Business

Is the U.S. Dollar Losing Its Status as the World’s Reserve Currency?

CHARLOTTESVILLE, Va. — The U.S. dollar, long considered the dominant global currency, faces unprecedented challenges as its status as the world’s reserve currency comes under scrutiny. Recent volatility in U.S. stock and bond markets, coupled with a notable weakening of the dollar against major currencies, raises questions about the future of the greenback on the world stage.

Last week, confidence in the dollar shook as it fell sharply amid turbulent market conditions. This unexpected decline prompted economists and investors to rethink the dollar’s supremacy, leading to discussions about potential successors such as the euro, the Chinese yuan, and digital currencies.

“For all of its flaws, the greenback remains the most important invoicing and vehicle currency,” said Marc Chandler, a currency strategist at Bannockburn Capital Markets, during a class at the University of Virginia‘s Darden School of Business. “But the landscape is shifting.”

Historically, the dollar has been a safe haven during global financial disturbances, but current dynamics are changing. According to Chandler, recent developments in U.S. economic policies, particularly under the Trump administration, have contributed to uncertainty surrounding the dollar’s reliability.

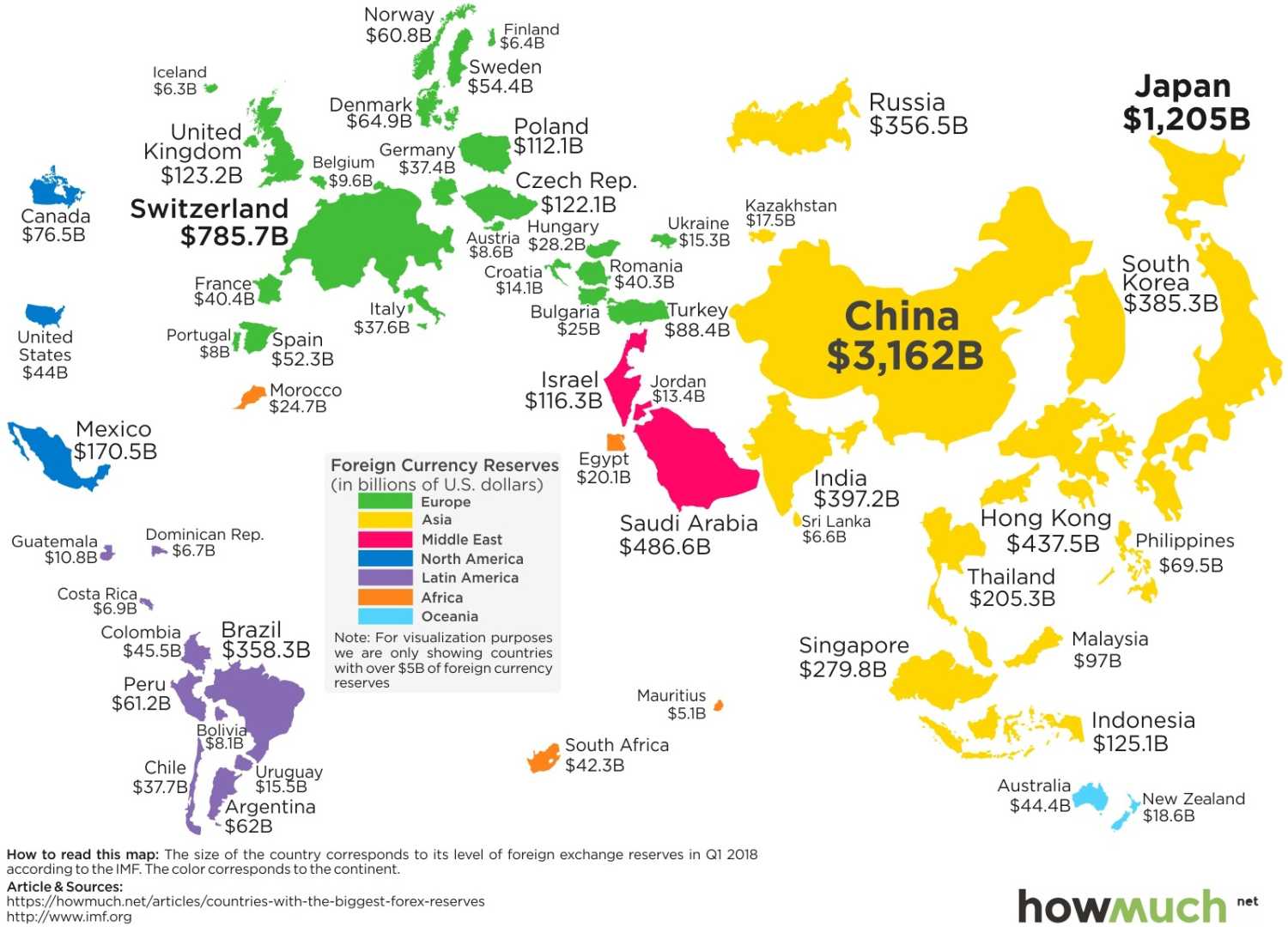

The dollar constitutes about 60% of global currency reserves, while the euro represents about 20%. But market reactions to tariffs and trade wars initiated by Trump have complicated the dollar’s position. Chandler referred to the ongoing situation as a “cloud of uncertainty” that could lead to slower economic growth not just in the U.S., but globally.

“It’s not just about whether the U.S. can maintain its obligations or not, but whether it will choose to,” he added. Concerns over confidence in the dollar are also fueled by discussions of potential tariff changes, with Trump’s recent announcements indicating tax increases on imports that could destabilize markets further.

Chandler expressed skepticism regarding the rise of cryptocurrencies such as Bitcoin as alternatives to traditional currencies, stating they do not fully meet the criteria of a reliable medium of exchange. “What we see with crypto is more a storage of savings than a legitimate currency that facilitates everyday transactions,” he explained.

Despite these uncertainties, he maintained that the dollar’s overwhelming presence as a funding currency and investment medium remains unchallenged. “Supply chains are often dollar-funded. The dollar knows no rival,” he said.

As international discussions continue about the future of monetary systems, the ECB and Bank of England, among others, keep a close eye on the evolving situation. The dynamics of global trade, especially concerning the worth of the dollar and competitive pressures from the eurozone and China, are significant. “The risk is high that decisions made in the U.S. could lead to a restructuring of global monetary trust,” warned Frank Warnock, a professor at Darden.

Lagarde’s remarks at the recent ECB meeting reflected the need for adaptability in the face of growing economic tensions. “We are always ready to use the instruments necessary to procure financial stability. The situation is evolving, and we must stay vigilant,” she said.

As conversations about reserve currencies span traditional finance and emerging digital alternatives, experts agree the future of the dollar is precarious. While a return to the status quo may not be guaranteed, the long-term potential for currencies such as the euro to ascend could reshape the global financial landscape.