Business

Dell Technologies Stock Surges Following S&P 500 Reentry and Positive Analyst Forecasts

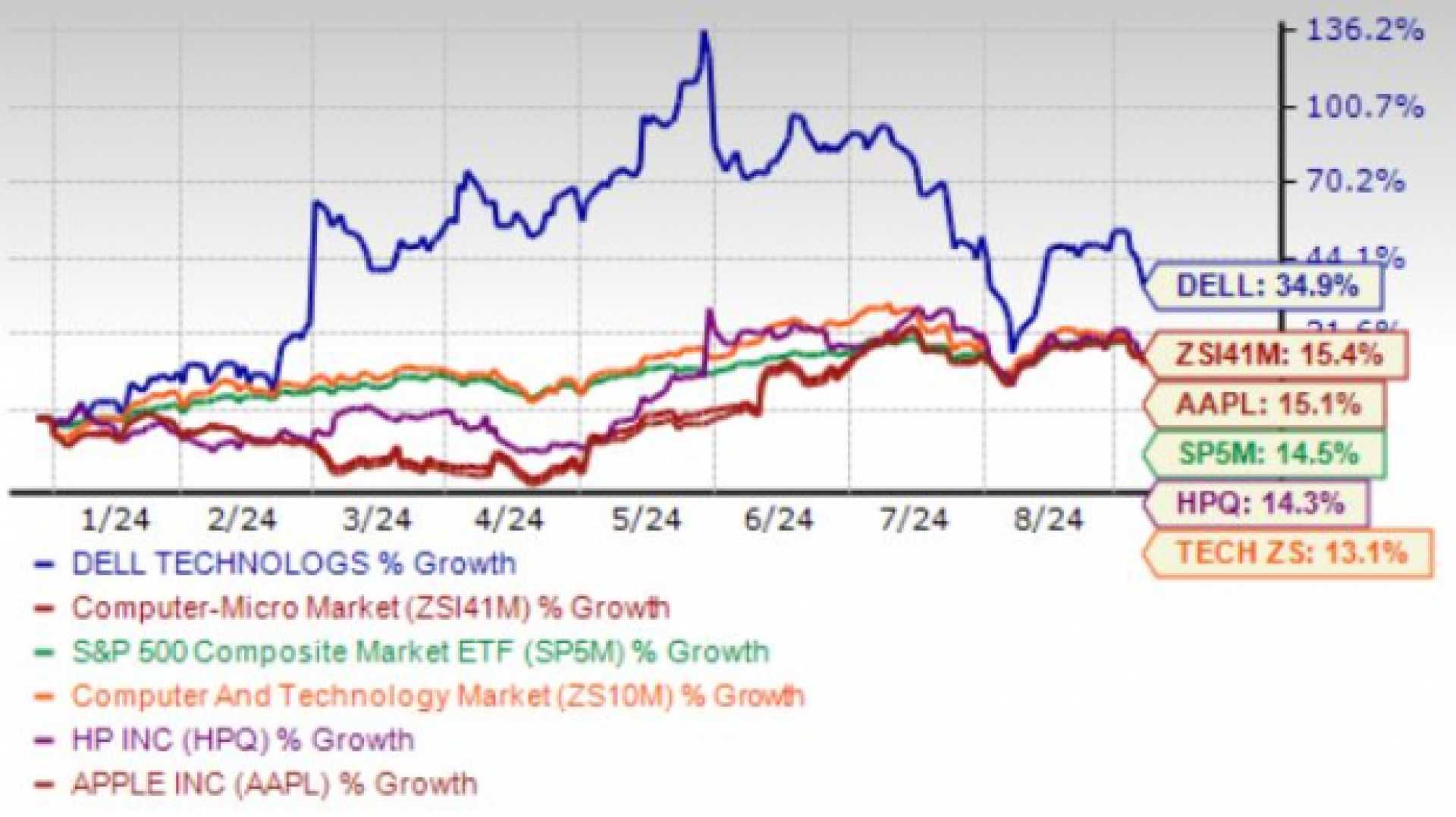

Dell Technologies Inc. (DELL) has seen a significant surge in its stock price in recent days, driven by several key factors. One of the most notable developments is the company’s reentry into the S&P 500 Index on September 24, 2024, marking its return after an 11-year absence since going private in 2013.

The inclusion in the S&P 500 Index aligns with Dell’s 40th anniversary and reflects the company’s strong performance and growth prospects. This milestone has been seen as a positive indicator by investors, contributing to the stock’s upward trend.

Analyst forecasts have also been favorable, with 16 analysts giving DELL stock an average rating of “Buy” and a 12-month stock price forecast of $142.13, representing an increase of 18.95% from the current price. This optimism is partly due to Dell’s strong AI server sales growth and its reasonable valuation.

In terms of financial performance, Dell Technologies reported revenue of $88.43 billion in 2023, although this was a decrease of 13.56% from the previous year. However, the company’s earnings increased by 31.49% to $3.21 billion during the same period. The company’s forward-looking financials, including projected net sales of $97.46 billion for 2025 and $105 billion for 2026, also suggest continued growth.

Additionally, Dell’s strategic collaborations, such as its extended partnership with NVIDIA to transform telecom network operations through AI, have further bolstered investor confidence in the company’s future prospects.