Business

Disney Stock Gains as 2025 Forecast Shows Growth Potential

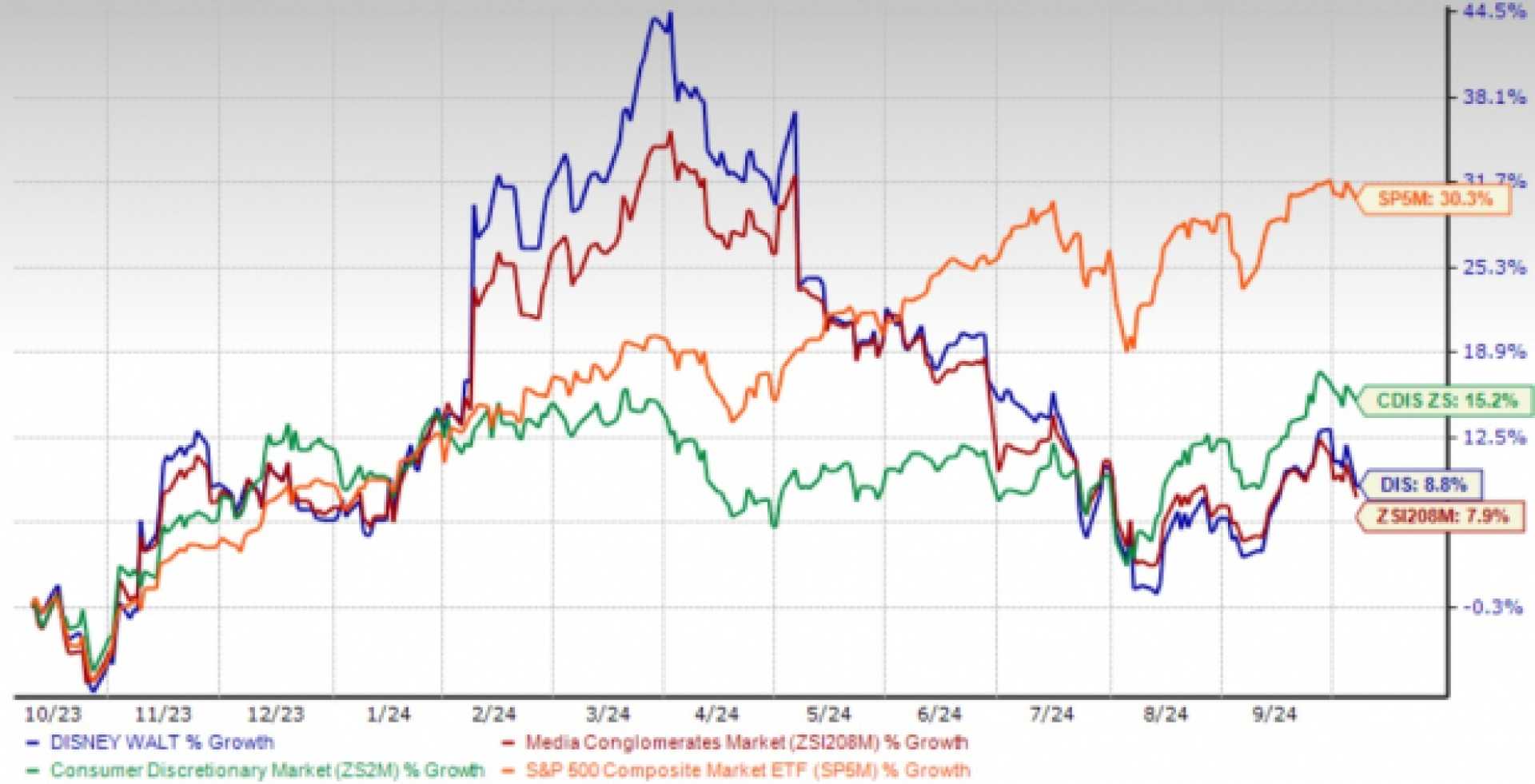

Disney stock saw a modest gain in early 2025, aligning with the S&P 500 Index, offering a reprieve for investors after a lackluster 4% return in 2023. The company, which underperformed the S&P 500 in both 2021 and 2022, is now projecting high single-digit revenue growth and double-digit earnings growth for fiscal 2025 and beyond.

Despite political headwinds, including criticism from President-elect Donald Trump over Disney’s perceived ‘wokeness,’ the company remains focused on its long-term fundamentals. Trump has repeatedly targeted Disney, most recently praising former Marvel Entertainment chairman Isaac Perlmutter for leaving the company, citing dissatisfaction with its direction.

Disney’s streaming business has turned profitable, with operating income expected to rise by $875 million in fiscal 2025. The company is also preparing to launch a direct-to-consumer ESPN platform in early fall 2025, which could become a key growth driver. Additionally, Disney is cracking down on password sharing and increasing ad sales to improve margins.

The company’s strong box office performance in 2024, with hits like ‘Zootopia 2‘ and ‘Captain America: Brave New World,’ is expected to continue into 2025 with a slate of highly anticipated releases. These successes not only boost earnings but also enhance Disney’s streaming content library, making its offerings more attractive to subscribers.

Analysts remain optimistic about Disney’s future, with 19 out of 30 rating the stock as a ‘Strong Buy’ and a mean target price of $127.23, representing a 14.2% upside from its December 2024 closing price. Despite political tensions, Disney’s strong fundamentals and growth potential make it a compelling choice for long-term investors.