Business

Critical Metals Corp. Hits All-Time High Amid Major Investment News

NEW YORK, NY — Critical Metals Corp. (NASDAQ:CRML) celebrated a significant milestone on Tuesday, extending its winning streak to five consecutive days. The company’s stock climbed to a new all-time high during intra-day trading, reaching $32.15 before closing at $29.97, a 28.74 percent increase.

This surge in stock price comes amid JPMorgan‘s announcement of a $1.5 trillion investment program aimed at supporting critical industries over the next decade. About $10 billion of this investment will focus on enhancing U.S. economic security through initiatives like critical minerals mining and processing.

“Reshoring key industries and building robust, redundant supply networks will safeguard against global disruptions,” JPMorgan stated in a press release. This strategy aligns with U.S. government efforts to strengthen domestic manufacturing and reduce import reliance.

In addition to its impressive stock performance, Critical Metals announced last week that it has signed agreements with REalloys and Ucore Rare Metals for the supply of 15 percent and 10 percent, respectively, of minerals produced from its Tanbreez project in Greenland.

While investment in Critical Metals carries inherent risks, some analysts express confidence in the company’s market position given its alignment with the burgeoning demand for critical minerals.

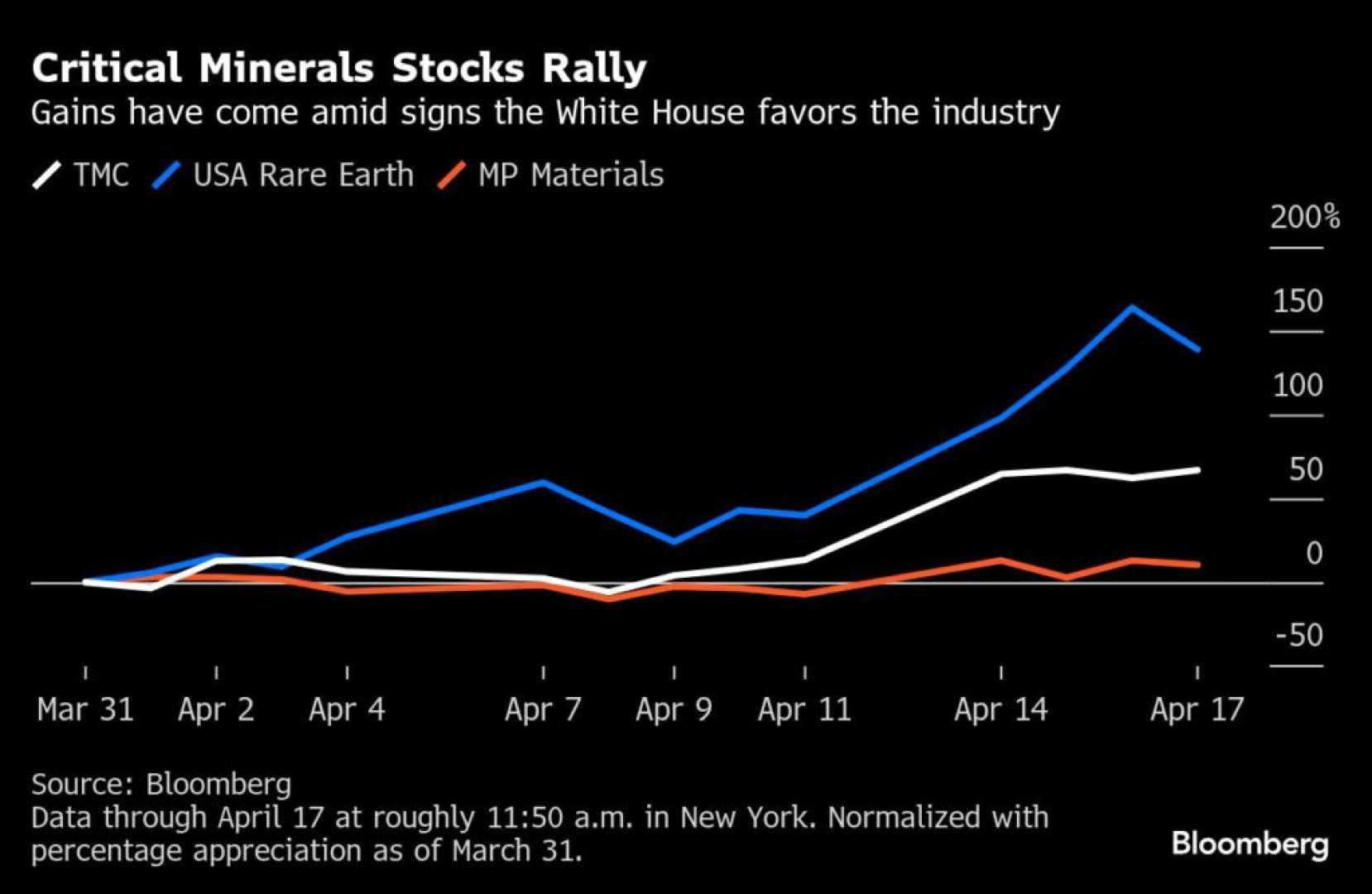

Investors are keenly watching how critical minerals will play a role in the evolving economic landscape as both governmental and private sectors ramp up their focus on domestic production.

“This is a pivotal time for the industry, and we’re excited to be part of a sector that could redefine energy independence,” said the CEO of Critical Metals.