Business

Eli Lilly (LLY) Stock Surges Ahead of Q3 Earnings: Analyst Expectations and Market Outlook

Eli Lilly and Company (LLY) is set to release its third-quarter earnings on October 30, 2024, amidst high investor anticipation and significant market movements. Wall Street analysts expect the company to report earnings per share (EPS) of $4.49 and revenues of approximately $12.10 billion.

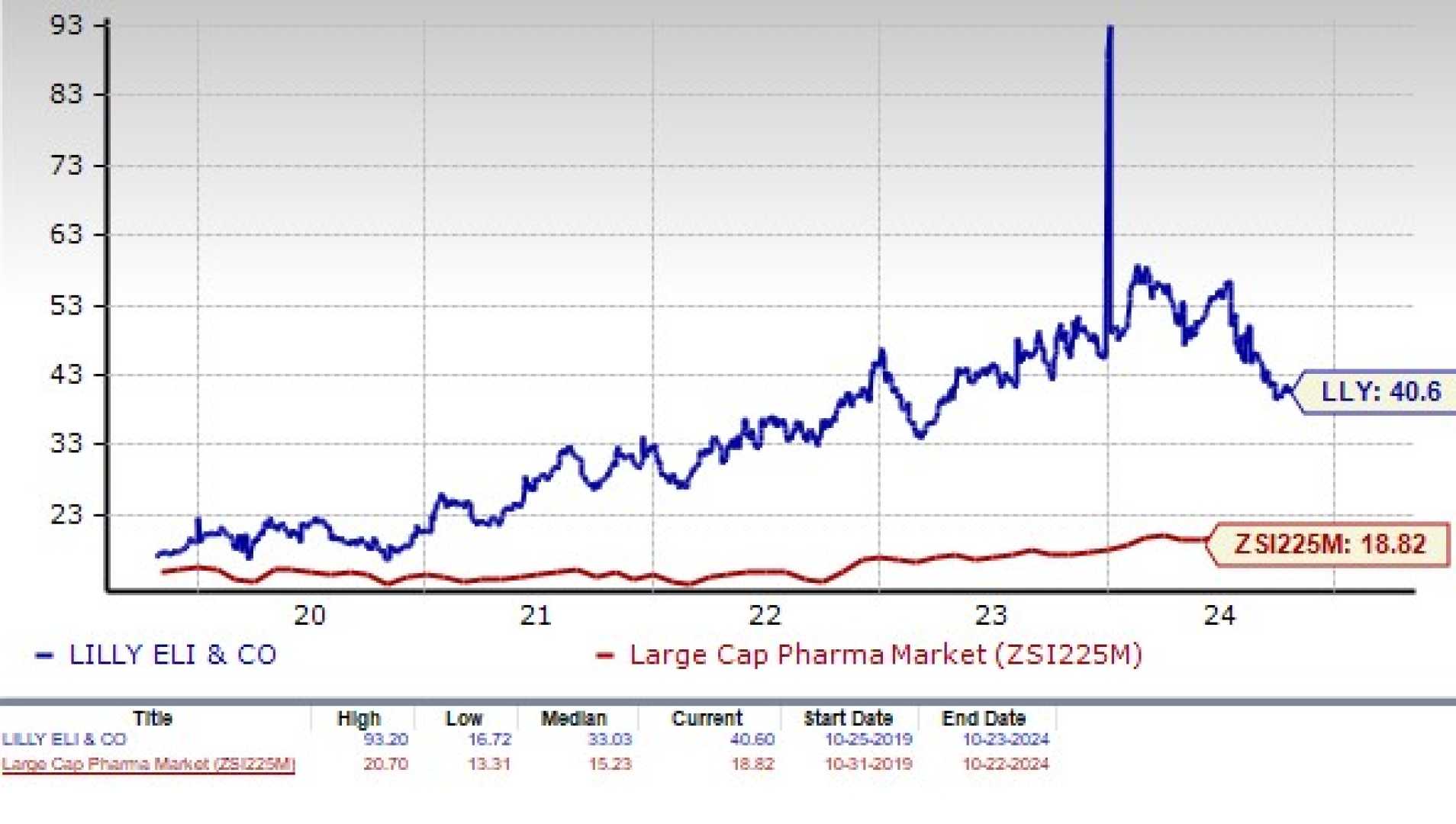

The company has seen a remarkable rise in its stock price, up 58.31% over the past year and 51.23% year-to-date, driven largely by the success of its weight loss medications, Mounjaro and Zepbound. These treatments collectively generated over $4 billion in revenue last quarter, solidifying Eli Lilly’s position in the rapidly expanding weight loss drug market.

Analysts have a “Strong Buy” rating for LLY stock, with a 12-month price target of $964.40, indicating an expected increase of 8.03% from the current price. The consensus among 21 analysts reflects the company’s robust financial performance and innovative drug pipeline, which includes new treatments and therapies for diabetes, cancer, and autoimmune diseases.

There are also rumors of a potential stock split, which could make shares more accessible to a broader range of investors. This move is seen as a strategy to attract more investors as the company continues to innovate and expand its product offerings in a growing market.

Technically, Eli Lilly’s stock has presented a bearish outlook in the short to mid-term, with the stock price below its five-, 20-, and 50-day exponential moving averages. However, long-term indicators suggest a bullish signal, with the stock sitting above its 200-day simple moving average.

In addition to its financial performance, Eli Lilly has been investing heavily in new research and manufacturing capabilities, including a $53 billion investment in Indiana. The company has also secured several regulatory approvals and is advancing promising next-generation therapies, such as orlipron and retatrutide, expected to yield significant revenue by 2030.