Business

U.S. Consumer Debt Patterns Show Mixed Trends Amid Inflation and Interest Rate Adjustments

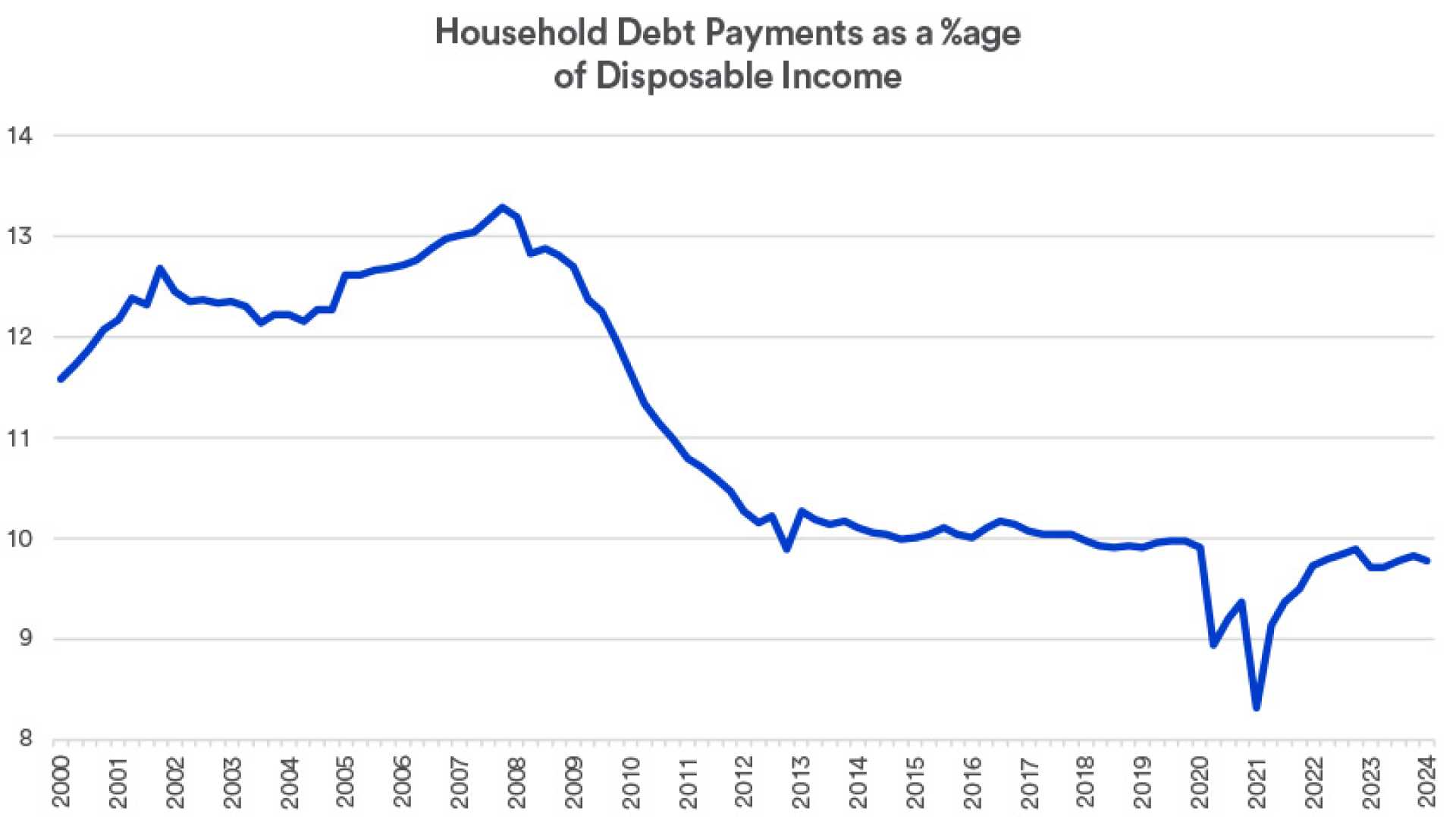

Recent data indicates a shift in American consumer spending behavior, with revolving debt, primarily composed of credit card balances, witnessing a decrease of 1.2% in August compared to the previous year. This information, released by the Federal Reserve, contrasts with a rise of 3.3% in non-revolving debt, which includes categories such as auto and student loans.

Ted Rossman, a senior industry analyst at Bankrate, suggests that these adjustments arise after a period of elevated inflation and high interest rates. “Consumers have been in a pretty frugal mood lately,” Rossman noted, emphasizing the high cost of borrowing associated with credit cards, which currently charge more than 20% interest on average.

Conversely, cardholders who prudently avoid carrying a balance can benefit from rewards without incurring such high interest rates. “The big fork in the road is whether or not you carry a balance,” Rossman further explained.

Despite August’s contraction in revolving debt, Matt Schulz, chief credit analyst at LendingTree, warns against assuming this marks a long-term trend. “It is far more likely that is just a blip,” Schulz said, pointing out that the upcoming New York Federal Reserve debt data will provide more insights.

Heading into the holiday season, the National Retail Federation predicts that easing inflation and potential interest rate cuts by the Federal Reserve could bolster consumer expenditure. Jack Kleinhenz, the chief economist at the NRF, highlighted that “easing inflation is providing added spending capacity to cost-weary shoppers.”

However, the savings trend presents a different picture, with the U.S. savings rate at 4.8% in August, slightly lower than the 4.9% recorded in July, yet significantly higher than the 2.9% rate earlier in the year. This indicates a broader effort among consumers to set aside earnings in the face of financial uncertainty.

The Federal Reserve’s report also noted an overall increase in consumer credit, which rose at an annual rate of 2.1% in August, down from 6.3% in July. Total credit outstanding rose by $8.9 billion in August, following a revised increase of $26.6 billion in July — marking the largest growth since October 2022.