Business

October CPI Report Shows Inflation Acceleration, Impacting Fed Rate Decisions

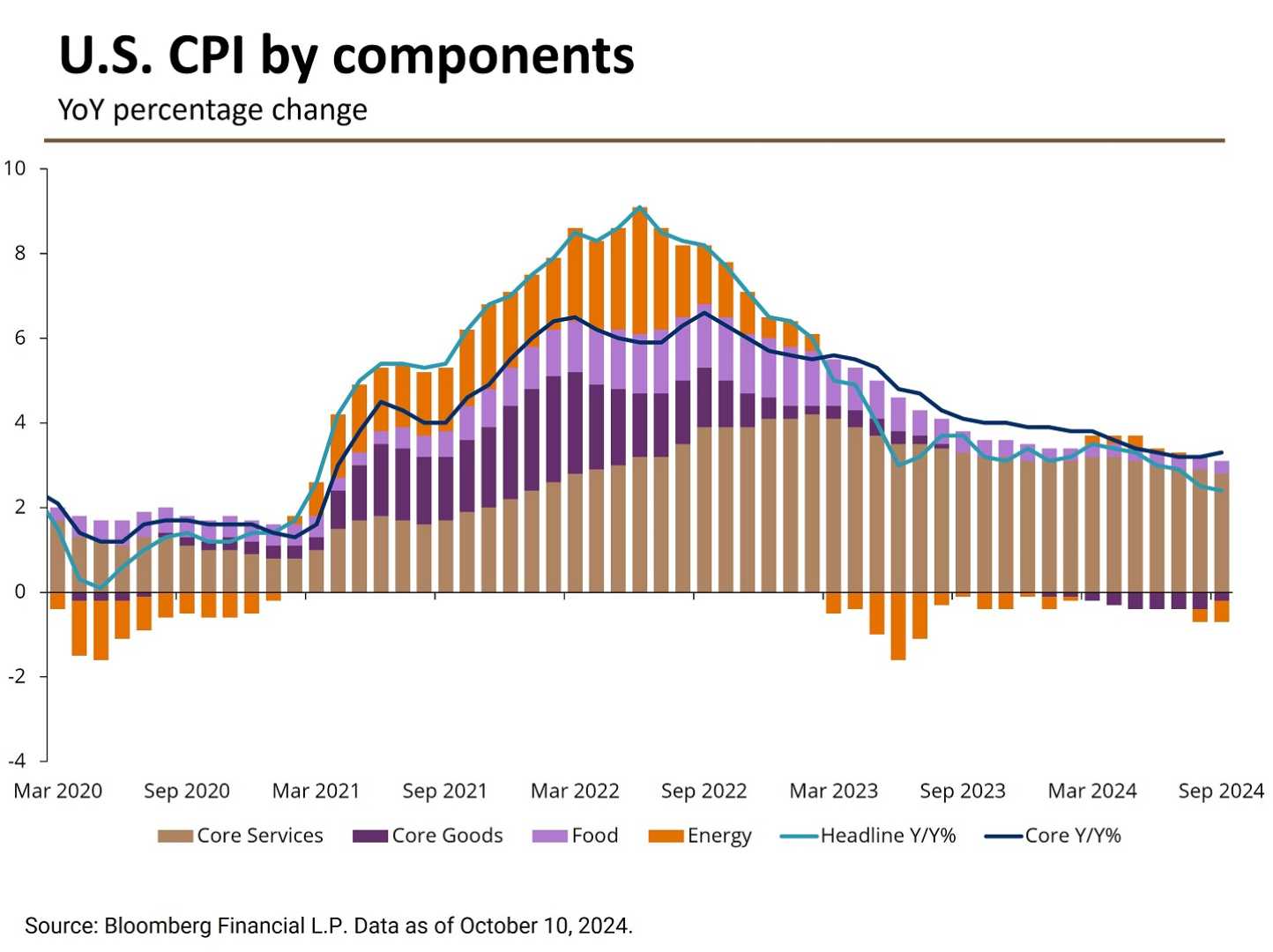

The Consumer Price Index (CPI) for October 2024 has been released, showing that inflation accelerated as expected. The CPI increased by 2.6% on a year-over-year basis, up from the 2.4% rate in September, matching economic forecasts.

This increase indicates that inflation, which had been cooling down for most of 2024, has seen a recent uptick. The last time the headline year-over-year rate increased was in March. The core CPI, which excludes volatile food and energy prices, rose 0.3% for the month and remained at 3.3% annually, also aligning with expectations.

The Federal Reserve, which recently cut interest rates by 25 basis points in its November meeting, will closely monitor these inflation figures. The Fed aims to see consistent signs of inflation decreasing towards its 2% target before deciding on further rate cuts. The upcoming jobs report in early December and other inflation data will also be crucial in shaping the Fed’s decisions.

The market’s reaction to the CPI report could be significant, with the US Dollar likely to experience volatility based on the inflation data. A higher-than-expected CPI reading could reduce the likelihood of a December rate cut, while a lower reading could reinforce expectations of further easing by the Fed.

Additionally, labor market data showed that Nonfarm Payrolls increased by 12,000 in October, and the Unemployment Rate remained steady at 4.1%. Wage inflation also rose to 4% over the year in October, up from 3.9% in September.