Business

Carnival Corporation (CCL) Stock Sees Mixed Signals Amid Market Fluctuations

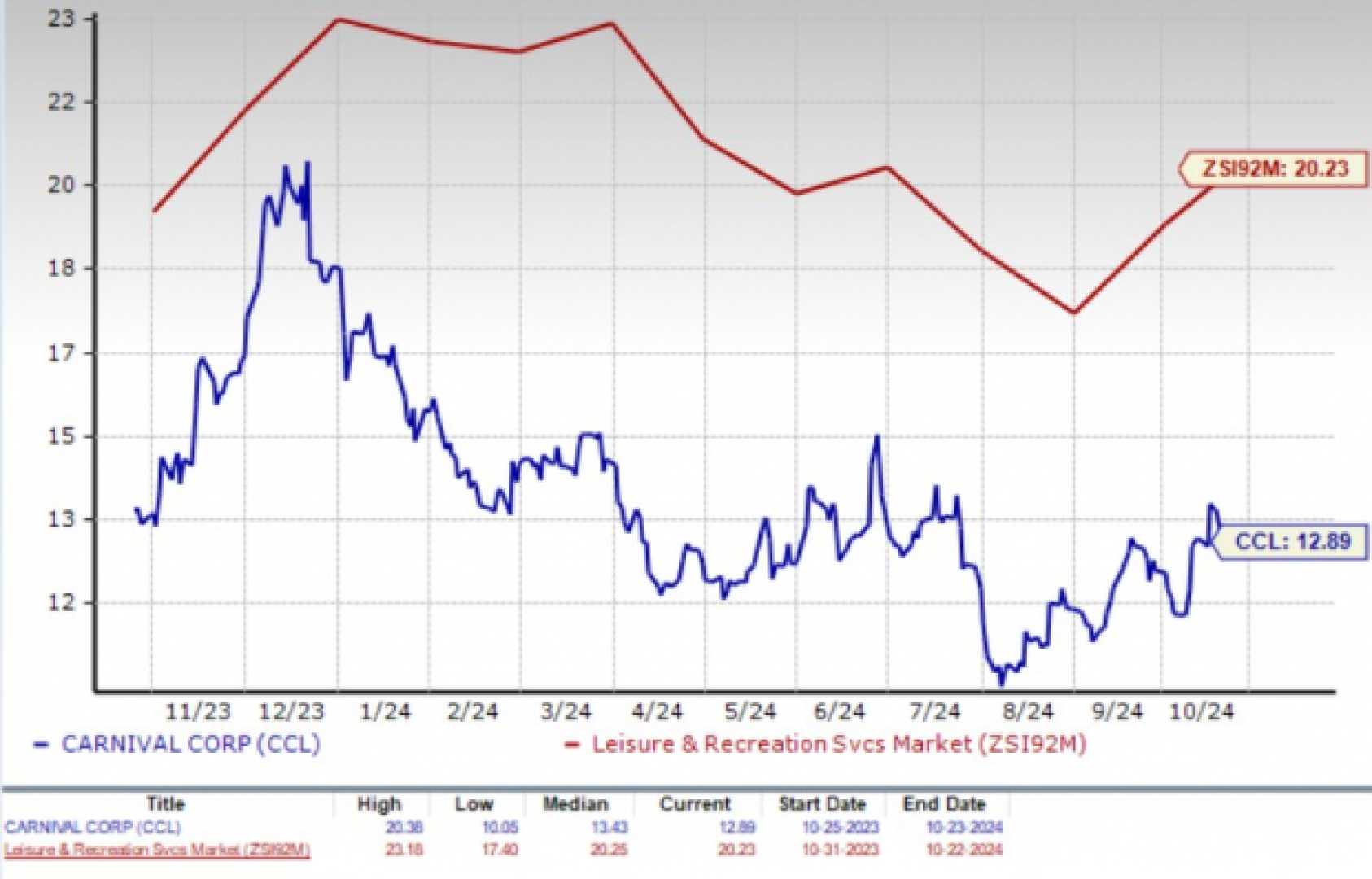

Carnival Corporation (CCL), one of the world’s largest cruise line operators, has been experiencing mixed signals in the stock market as of late October 2024. The company’s market capitalization stands at approximately $28.17 billion, ranking it as the 723rd most valuable company globally.

As of the latest trading sessions, Carnival’s stock price has shown a slight increase, with the current price at $21.67, up by 3.63%. However, analyst forecasts and technical indicators paint a more nuanced picture. According to MarketBeat, the average twelve-month stock price forecast for Carnival is $23.53, with a high forecast of $28.00 and a low of $16.50. This suggests a predicted upside of 9.70% from the current price.

The sentiment around Carnival’s stock is bullish, despite a Fear & Greed Index indicating fear. The stock has recorded 40% green days over the last 30 days, with a volatility of 7.20%. Some analysts have recently upgraded their ratings for Carnival, with Peel Hunt raising the target to ‘buy’ with a price target of 1300 pence in the UK market.

Investors remain cautious due to the volatile nature of the stock. Discussions on investor forums highlight the unpredictability of Carnival’s stock performance, with some investors expressing concerns about potential drops despite current gains. The overall outlook suggests that while there is optimism about Carnival’s financial recovery and debt management strategies, the stock’s performance is subject to significant market fluctuations.