Business

Carvana Eyes Continued Profitability Ahead of Fourth-Quarter Earnings Report

PHOENIX, Arizona — Carvana Co. (CVNA) aims to extend its profitability streak as it prepares to report fourth-quarter financial results after the market closes. Analysts predict the online used car retailer will post revenues of $3.31 billion, a significant increase from $2.42 billion in the same quarter last year.

The anticipated revenue would mark Carvana’s fourth consecutive quarter with earnings exceeding $3 billion. Analysts’ estimates suggest an earnings per share (EPS) of 29 cents, reversing last year’s EPS loss of $1.00. Carvana has demonstrated consistency with earnings per share, outperforming analyst expectations in three of the last straight quarters and seven out of the last ten quarters.

Recent quarterly reports revealed profits of 64 cents, 14 cents, and 23 cents per share, a notable recovery from previously reported losses. This turnaround has positioned Carvana as a prominent player in the used vehicle market, particularly with its focus on electric vehicles (EVs), where it claims 5.7% of its used vehicle sales are electric, compared to only 1.3% nationwide in the used car sector.

“Momentum continues to be strong for Carvana, which has become one of the hottest turnaround stocks in recent years,” said analyst Brad Erickson from RBC Capital. The firm recently upgraded Carvana’s stock rating from Sector Perform to Outperform, setting a price target increase from $270 to $280, signifying confidence in the company’s future market position.

Despite analyst optimism, Carvana navigates challenges posed by short sellers who have targeted the firm. Recent guidance suggests Carvana could leverage its financial strength to counteract these pressures. “With just 1% share in an enormous market, significant capacity to support growth, and a business that generates positive feedback as it scales, we are just getting started,” said Carvana CEO Ernie Garcia following the third-quarter earnings.

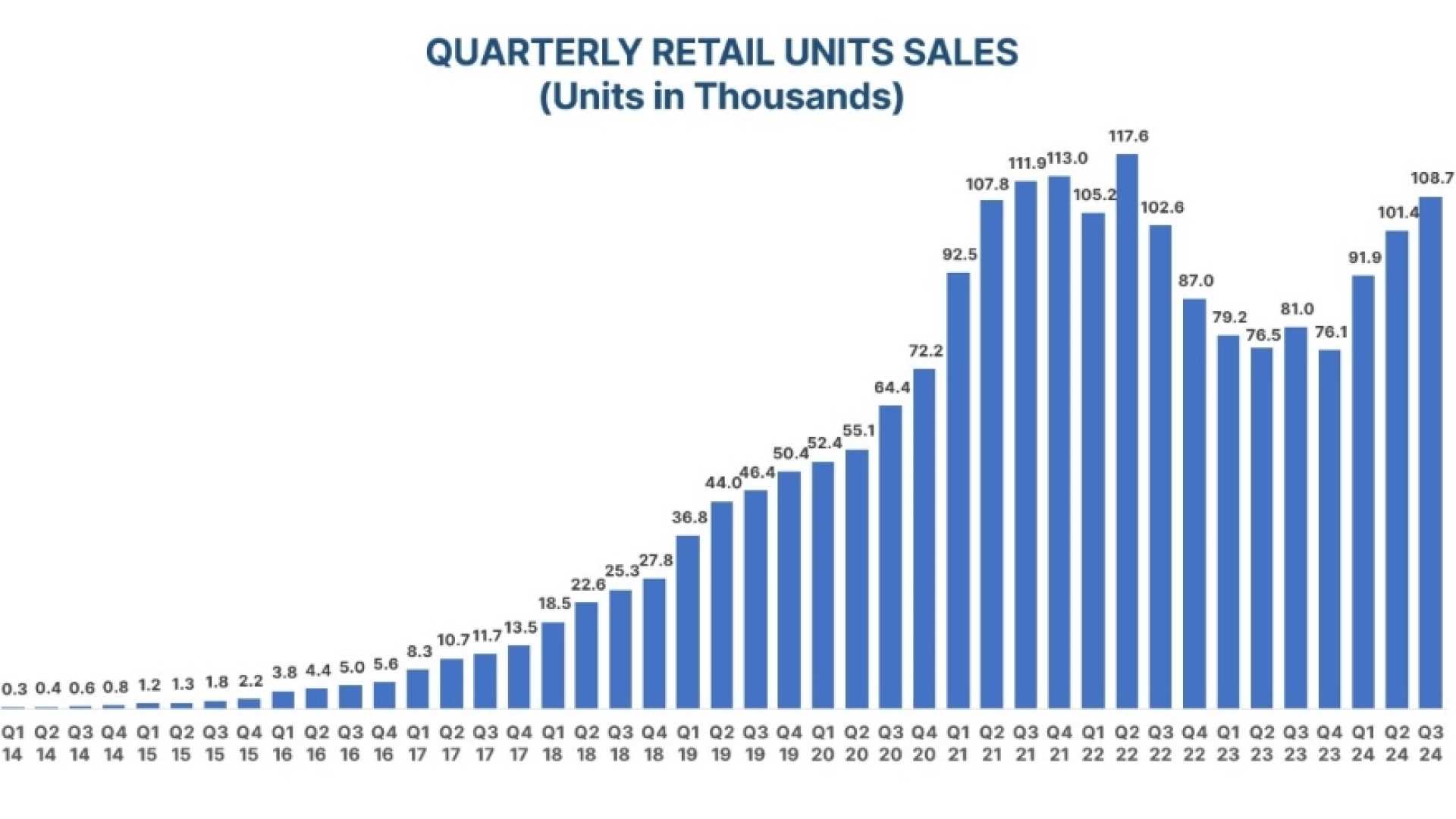

In terms of unit sales, Carvana reported selling 108,651 vehicles for a year-over-year increase of 34%. This metric alongside financial results will be closely monitored by investors during the earnings announcement. The company’s ability to translate sales into profitability will be a focal point, particularly in light of the increased profit per vehicle reported in the third quarter.

Carvana’s stock performance reflects its recovery; shares traded under $10 in May 2023 and dipped below $5 earlier in January 2023. However, confidence from investors has led to a substantial rise in stock value, with a 42.6% increase in 2025 and over a staggering 449% growth over the past year. On Tuesday, shares were trading down 0.3% to $284.53, having reached a 52-week high of $291.27 earlier in the session.