Business

Crypto Prices Take a Hit as Global Markets Stumble

Cryptocurrency prices are facing a rough time lately, with Bitcoin and Ether taking significant hits as concerns about global markets grow.

On a recent Sunday evening in the U.S., Bitcoin dropped by more than 12% over 24 hours, plunging to levels not seen since February. Ether didn’t fare any better, seeing declines of around 21% in the same period and dipping back to prices reminiscent of last December.

The broader cryptocurrency market overall is also down by about 12% in just 24 hours, leading traders to feel the brunt of the market’s volatility.

This market correction seems to be triggered by actions from the Bank of Japan last week, which surprised many by tightening its monetary policy. This unexpected move sent the Japanese yen soaring and sent the Nikkei stock index tumbling.

While the Nikkei dropped another 6% early on Monday, it is already down roughly 15% over the past three trading sessions and about 20% from its mid-July peak.

The turbulence in Japan didn’t stay there; it spilled over into the U.S. markets. The Nasdaq, in particular, experienced a slide of over 5% at the end of last week, and futures for the Nasdaq are already down another 2.5% this Sunday evening.

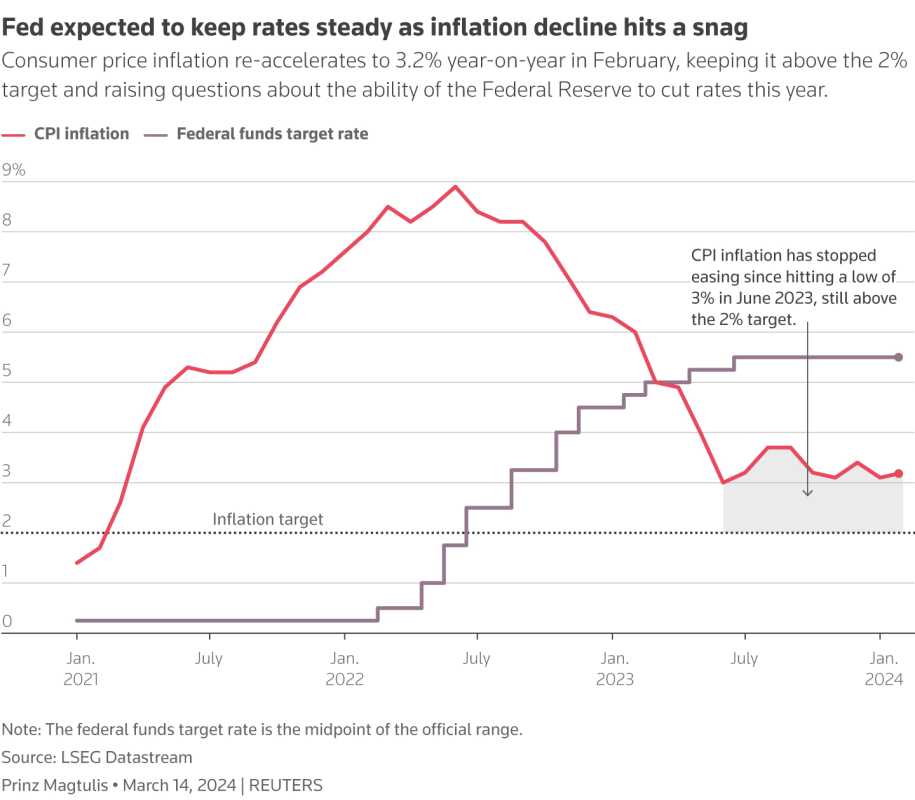

In addition to Japan’s surprising move, the U.S. Federal Reserve also threw a curveball by appearing uncertain about cutting interest rates in September. Traders had widely expected a move to lower rates, but the Fed’s latest hints seemed to throw that assumption into question.

As traders adjust their expectations, they’re now pricing in a 100% chance for lower base rates in September, with a strong possibility of significant cuts coming soon.

Meanwhile, the U.S. 10-year Treasury yield has also dropped sharply, tumbling from 4.25% just a week ago to around 3.75% now, in line with the current economic sentiment.

In the midst of all this, Stephen Alpher, CoinDesk’s managing editor for Markets, pointed out how the scenario is developing, especially with Bitcoin trading drastically lower.