Business

Coinbase Stock Surges Despite Recent Volatility and Mixed Earnings Report

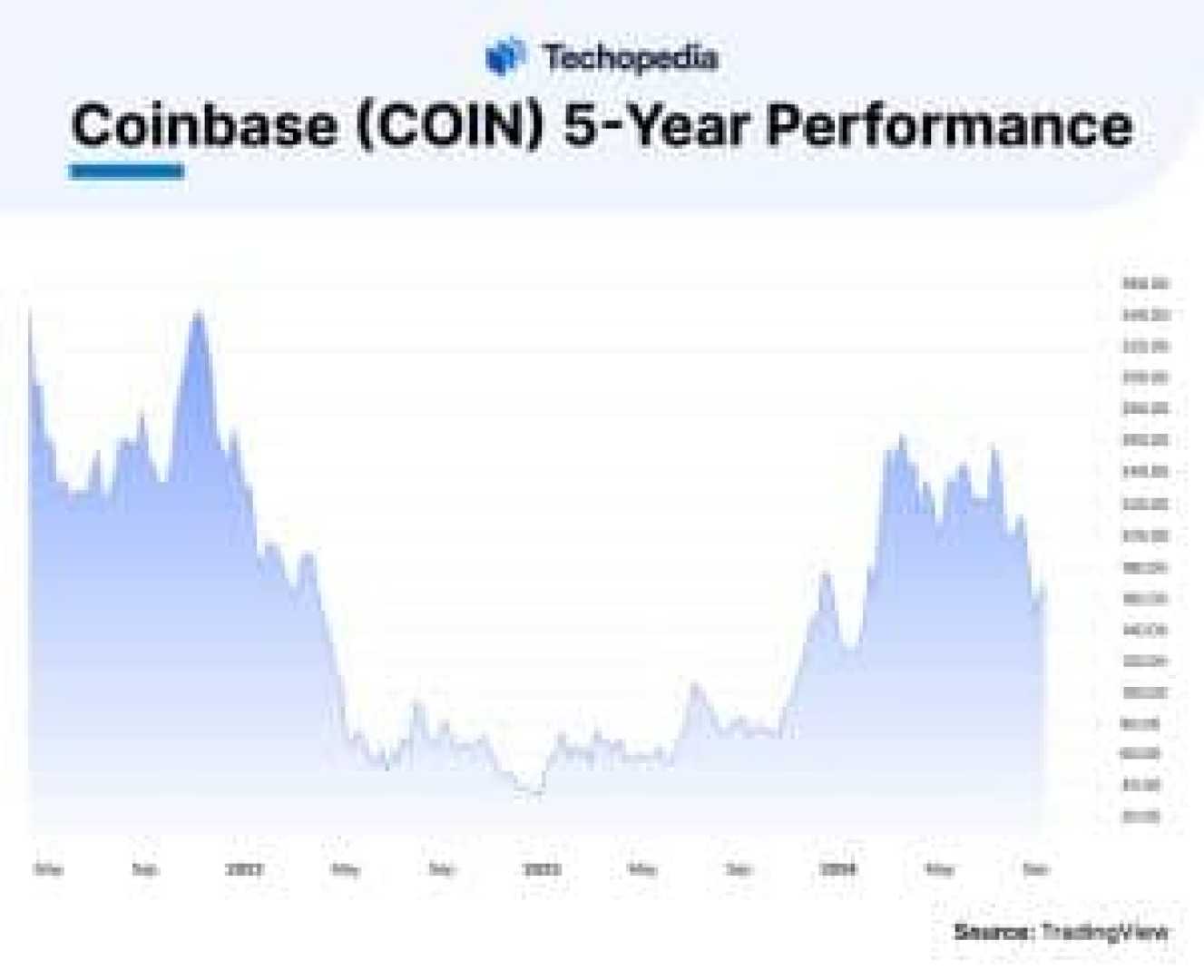

Coinbase Global Inc. (COIN) has seen a significant surge in its stock price, despite recent volatility and a mixed earnings report. As of November 11, 2024, the stock price of Coinbase Global Inc. stands at $270.74, marking a 5.93% increase.

The recent uptick in the stock price is noteworthy, especially given the company’s earnings report which showed revenue increases but a decline in profits. This mixed performance has led to varied analyst opinions, with some technical indicators suggesting a sell signal while others indicate a buy.

From a technical analysis perspective, Coinbase Global’s stock is currently above its 5, 20, and 50-day exponential moving averages, indicating a strongly bullish trend and buying pressure. However, other indicators such as the 8-day and 20-day simple moving averages suggest a sell signal.

Fundamentally, Coinbase remains a leader in the U.S. cryptocurrency exchange market, known for its strong security and regulation-compliant practices. The company’s expansion into adjacent businesses like prime brokerage and data analytics also adds to its growth potential. However, the cyclical nature of cryptocurrency markets poses a significant risk to its revenue stability.

The market capitalization of Coinbase Global Inc. is approximately $46.63 billion, with a 52-week range of $84.09 to $283.48. The stock’s price-to-earnings ratio stands at 41.54, reflecting the market’s valuation of the company’s earnings.

Despite the volatility, many analysts still consider Coinbase Global a buy due to its strong market position and potential for future growth. The Relative Strength Index (RSI) of 46.84 suggests that the stock is currently oversold, which could be a positive indicator for future bullish movement.