Business

Changing Risk Models Challenge Reliance on VIX for Market Assessment

NEW YORK, NY – The financial landscape is undergoing significant changes, prompting a reevaluation of risk indicators used by investors. For decades, the CBOE Volatility Index (VIX) was viewed as the primary gauge of market fear. However, market experts now argue that this reliance has become insufficient.

Recent developments in financial markets, including the rise of sophisticated financial instruments, have altered the way risk should be assessed. The VIX calculates implied volatility from options that expire within a 23 to 37 day window. However, the introduction of Zero Days to Expiration (0DTE) options has created blind spots for traditional risk models.

These 0DTE options allow institutional investors to hedge positions intraday, resulting in a phenomenon called Gamma Suppression. This suppression during volatile moments can mask the actual market risks. Additionally, Goodhart’s Law states that as traders increasingly rely on the VIX for risk management, the index’s reliability diminishes, often pushing traders towards short-volatility strategies.

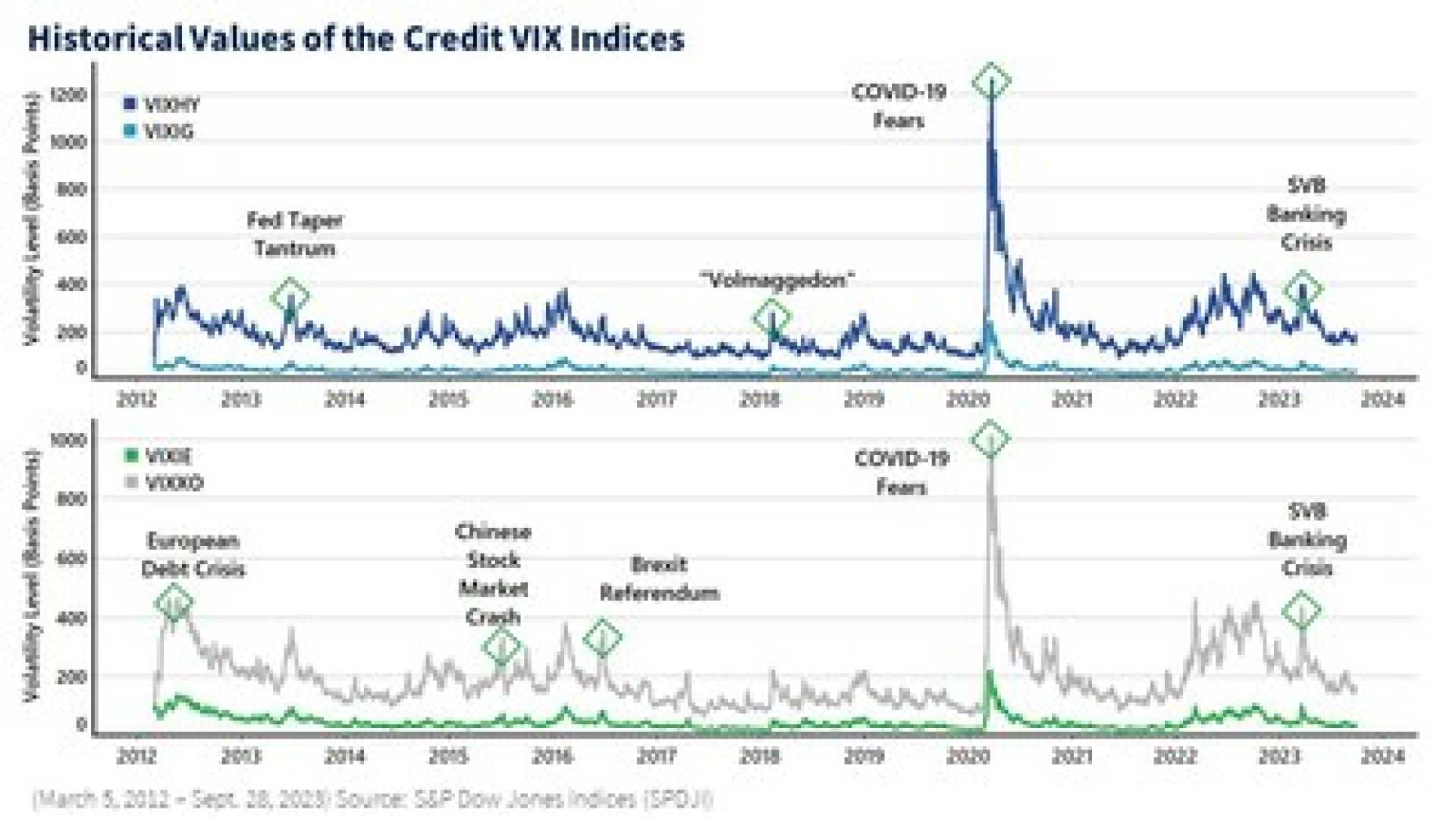

To address these shortcomings, experts propose the Macro Risk Trinity approach. This methodology integrates three core aspects of financial assessment: Rates, Credit, and Equity. It highlights the importance of the MOVE Index, which serves as a barometer for bond variance risk premiums, often acting as a leading indicator for equity markets.

Research indicates that instability in the bond market can necessitate a reassessment of risk across various asset classes. When discrepancies arise between low VIX readings and widening Option Adjusted Spreads (OAS), it suggests an impending risk situation, indicating that equity markets may appear stable despite underlying economic weaknesses.

The Macro Risk Trinity approach employs visual signals to help traders understand current market conditions. It utilizes a Dual Z-Score normalization process to standardize risk metrics, allowing for clearer comparisons between the VIX and credit spreads, and highlighting when credit stress surpasses equity fear.

This tool is designed for daily use and incorporates historical institutional data to reduce false signals. While it builds on past market behavior, experts acknowledge that evolving dynamics may impact correlations in the future. As the financial markets continue to change, so too must strategies for assessing risk.