Business

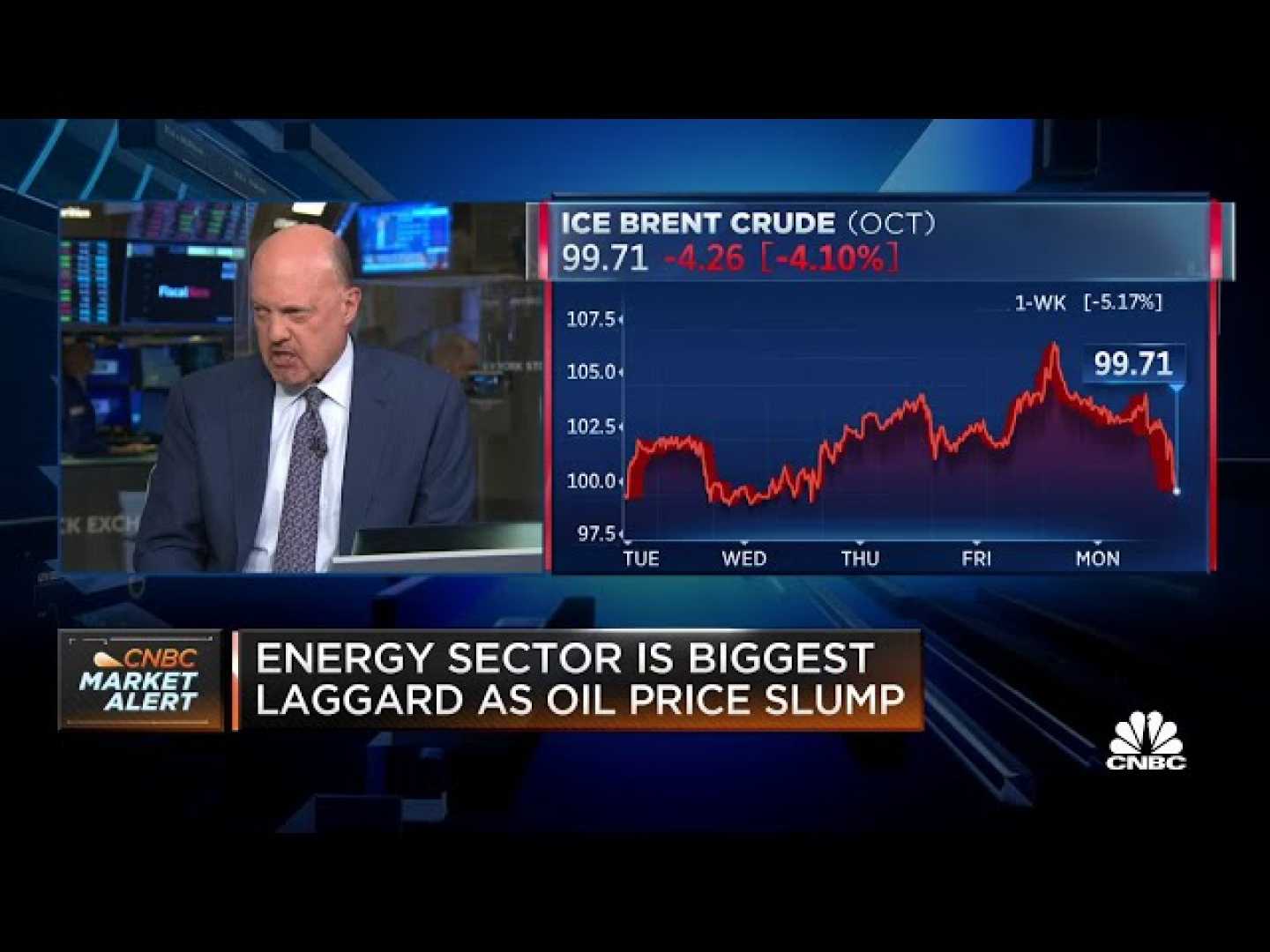

Cramer Advises Caution on Oil Stocks Despite Trump’s Pro-Drilling Stance

NEW YORK — CNBC‘s Jim Cramer cautioned investors on Wednesday that oil service stocks may not immediately benefit from President Donald Trump‘s pro-drilling policies, despite the industry’s enthusiasm for a “drill, baby, drill” administration.

“The whole oil and gas industry loves a ‘drill, baby, drill’ White House, but it doesn’t automatically take up the oil service stocks, or the producers for that matter,” Cramer said. He pointed to recent earnings reports from SLB and Halliburton, two major oil service companies, as evidence of a cautious outlook for the sector.

Cramer noted that while SLB beat earnings expectations, CEO Olivier Le Peuch expressed concerns about an oil oversupply. Le Peuch suggested that the “oil supply imbalance will gradually abate,” citing growing energy demand from artificial intelligence, data centers, and a global focus on energy security.

Halliburton, on the other hand, missed revenue targets and delivered only a slight earnings beat. The company’s management also offered a guarded near-term outlook, though they remained optimistic about long-term growth, particularly due to rising energy demands driven by AI.

Cramer attributed the tempered outlook to comments from RBN Energy CEO Rusty Braziel, who warned that oil producers might hesitate to ramp up production under Trump’s policies due to fears of oversupply and falling prices. “Given how cheap they are, I can’t blame anyone for wanting to pick at them down here,” Cramer said, referring to SLB and Halliburton stocks. “Just please, I’m begging you, buy them gradually, because my bet is we’ll get more near-term weakness as American oil companies hold back to keep prices high and profits robust.”

Neither Halliburton nor SLB immediately responded to requests for comment.