Business

Economic Concerns Rise as US Data Shows Slowdown

WASHINGTON, D.C. — The U.S. economy is showing signs of slowing as new data released Wednesday reveals a drop in job openings and deteriorating consumer confidence. The Labor Department reported that job openings fell to a six-month low of 7.19 million in March, down from 7.48 million in February.

The Conference Board‘s consumer confidence index also fell to 86.0 in April, marking a nearly five-year low and falling short of expectations which had anticipated a figure of 87.7. This drop particularly affects perceptions of the economy’s future, according to experts.

“The numbers highlight growing concerns over the labor market and income levels,” said senior economist Sarah Williams. “They indicate potential headwinds for economic growth.”

Market reactions mirrored these anxieties, as bond yields dropped sharply following the data release. The 10-year U.S. Treasury yield fell by 3.4 to 4.7 basis points across the curve, erasing earlier gains, a sign that investors are increasingly betting on the Federal Reserve to cut rates.

This comes ahead of the anticipated jobs report due on Friday, which analysts predict may show a slowdown in job growth, forecasting only 115,000 new jobs added in April, down from 155,000 in March.

Meanwhile, President Donald Trump reiterated his commitment to tariffs, projecting that they would ultimately bolster U.S. manufacturing and contribute to economic growth. “As tariffs take effect, we expect growth to rebound,” Trump said during a speech marking his administration’s 100th day in office.

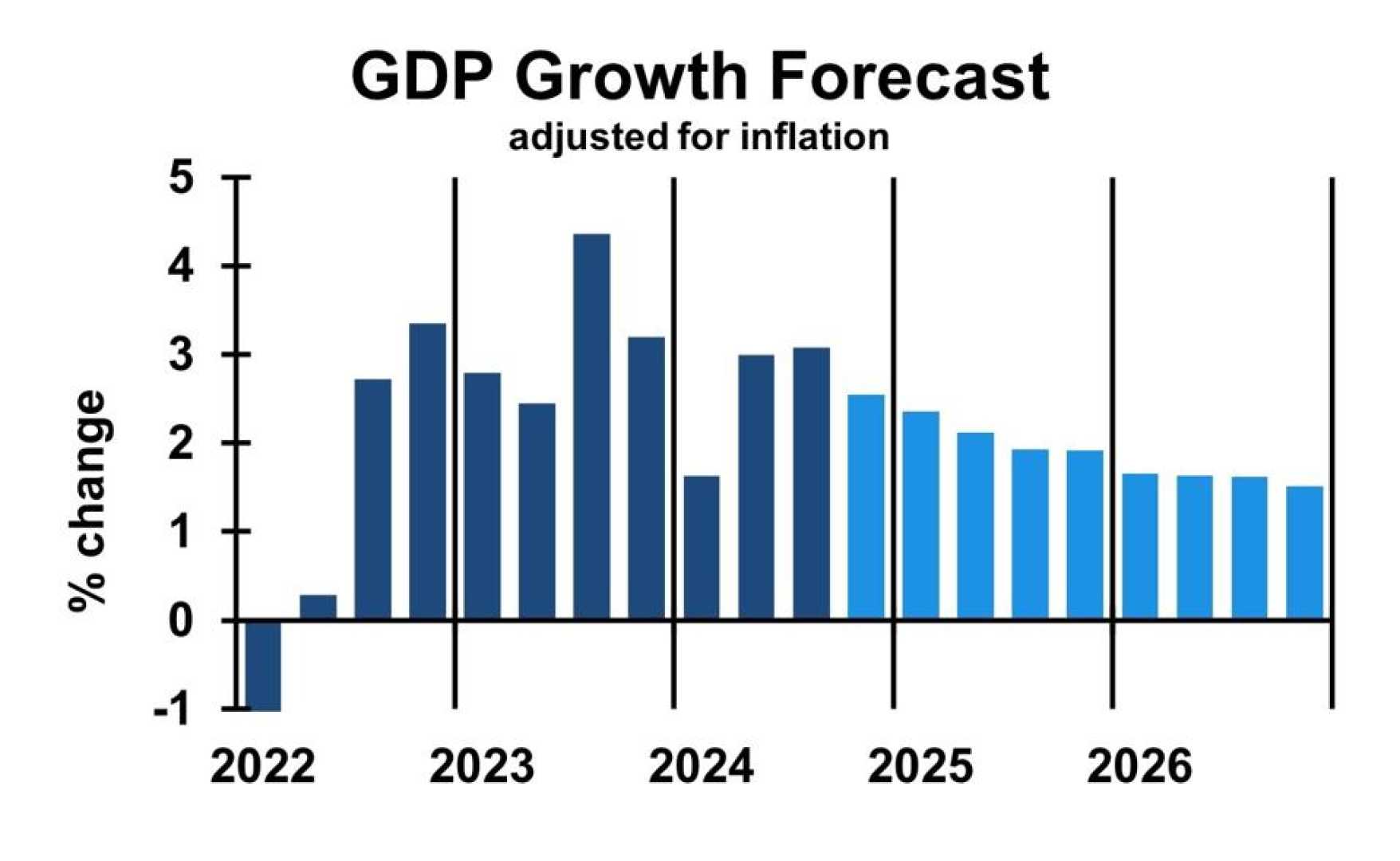

Global economic indicators reflect a mixed picture as well, with the Eurozone posting a GDP growth of 1.2% for the same quarter, signaling a wider divergence in economic recovery prospects. U.S. GDP growth for the first quarter is expected to show only a 0.4% increase, a significant slowdown from 2.4% growth seen in the previous quarter.

As data continues to flow in, market participants will be closely monitoring the implications for both consumer sentiment and future Federal Reserve actions.

“The coming days will be critical. The first quarter GDP report and non-farm payrolls will likely shape the outlook for the remainder of the year,” Williams noted.