Business

U.S. and China Agree to Suspend Tariffs, Uplifting Global Markets

New York, NY — U.S. stock futures soared early Monday after the U.S. and China agreed to suspend most tariffs on each other’s goods over the weekend in Geneva. Dow futures jumped 850 points, or 2.1%, while S&P 500 and Nasdaq futures climbed 2.8% and 3.8%, respectively.

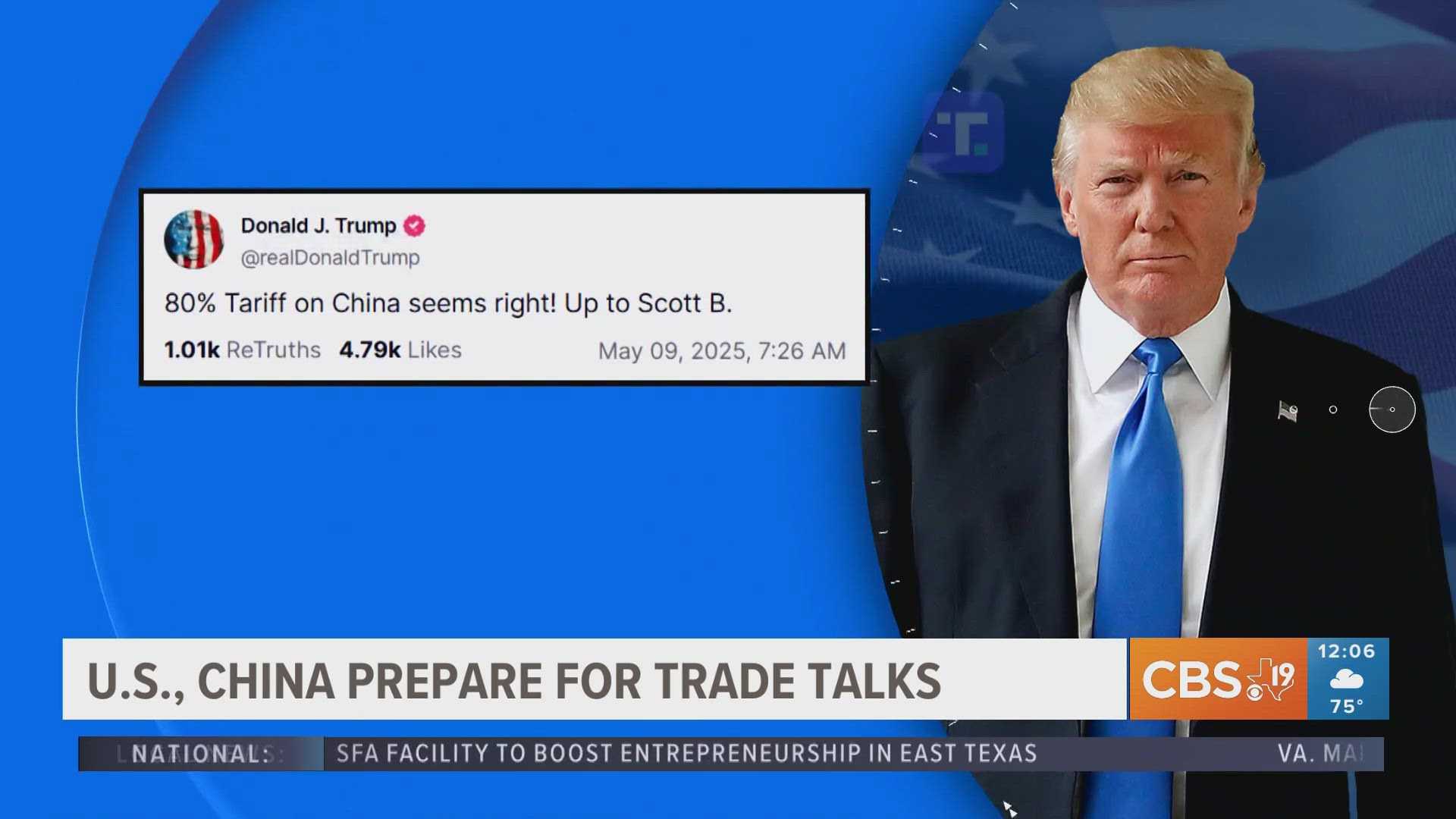

U.S. Treasury Secretary Scott Bessent described the trade talks as “very productive.” Both nations agreed to lower reciprocal tariffs by 115 percentage points for 90 days—reducing U.S. tariffs on Chinese imports from 145% to 30%, and Chinese tariffs on U.S. goods from 125% to 10%.

These negotiations follow escalating tensions from last month when President Donald Trump introduced hefty tariffs on imported Chinese goods, which prompted retaliatory measures from Beijing that affected U.S. exports. Bessent emphasized that these new tariff rates may be in place for the foreseeable future.

Despite last week’s losses, where the S&P 500 and Nasdaq Composite dropped 0.5% and 0.3% respectively, investor sentiment improved on the news. The upcoming consumer price index report and retail sales data are key indicators investors will analyze to gauge the economic effects of the trade tensions.

In Asia, markets reacted positively to the news, with the Hang Seng Index rising 5.16% and the Nikkei 225 gaining 0.38%. The CSI 300 Index in mainland China saw a 1.16% increase.

Pharmaceutical stocks, however, faced declines after Trump announced plans to cut prescription drug prices by 30% to 80% through an executive order expected to be signed Monday morning. Major drug manufacturers saw significant drops, with shares of prominent companies losing up to 10%.

Overall, the optimism surrounding the U.S.-China trade agreement serves as a possible turning point amid a period of economic uncertainty, and further developments are likely to attract global attention.