Business

U.S. Employment Growth Slows as Market Awaits Job Data

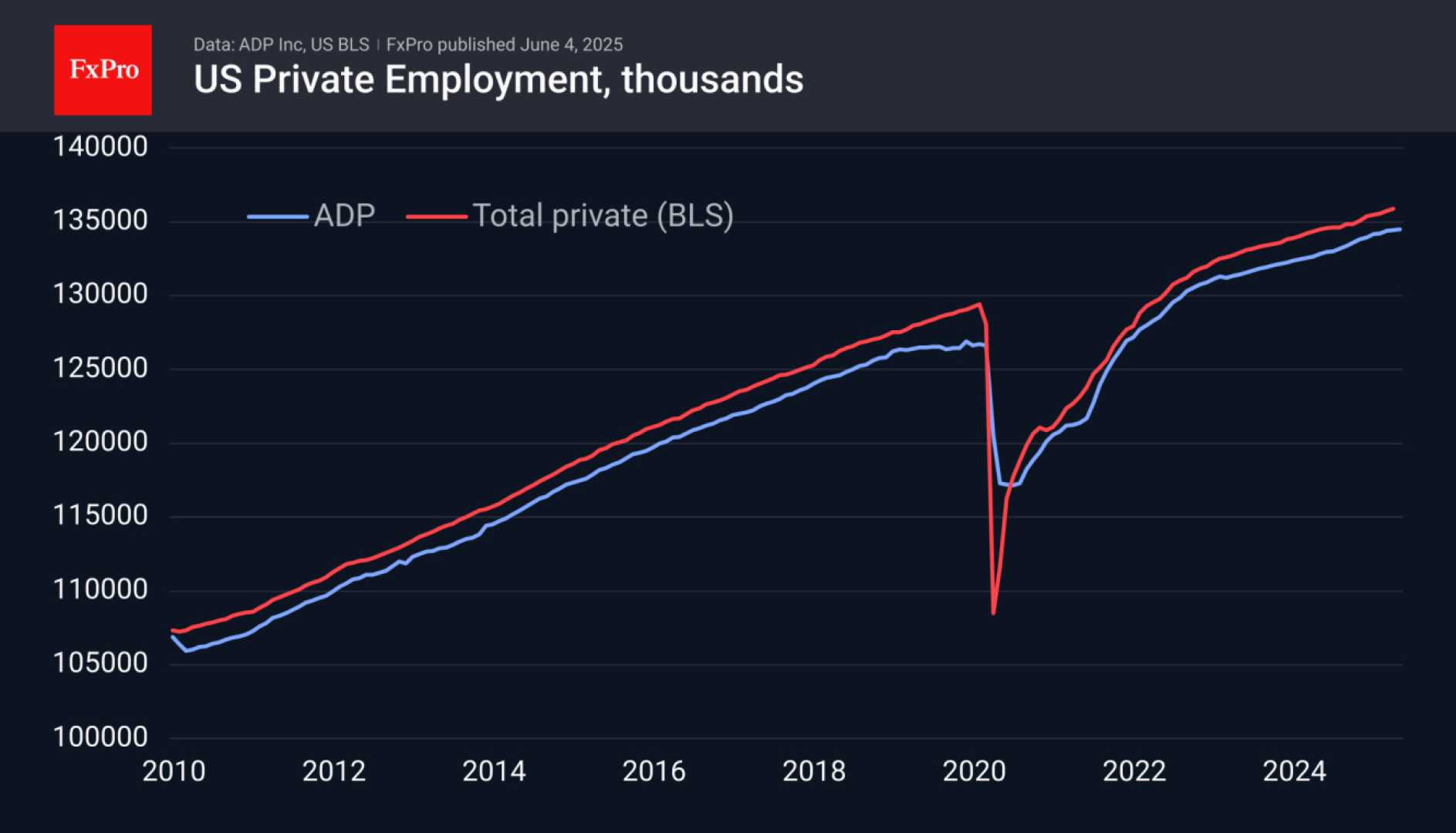

New York, NY — The U.S. ADP Employment Change reported a modest increase of 62,000 jobs in April, falling short of historical averages and market predictions. This weak data has raised concerns about slowing job creation, potentially impacted by temporary disruptions such as adverse weather and lagging demand in interest-sensitive sectors.

The forecast for May has been adjusted slightly upward to 70,000, suggesting optimism that April’s downturn was temporary. Seasonal hiring trends typically improve in construction, hospitality, and retail as spring advances. Recent economic data, including stable consumer spending and strong corporate earnings, indicates the labor market remains fundamentally sound.

The ADP report, which informs the official U.S. job data, is expected to be released today at 12:15 GMT. This comes as businesses are cautiously addressing hiring as the economy shows signs of a soft landing—slower growth without a significant contraction.

In Canada, the Bank of Canada kept its key interest rate steady at 2.75% in its last policy meeting, showing a wait-and-see approach regarding inflation and economic health. With easing price pressures and moderate growth, the market consensus suggests continued stability at this rate, with no urgent need for rate adjustments.

Later today, the U.S. ISM Services PMI index is set for release, anticipated to show slight growth in the services sector, projected at 52 for May. Although earlier readings were slightly higher, these figures indicate resilience in business activity despite inflation and demand pressures.

Market participants are monitoring these developments closely, awaiting indications from the European Central Bank (ECB) and Bank of Canada’s upcoming meetings on potential rate cuts. Yesterday’s data indicated that both regions may adopt more accommodative monetary policies.