Business

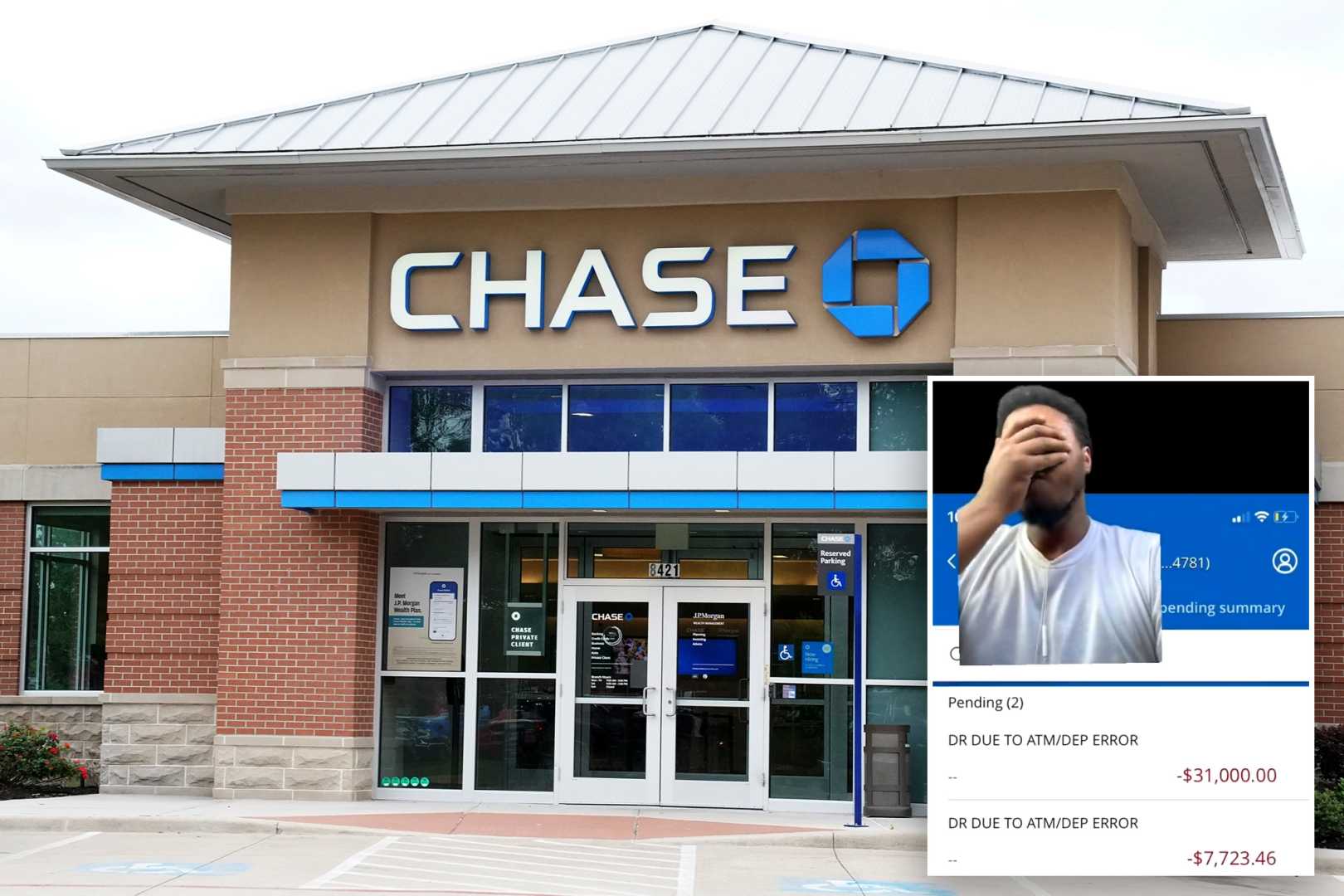

Chase Bank Addresses Fraudulent Activities Linked to Viral TikTok Trend

The US banking giant Chase has issued a stern warning following a viral trend on TikTok where individuals allegedly attempted to withdraw funds exceeding their account balances by exploiting a system delay.

Reports have emerged indicating that some customers knowingly deposited bad checks with large sums of money and subsequently withdrew those funds from Chase ATMs before the checks could bounce. This action resulted in significant negative balances once the fraudulent checks were processed.

In response to these activities, Chase Bank clarified that such behavior is unequivocally considered fraud. In an official statement, the bank emphasized, “Regardless of what you see online, depositing a fraudulent check and withdrawing the funds from your account is fraud, plain and simple.”

As the situation escalated, videos circulated on social media featuring participants celebrating their withdrawals while others expressed dismay upon discovering their account deficits once the checks were returned. This contrast highlights the severe consequences of engaging in such illicit schemes.

Dan Awrey, a law professor at Cornell University, commented on the incident, referring to it as “check kiting,” a practice that has been in existence since the inception of checks.

The viral nature of the trend was exacerbated by the long bank holiday weekend, creating an environment ripe for exploitation. Self-proclaimed financial advisors emerged on platforms like TikTok, offering misguided guidance to those seeking to take advantage of the situation.

The aftermath of these fraudulent activities poses significant challenges for Chase Bank and potential legal repercussions for those involved. The bank’s efforts to reclaim funds are complicated by the fact that many of the individuals who participated may not have the financial means to repay their withdrawals.