Business

Etsy Stock Faces Challenges After Goldman Sachs Downgrade and Q3 2024 Results

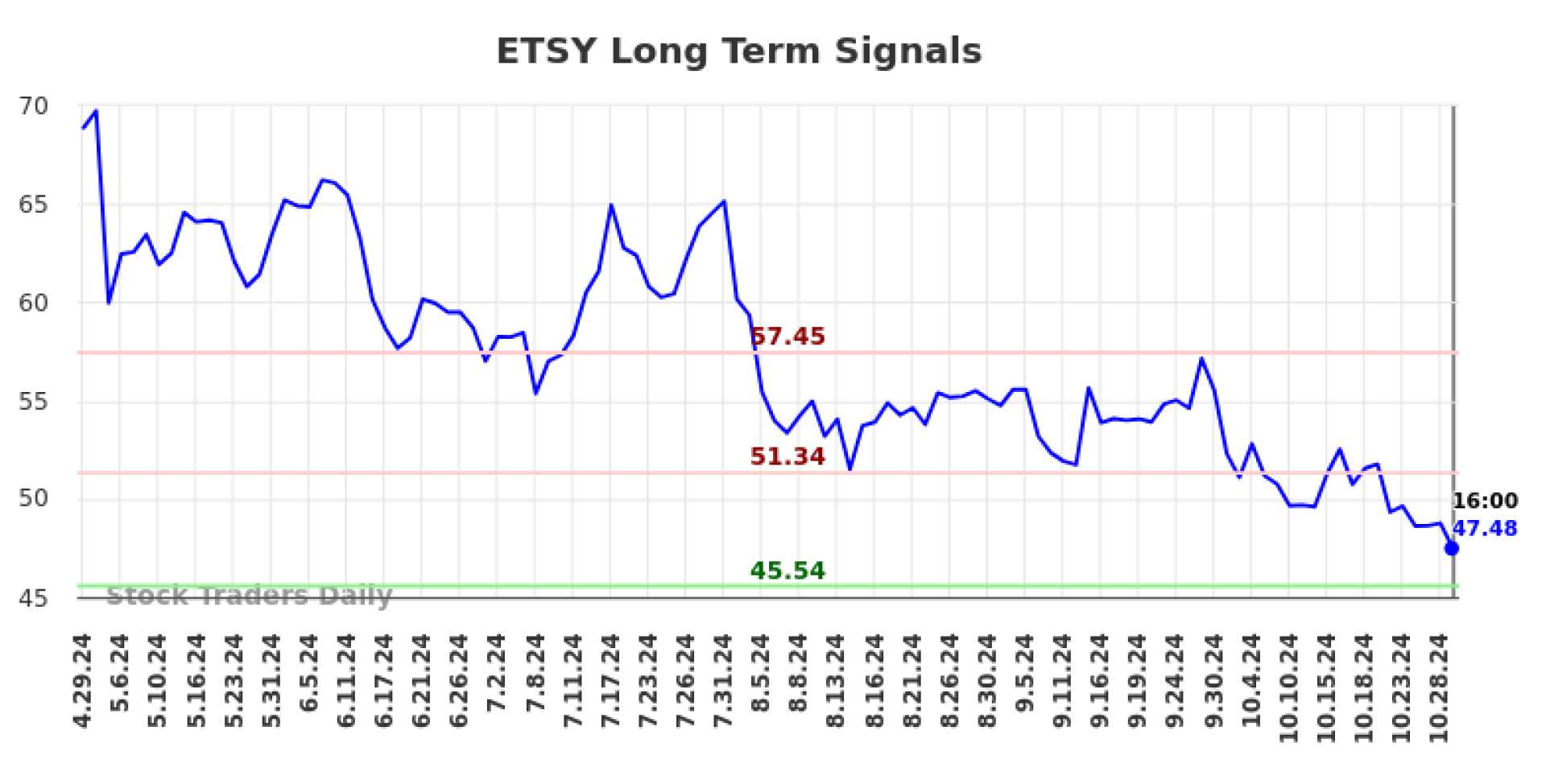

Etsy, Inc. (ETSY) has encountered significant challenges in recent days, marked by a downgrade from Goldman Sachs and the release of its third-quarter 2024 financial results. On October 30, 2024, Goldman Sachs downgraded Etsy’s stock from Neutral to Sell, citing concerns over margins and merchandise sales.

The company reported its Q3 2024 results, showing a decline in gross merchandise sales (GMS). Consolidated GMS stood at $2.9 billion, a 4.1% year-over-year decrease, with Etsy marketplace GMS dropping 6.0% to $2.5 billion.

Etsy’s stock has been under pressure, having fallen by around 80% from its highs in 2021. The stock is currently trading at levels last seen in April 2020, reflecting the company’s struggles in a competitive e-commerce landscape.

Despite the current downturn, analysts maintain a mixed outlook. The average 12-month price target for Etsy is $67.23, indicating a potential upside of 35.43% from the current price. However, the consensus rating among analysts is “Hold,” with some recommending caution due to the company’s slowing growth and increasing competition.

Etsy is exploring various strategies to revitalize its growth, including the launch of a loyalty program and the implementation of AI to enhance the shopping experience. CEO Josh Silverman has emphasized the importance of these initiatives in driving consumer engagement and sales.