Business

EQT Corporation Poised for Earnings Growth Amidst Natural Gas Price Fluctuations

PITTSBURGH, Pa. — EQT Corporation is set to announce its fourth-quarter earnings on February 18, following the closing bell. Analysts anticipate that the largest natural gas producer in the United States will report a notable increase in earnings due to rising sales volumes and improved realized prices.

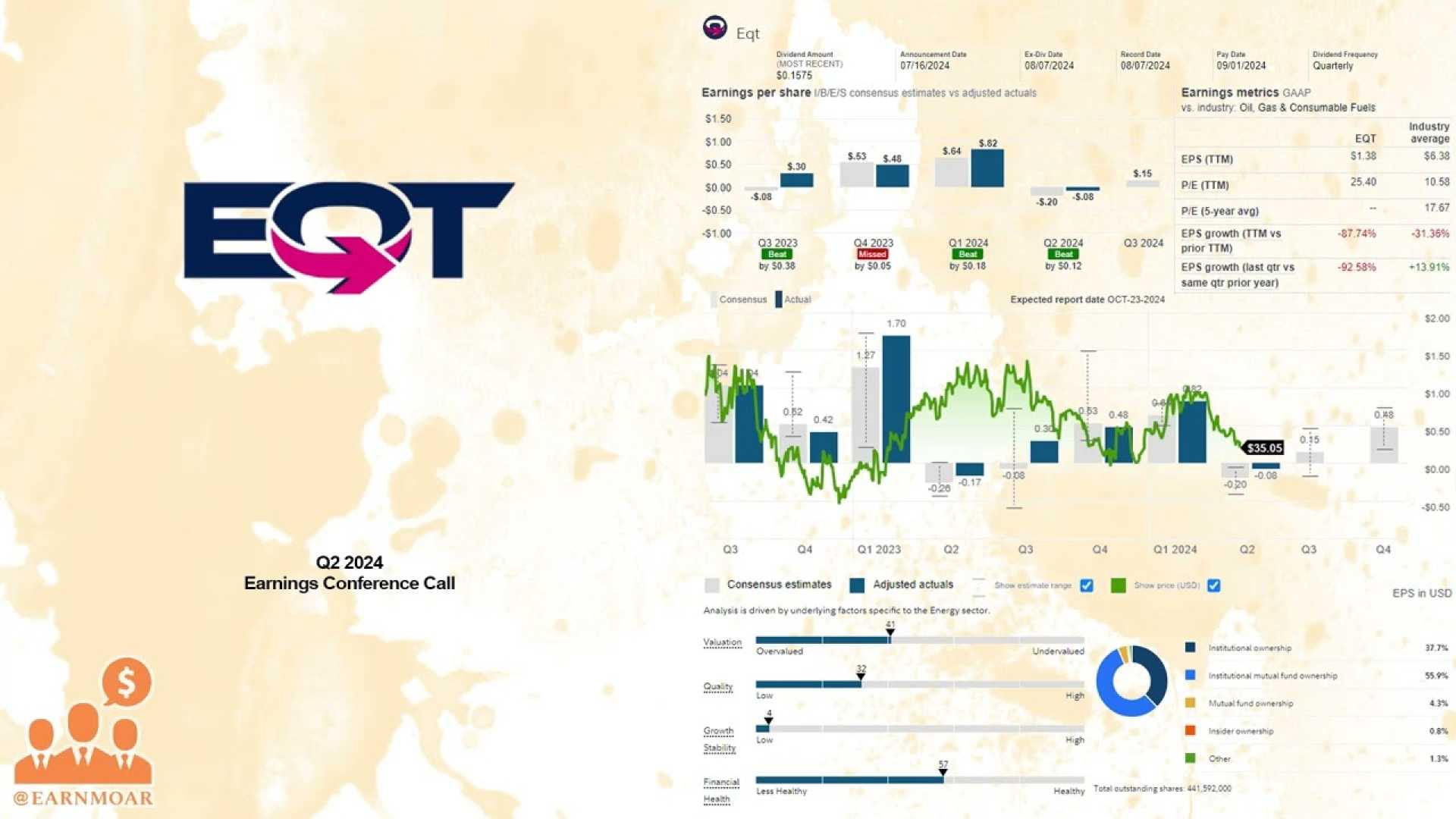

In the prior quarter, EQT’s earnings per share (EPS) stood at $0.12, surpassing the Zacks Consensus Estimate of $0.05. This strong performance was attributed to higher production levels and favorable pricing dynamics, as the company met or exceeded earnings estimates in three out of the last four quarters, achieving an average surprise of 56.01%.

The market’s current consensus estimates suggest EQT will report EPS of $0.50, reflecting a 4.17% increase year-over-year. Revenue estimates also show a promising forecast, with expected revenues of $1.73 billion, marking an 11.99% improvement from the corresponding period last year.

EQT’s strategic focus on increasing production levels in a recovering commodity pricing environment has largely contributed to its earnings potential in the upcoming report. According to recent calculations, the company is projected to achieve a 5.8% increase in natural gas equivalent volumes compared to last year.

Data from the U.S. Energy Information Administration indicates a downward trend in natural gas prices compared to last year, with average Henry Hub prices of $2.20, $2.12, and $3.01 per million Btu recorded in the last three months of 2024, compared to $2.98, $2.71, and $2.52 during the same time in 2023. Despite this decline, EQT’s enhanced production capabilities are expected to offset the pricing challenges.

The firm is also working diligently on reducing its operating expenses by minimizing upstream lease operating expenses (LOE) as well as general and administrative costs (G&A), a strategy expected to further bolster profitability.

Using a proven earnings model, our insights suggest EQT is likely to outperform the estimates once again. Currently, the company exhibits an Earnings ESP of +7.44%, bolstered by maintaining a Zacks Rank of #3 (Hold), which further emphasizes its likelihood of an earnings beat.

Other companies in the sector showing promise include SM Energy, which has an Earnings ESP of +0.36% and a Zacks Rank of #1 (Strong Buy). SM Energy plans to unveil its fourth-quarter results on February 19, with an earnings estimate of $1.93 per share, up 23.72% from last year.

Kimbell Royalty is also on the radar, possessing an Earnings ESP of +0.9% and a Zacks Rank of #1, scheduled to report on February 27. The consensus estimate for Kimbell’s earnings stands at 19 cents per share, indicating a 35.71% year-over-year increase.

Additionally, Range Resources Corporation reports a +1.96% Earnings ESP and a Zacks Rank of #2, with expectations set for a release on February 25, targeting an estimated 55 cents per share in earnings, a 12.7% decline from the previous year.