Business

Cryptocurrency Basics: What Investors Need to Know

NEW YORK, NY — Cryptocurrency continues to capture global attention as a digital currency and alternative investment. As the market evolves, potential investors are faced with critical questions regarding its viability and future.

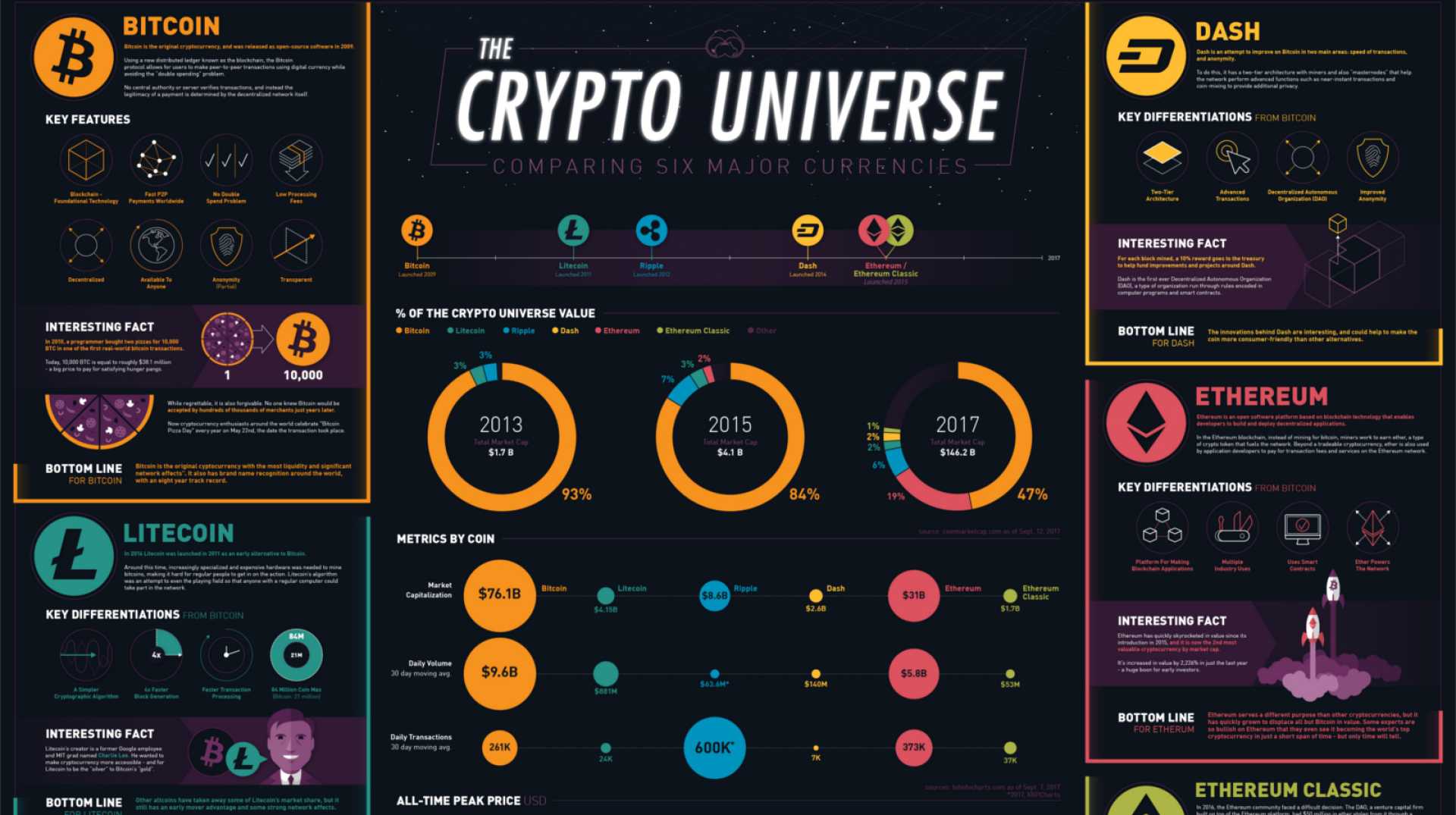

Cryptocurrency, such as Bitcoin and Ethereum, operates without central authority or banks, leveraging advanced cryptographic techniques to enable secure transactions. This decentralized nature is a significant draw for many users, fundamentally altering people’s understanding of finance.

Bitcoin, the first cryptocurrency introduced in 2009, is often seen as a speculative asset, with its value driven by supply and demand dynamics. A growing interest in Bitcoin as a medium for daily transactions could significantly impact its price. “If Bitcoin is adopted broadly as a payment method, demand will rise, thus increasing its value,” said financial analyst John Smith.

Similarly, Ethereum serves as a foundation for decentralized applications and employs its cryptocurrency, Ether, for transactions. The demand for Ether rises in correlation with the growing number of applications developed on its blockchain. “Ethereum’s usefulness for building decentralized applications is a core reason for its value,” added tech entrepreneur Jane Doe.

A fundamental appeal of cryptocurrencies lies in their underlying technology: blockchain. This tamper-resistant ledger allows trustless transactions among parties who may not know each other. Experts agree that blockchain’s ability to secure transaction records is revolutionary, helping to mitigate issues seen in previous attempts to launch digital currencies.

Mining is a primary method for creating new cryptocurrency units. In Bitcoin’s case, this energy-intensive process involves solving complex mathematical problems to validate transactions. While lucrative, the costs and competition associated with mining can be high, and many potential miners resort to joining mining pools. In contrast, newer cryptocurrencies may use less energy-intensive methods for generating and distributing tokens.

While Bitcoin remains the most recognized cryptocurrency, there are thousands of alternatives, each with varying degrees of market valuation. According to CoinMarketCap, many cryptocurrencies have total market caps worth billions, while others may currently be considered worthless.

Investors seeking cryptocurrencies should approach the market with caution. It’s generally recommended that high-risk investments, including cryptocurrencies, comprise a maximum of 10% of one’s overall portfolio. Financial experts recommend analyzing the purpose and application of a cryptocurrency, as well as reviewing publicly available metrics to determine market viability.

The legal landscape surrounding cryptocurrency is still evolving, with regulators across the globe working to determine how best to classify and treat these digital assets. Discussions on potential regulation suggest Congress may take steps to define classification more clearly, which could have major impacts on the market.

As the interest in cryptocurrency grows, so does the urgency for prospective investors to conduct thorough research. Resources like white papers, which outline project intents and mechanics, are essential for due diligence in this burgeoning space. Cryptocurrency carries inherent risks, and savvy investors should remain aware of the potential for significant fluctuations in asset values.

In conclusion, as cryptocurrency technology continues to mature, it becomes increasingly relevant for investors to reflect on its implications and opportunities. Industry experts urge both new and seasoned investors to stay informed, utilize available resources, and embrace cautious strategies for participation in this rapidly changing market.