Business

Expert Warns UK Risks Losing Economic Momentum Over Tax Policies

London, England – A financial expert warns that the UK could face economic stagnation if current tax policies remain unchanged. Jessica Cook, a wealth management adviser at AES International, emphasizes the importance of incentives in driving economic behavior in her recent article in The Times.

Cook notes that Chancellor of the Exchequer Rachel Reeves’s recent budget proposals threaten to raise barriers for taxpayers, potentially leading to reduced economic growth. She cites historical examples, such as the significant tax cuts implemented by Nigel Lawson in 1988, which resulted in a surge in economic growth.

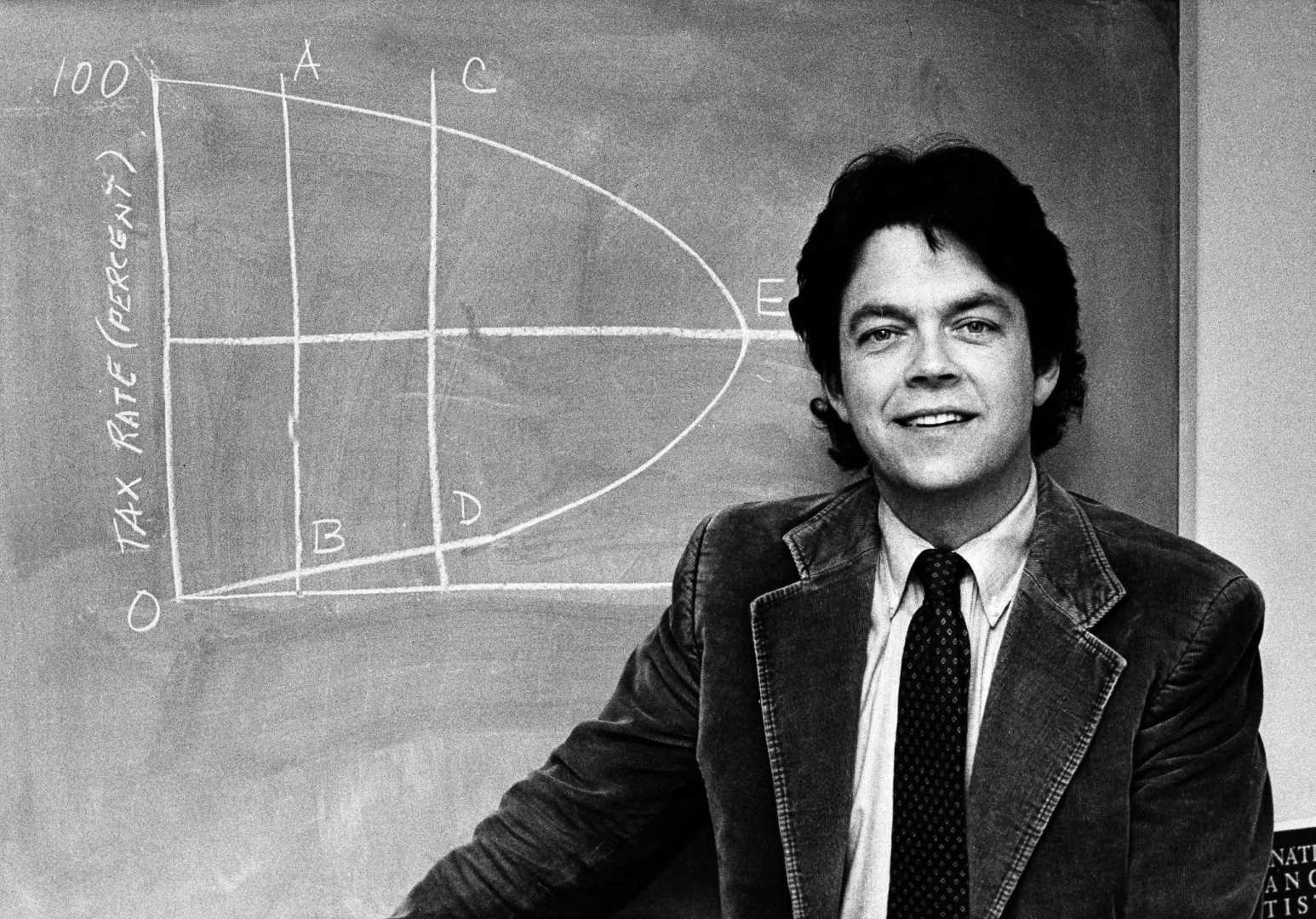

In her piece, Cook references the concept of the Laffer Curve, introduced by economist Arthur Laffer in the 1970s. Laffer illustrated that excessive taxation could discourage earning and investment, ultimately reducing government revenue.

“You can’t tax your way to growth any more than you can diet on cake,” Cook quotes an economist, highlighting the dangers of high taxation. She argues that the UK is not facing a shortage of taxpayers but a lack of confidence among them, which discourages productivity and economic aspiration.

Cook further explains that the Office for Budget Responsibility now considers ‘behavioral responses’ in its forecasts, indicating that high marginal tax rates significantly affect work incentives. Many individuals who are considered the backbone of the UK economy, including teachers, nurses, and small business owners, are feeling the pressure of diminishing returns on their hard work.

If the trend continues, Cook warns that the economic landscape could tilt negatively, resulting in a quiet withdrawal of effort from those who feel undervalued. “You can’t see fiscal drag on a payslip, but you can feel it,” she concludes, urging for a reevaluation of the current tax strategy.