News

Deadline Approaches for $1,400 COVID Stimulus Tax Credit Claims

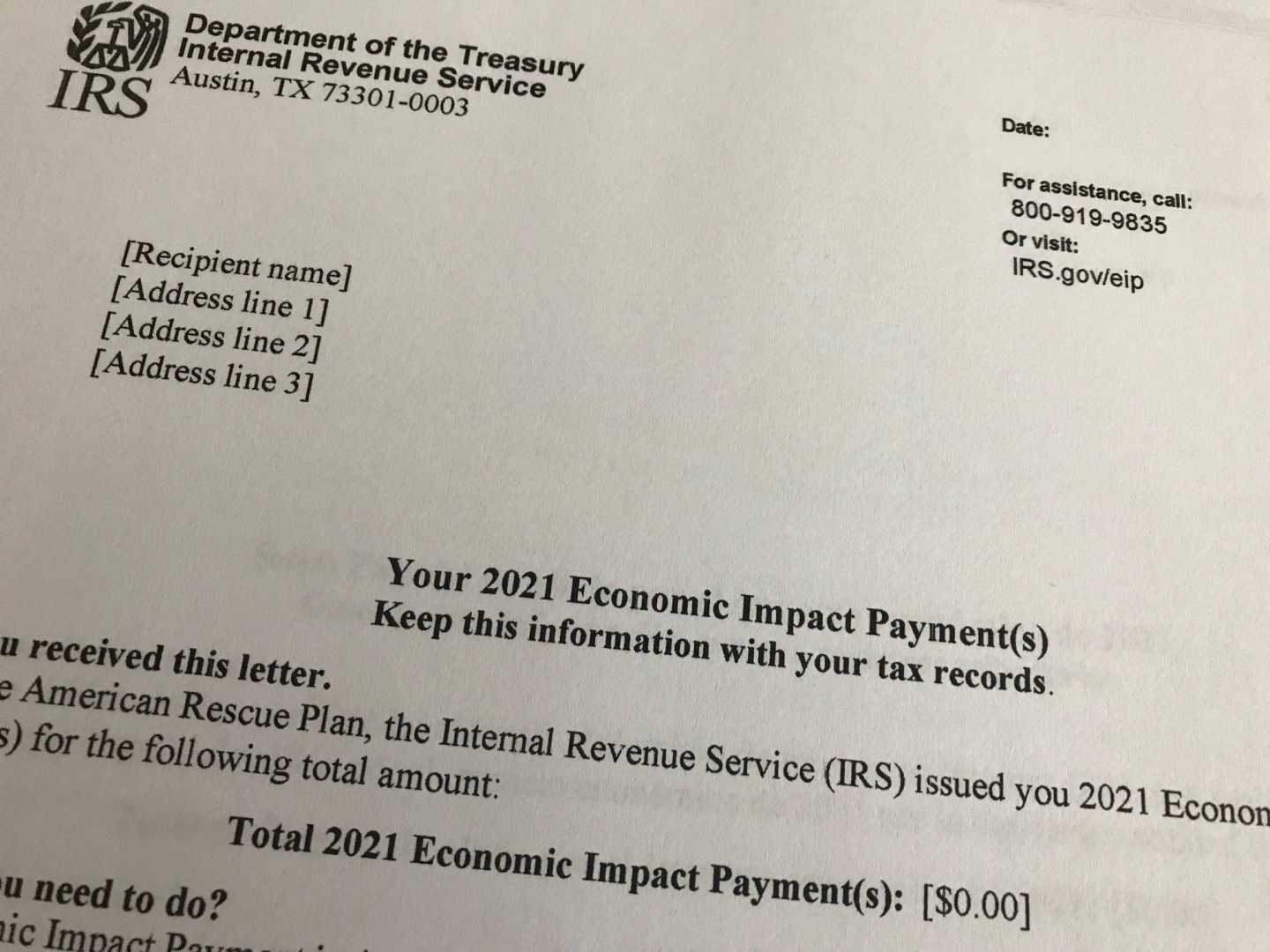

WASHINGTON — The Internal Revenue Service (IRS) is urging over one million Americans to claim a crucial tax credit before the April 15, 2025, deadline that could provide up to $1,400 in stimulus payments. This opportunity is specifically aimed at those who did not receive full Economic Impact Payments (EIPs) during the COVID-19 pandemic.

Three rounds of EIPs were issued to eligible taxpayers to help alleviate financial burdens caused by the pandemic. According to the IRS, while many received their payments automatically, about one million taxpayers either failed to file a 2021 tax return or neglected to claim the Recovery Rebate Credit (RRC).

IRS data showed discrepancies in filings, leading to this notification issued to potential claimants. “If you didn’t get the stimulus, you’re running out of time,” cautioned Robert Nassau, law professor at Syracuse University and director of the school’s low-income tax clinic.

The IRS expects to have distributed most automatic payments by late January 2025. However, individuals who did not file a 2021 return must act swiftly to receive their credits. “Deadline is critical,” Nassau added, emphasizing the necessity to file before the cut-off date.

To qualify for the $1,400 credit, taxpayers must file a 2021 federal tax return and explicitly claim the RRC, even if they had little or no taxable income. The full payment is available for single filers with an adjusted gross income (AGI) of $75,000 or less and couples filing jointly with an AGI of $150,000 or lower.

Dependent children also qualify for the payment, with same AGI thresholds applying. Missing the April 15 deadline risks losing out on both the stimulus payment and other tax breaks, including the Earned Income Tax Credit (EITC), which can yield refunds even without tax liabilities.

As of March, the IRS noted more than 1.1 million taxpayers were owed refunds from the previous year, with a median refund of $781. These figures do not account for any credits claimed.

Simplifying the process, the IRS encourages eligible individuals to utilize its resources, such as free filing services, to ensure they submit their returns correctly. “We want to make sure everyone has the chance to claim what they are owed,” said an IRS spokesperson.

For those at home who remain unsure about their eligibility, the IRS has made online tools available. Taxpayers can create an online account to check their tax records, ensuring they don’t miss out on any payments.

It’s essential to file the 2021 return and claim the RRC in the right section of the form. The IRS also urges individuals to seek professional assistance or check prominent filing services to maximize their chances of a successful claim.

The IRS maintains that $2.4 billion in payments could go to those who qualify for the RRC. They are committed to assisting those who may have been confused about their eligibility or regrettably missed the opportunity to file their returns.

As the application period closes, the IRS emphasizes that this is the last chance for taxpayers to collect their credits from the 2021 tax year. The Recovery Rebate Credit is a vital resource and those impacted by the pandemic are encouraged to act immediately to avoid losing out on financial relief.