Business

Carbon Markets Evolve Amid Rising Environmental Awareness

WASHINGTON, D.C. — As global emissions rise, carbon markets are gaining traction as a solution for environmental challenges. Carbon credits and offsets are tools that businesses and investors are increasingly using to reduce carbon footprints.

Since the 1997 Kyoto Protocol and the 2015 Paris Agreement set emission reduction targets, carbon trading has expanded. Although the United States doesn’t have a federal carbon market, several states, like California, have implemented cap-and-trade programs. In 2023, Washington State joined the ranks with its cap-and-invest initiative.

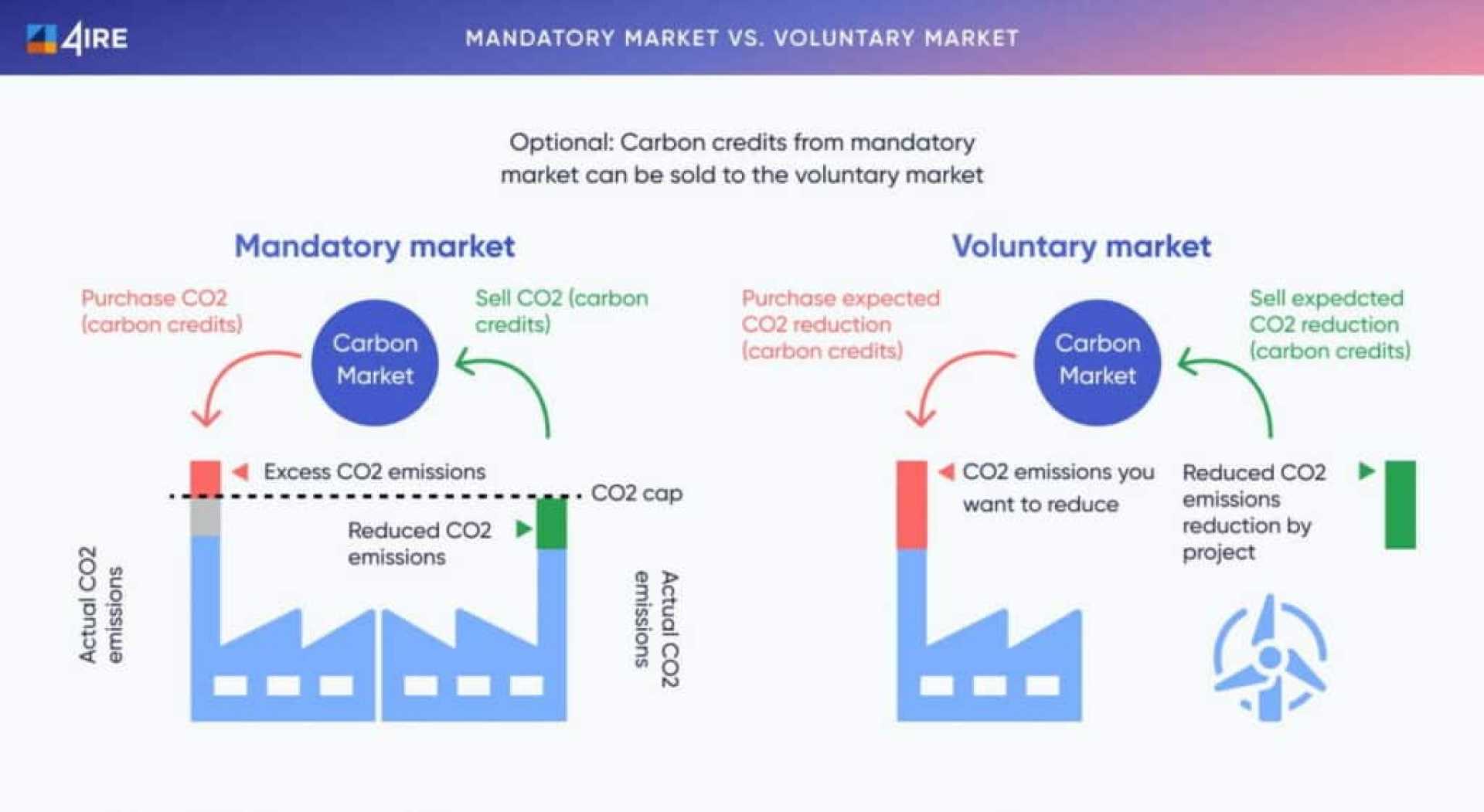

The cap-and-trade system establishes a limit on emissions, which decreases over time, compelling companies to either reduce emissions or purchase carbon credits. A carbon credit allows a business to emit one ton of CO2 and can be bought or sold, creating a financial incentive to cut emissions.

Conversely, carbon offsets are voluntary purchases made by companies to compensate for their emissions. If a business plants trees or invests in renewable energy projects, it can generate offsets that other companies may buy to reduce their carbon impact.

Experts anticipate that the voluntary carbon market, which trades carbon offsets, will continue to grow. Many believe it signals strong commitments toward net-zero emissions. In 2023, over 250 million carbon credits were traded, reflecting a significant increase from past years.

Both regulated and voluntary markets present unique opportunities. For instance, companies like Brookfield Renewable Partners are positioning themselves as leaders in clean energy investment, with projected growth of 11% in 2024.

Investors are looking at companies with robust carbon strategies as more businesses seek to meet sustainability goals. The demand for carbon credits is expected to rise, offering great potential for companies that can effectively capture and manage emissions.

“With the world increasingly focused on sustainability, carbon credits offer financial and environmental returns,” said Sarah Thompson, an environmental investment analyst.

This growing awareness has potential investors exploring various options, including Exchange-Traded Funds (ETFs) that focus on sustainable energy. For example, the iShares Global Clean Energy ETF and Invesco Solar ETF are already gaining traction, reflecting the shift towards renewable energy solutions.

In conclusion, as environmental responsibilities grow, carbon markets could play a pivotal role in shaping the future of global emissions management and sustainability efforts.