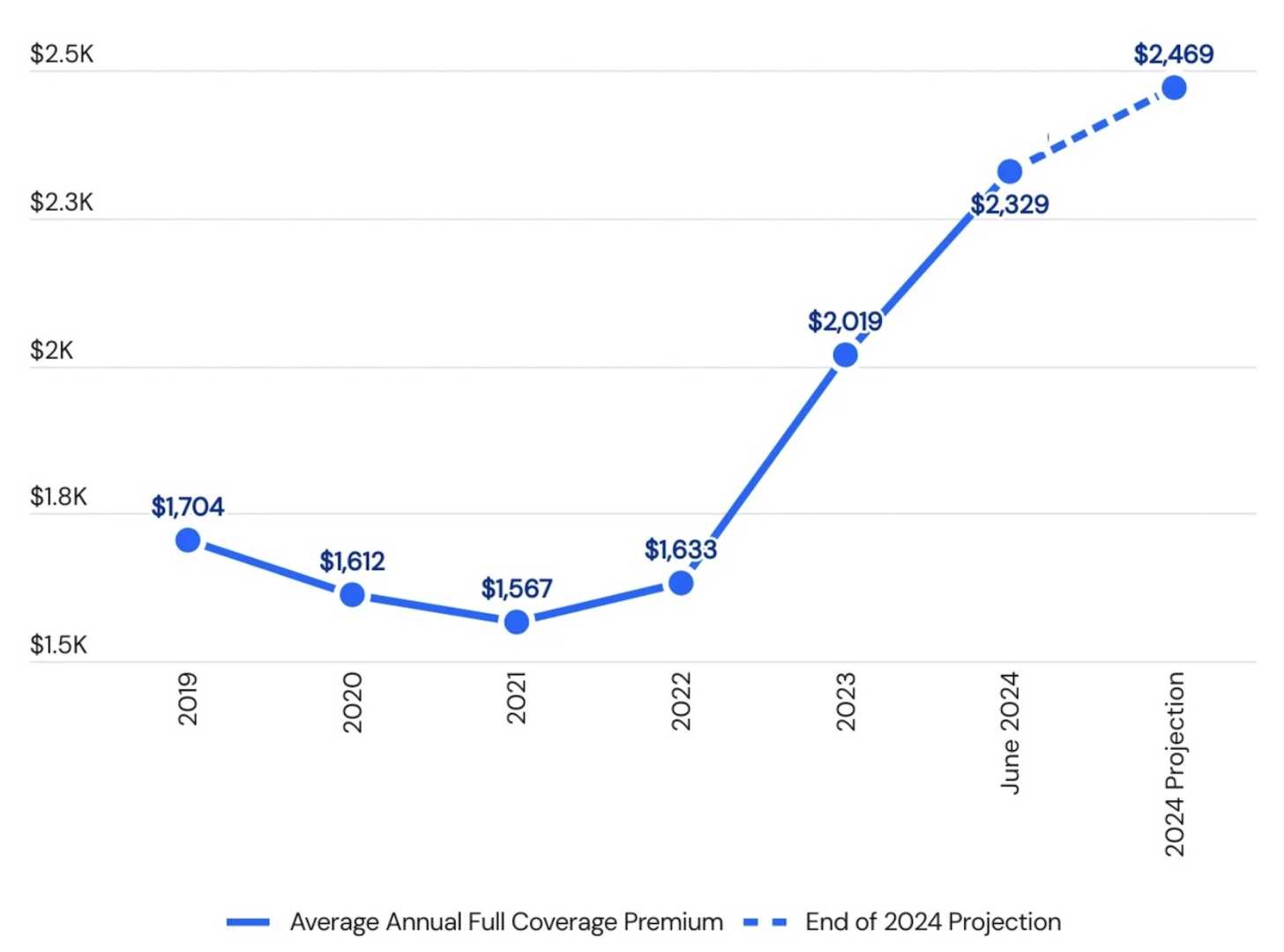

Car Insurance Rates and Trends: What You Need to Know for 2024

In 2024, car insurance rates continue to vary significantly across different states and demographics. In Massachusetts, for instance, the average car insurance premium stands at $1,201 per year, or $100 per month, which is 15.8% less than the US average. Drivers in their 70s in Massachusetts enjoy the lowest rates, paying about $77 per month. Notably, Massachusetts is one of the few states that does not allow credit score, gender, or marital status to be used as rating factors in car insurance pricing.

In contrast, New Hampshire drivers pay an average of $1,753 annually for full coverage car insurance, which is lower than the national average. Here, 18-year-old drivers face the highest rates, and drivers with poor credit pay more than double the state average for full coverage. The cost of car insurance in New Hampshire also varies by city, with urban areas generally having higher premiums due to the increased risk of accidents.

Connecticut presents a different picture, with drivers paying an average of $2,506 annually for full coverage and $987 for minimum coverage. In Connecticut, a single DUI conviction can increase full coverage rates by 83%, and drivers with poor credit histories pay 93% more than those with good credit. The type of vehicle also significantly influences insurance costs, with a BMW 330i costing 22% more to insure than a Ford F150.

Aside from state-specific rates, the commercial auto insurance sector is facing significant challenges. Despite years of rate increases, the sector marked its worst performance in 2023 with $5 billion in underwriting losses. Rising loss severity, driven by higher costs of auto parts and repair labor, and the impact of social inflation with larger jury awards and settlements, are key factors contributing to these losses. Insurers are responding with pricing adjustments, enhanced underwriting practices, and targeted loss control initiatives.

In a bizarre incident highlighting the need for vigilance in insurance claims, four individuals in the Los Angeles area were arrested for insurance fraud after claiming a bear damaged their cars. An investigation revealed that the “bear” was actually a person in a bear costume, and the suspects had defrauded insurance companies of $141,839.