Business

Chipotle Mexican Grill (CMG) Stock Sees Positive Analyst Outlook Despite Recent Market Fluctuations

As of October 29, 2024, Chipotle Mexican Grill, Inc. (CMG) stock is experiencing a mix of market dynamics and positive analyst forecasts. Despite a slight decline in the stock price, currently trading at around $60.45, the overall sentiment from analysts remains optimistic.

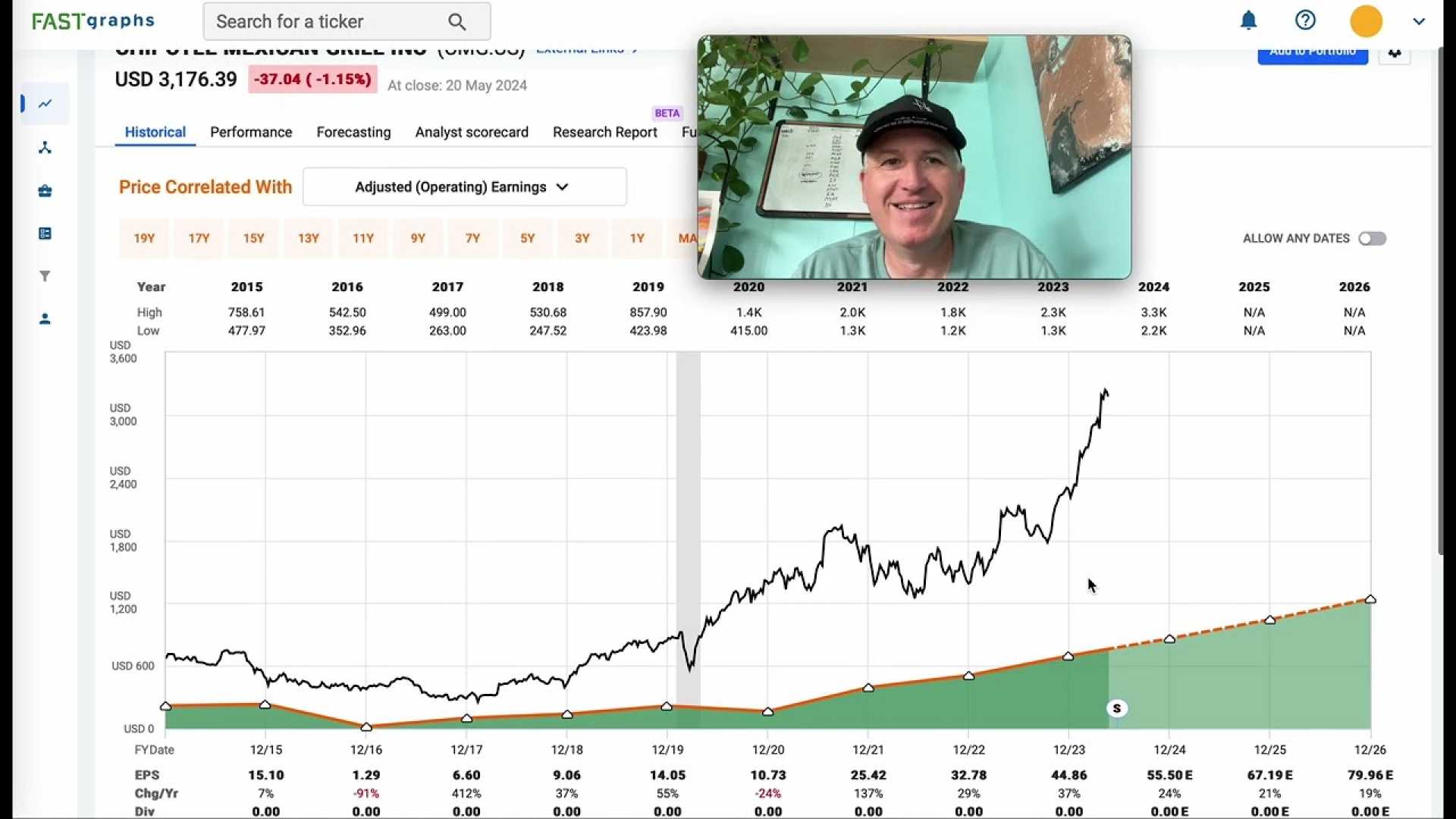

According to 30 analysts, the average rating for CMG stock is “Buy,” with a 12-month stock price forecast of $62.37, representing a 5.16% increase from the current price. This positive outlook is supported by Chipotle’s strong financial performance in 2023, where the company saw a revenue increase of 14.33% to $9.87 billion and earnings growth of 36.66% to $1.23 billion.

Chipotle’s interim CEO, Scott Boatwright, and President, Jack Hartung, have recently discussed the company’s future prospects, highlighting the continued strength in value scores and the resilience of consumer spending despite inflationary pressures. Hartung noted “macro resistance” from California consumers, indicating that price increases have not significantly deterred customer demand.

The company’s digital adoption and loyalty program have been key drivers of its success, with accelerated growth during the pandemic. These factors are expected to continue driving increased order frequency and reducing customer churn.

However, some analysts caution about potential shifts in consumer spending towards grocery and convenience stores if the macroeconomic environment deteriorates further. Despite these concerns, Chipotle’s market cap remains robust at over $80 billion, reflecting its strong market position as the largest fast-casual chain restaurant in the United States.

In terms of valuation, Chipotle’s stock is currently trading at a premium compared to its historical means and sector peers, but some analysts argue that the recent pullback has brought the stock to a more reasonably priced valuation.