Business

Cryptocurrency Market Plummets $40 Billion Amid Unprecedented Challenges

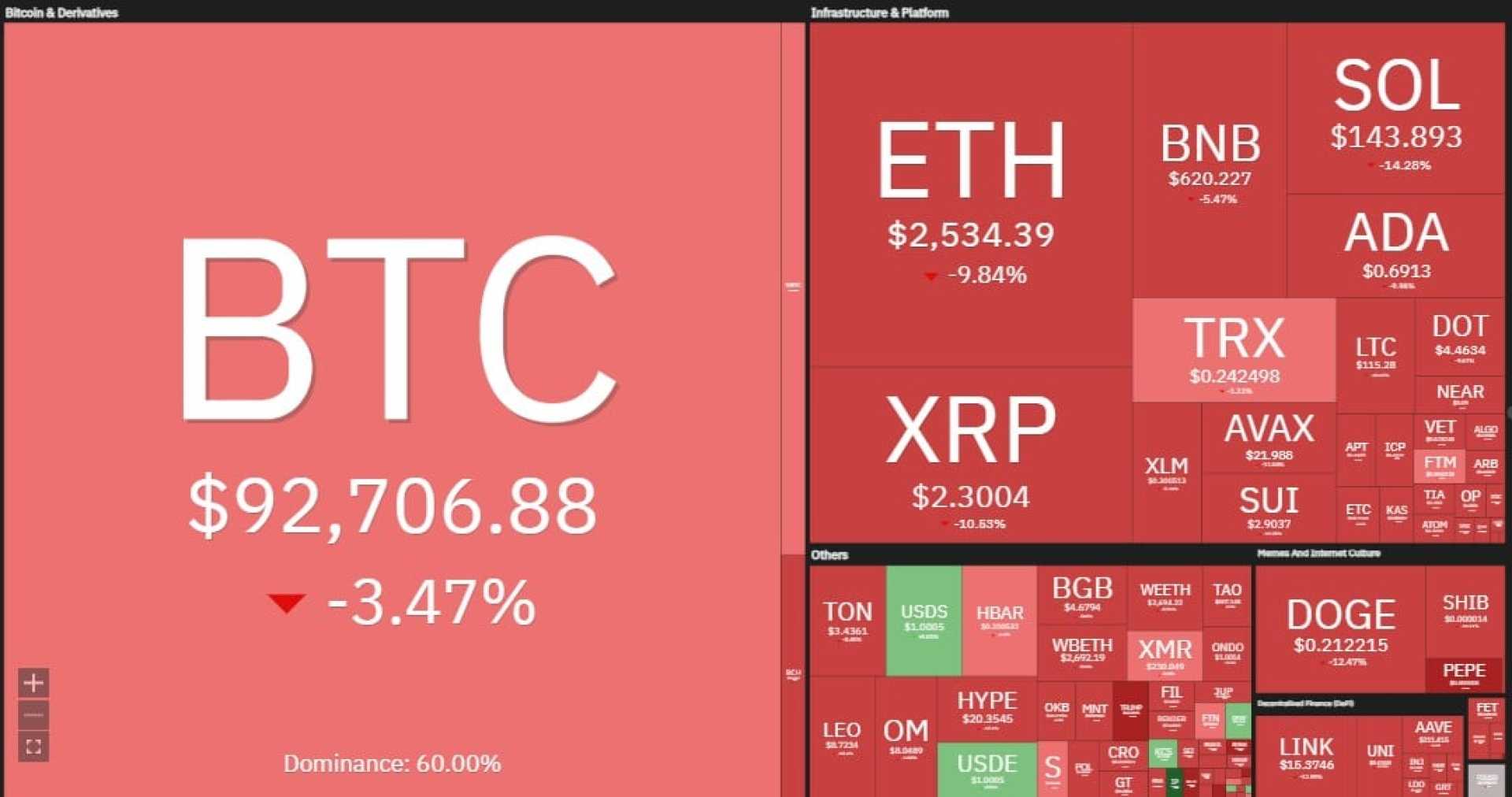

NEW YORK, Feb. 24, 2025 — The cryptocurrency market experienced a significant decline today, with its total market capitalization dropping by 2%, resulting in a loss of approximately $40 billion within 24 hours. Major cryptocurrencies Bitcoin and Ethereum face mounting challenges amid unprecedented outflows from exchange-traded funds (ETFs), significant security breaches, and unfavorable historical market trends.

This downturn is characterized by substantial withdrawals from Bitcoin and Ethereum ETFs, which have seen a combined outflow of over $1.14 billion in the last two weeks—marking the largest net outflows since their launch. In just the past week, more than $571 million was withdrawn from Bitcoin ETFs alone, with Fidelity Investments leading the outflows, followed closely by Grayscale and Bitwise.

The Crypto Fear & Greed Index currently rests at 40, indicating a neutral sentiment in the market that may swiftly deteriorate into fear if these trends persist. Analysts attribute these extensive withdrawals to growing concerns over economic issues such as trade tariffs, inflation, and potential shifts in monetary policy.

Further intensifying market unease are recent security breaches impacting investor confidence. Notably, Bybit’s CEO Ben Zhou announced the recovery of $742 million following a major breach where $1.4 billion in Ethereum was lost, yet many investors remain apprehensive about the security of their assets. A separate hack involving neobank Infini resulted in a $49.5 million loss attributed to USDC, compounding the market’s downward spiral.

Historically, February has been a favorable month for Bitcoin, with most years yielding positive returns, except for 2014 and 2020. However, Bitcoin is currently down 6.41% this February. Analysts suggest that the cryptocurrency must close above $102,500 to avoid marking a third negative February in its history. Currently fluctuating between $93,000 and $100,000, analysts warn that a failure to maintain support at $93,000 could lead to Bitcoin plummeting further to $90,000, with recent trading showing it below $96,000.

Similarly, Ethereum has faced its own set of challenges, trading at around $2,706 after a decline of 2.2%. Despite demonstrating strong performance in the first quarter of every fourth year historically—such as the gains witnessed in Q1 2017 and Q1 2021—Ethereum is down 17% this year, facing fierce competition from rival blockchains like Solana and Cardano.

Amid this tumultuous climate, some companies are seizing the moment to bolster their holdings. Strategy, formerly MicroStrategy, announced a purchase of 20,356 BTC valued at approximately $1.99 billion, averaging $97,514 per bitcoin. This acquisition, reported by co-founder Michael Saylor, brings the company’s total Bitcoin holdings to 499,096 BTC, an investment totaling $33.1 billion, now valued at roughly $47.4 billion.

Despite these recent purchases, Strategy’s stock has not been immune to market pressures, losing more than 12% over the past five days and down 16.5% since last month. Yet, the company remains up by 105% over the past six months, trading near $300 per share.

In conclusion, as the cryptocurrency market grapples with ETF outflows, security concerns, and historical trends, market participants are keenly observing critical support levels for both Bitcoin and Ethereum, awaiting any shifts in sentiment or market conditions that may signal a reversal of fortune.