Business

Expert Predictions on Silver Price Surge to $100 per Ounce

TORONTO, Canada — Keith Neumeyer, CEO of First Majestic Silver, forecasts silver could soar to $100 per ounce, driven by its industrial demand and the current market dynamics. Despite recent volatility, Neumeyer remains confident that silver’s price will eventually reflect its true value.

As of March 31, 2025, the spot price of silver had stabilized above $34, after reaching nearly $35 just a few months prior. Neumeyer emphasized that silver’s potential is not only driven by recent price fluctuations but also by strong fundamentals, including a persistent supply-demand deficit.

“I believe that silver’s market is fundamentally undervalued compared to gold, with significant industrial applications driving demand,” Neumeyer said during a recent interview. “We’re currently experiencing a major deficit in the silver market that is likely to worsen over the coming years.”

Currently, analysts report that the silver market faces a shortfall in supply, with consumption outpacing production. “In 2022, production was approximately 800 million ounces, while consumption was between 1.2 and 1.4 billion ounces,” Neumeyer explained, highlighting the burgeoning demand for silver in various technologies including electric vehicles and renewable energy systems.

The outlook for silver is further complicated by external factors such as geopolitical tensions and economic policies. These uncertainties have recently contributed to investor interest in precious metals as safe-haven assets. According to analysts, as the economic landscape becomes more unpredictable, demand for both silver and gold is expected to increase.

“Silver does not just react to market sentiment,” added Neumeyer. “Its value is intrinsically tied to its essential role in technology and its limited supply, which creates an ideal environment for price increases.”

The recent increase in industrial usage of silver, particularly in solar panel production, underscores its critical role in the move toward renewable energy. With global photovoltaic installations projected to rise significantly, Neumeyer believes this could push silver prices higher as manufacturers require more of the metal to enhance energy efficiency.

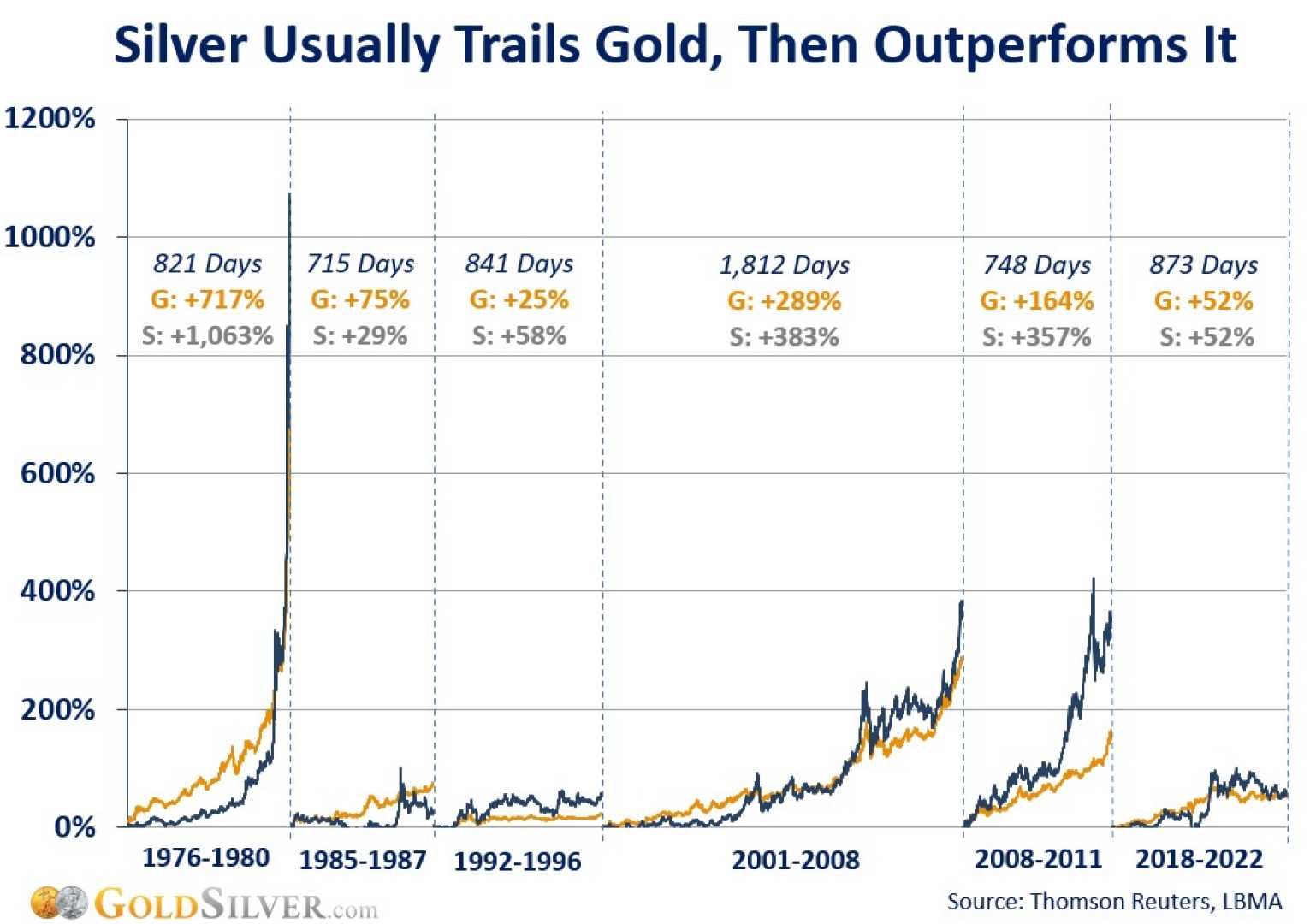

Despite the challenges of fluctuating prices, Neumeyer is not alone in his predictions about a potential silver price surge. Peter Krauth, a well-known analyst, echoed similar sentiments. “I predict we could see a dramatic increase in silver prices, potentially leading to a significant bull market,” Krauth mentioned, noting that the current market appears to mirror previous uptrends in precious metals.

However, not all market analysts share the same optimism. Some experts caution that while silver might see short-term surges, its long-term trajectory remains uncertain. They cite historical trends showing that silver can become volatile, particularly during periods of economic instability.

Investors are advised to conduct thorough research and consider their portfolios carefully, as the intrinsic value of silver fluctuates based on numerous external factors. The investment community remains divided, and while there are many believers in a bullish trend for silver, skepticism persists among conservative investors.

In conclusion, while Neumeyer’s assertion points towards a bright future for silver, analysts advise caution. Understanding the various dynamics at play is crucial for potential investors looking to enter the market.