Business

Experts Discuss AI Growth and Investment Opportunities Amid Market Evolution

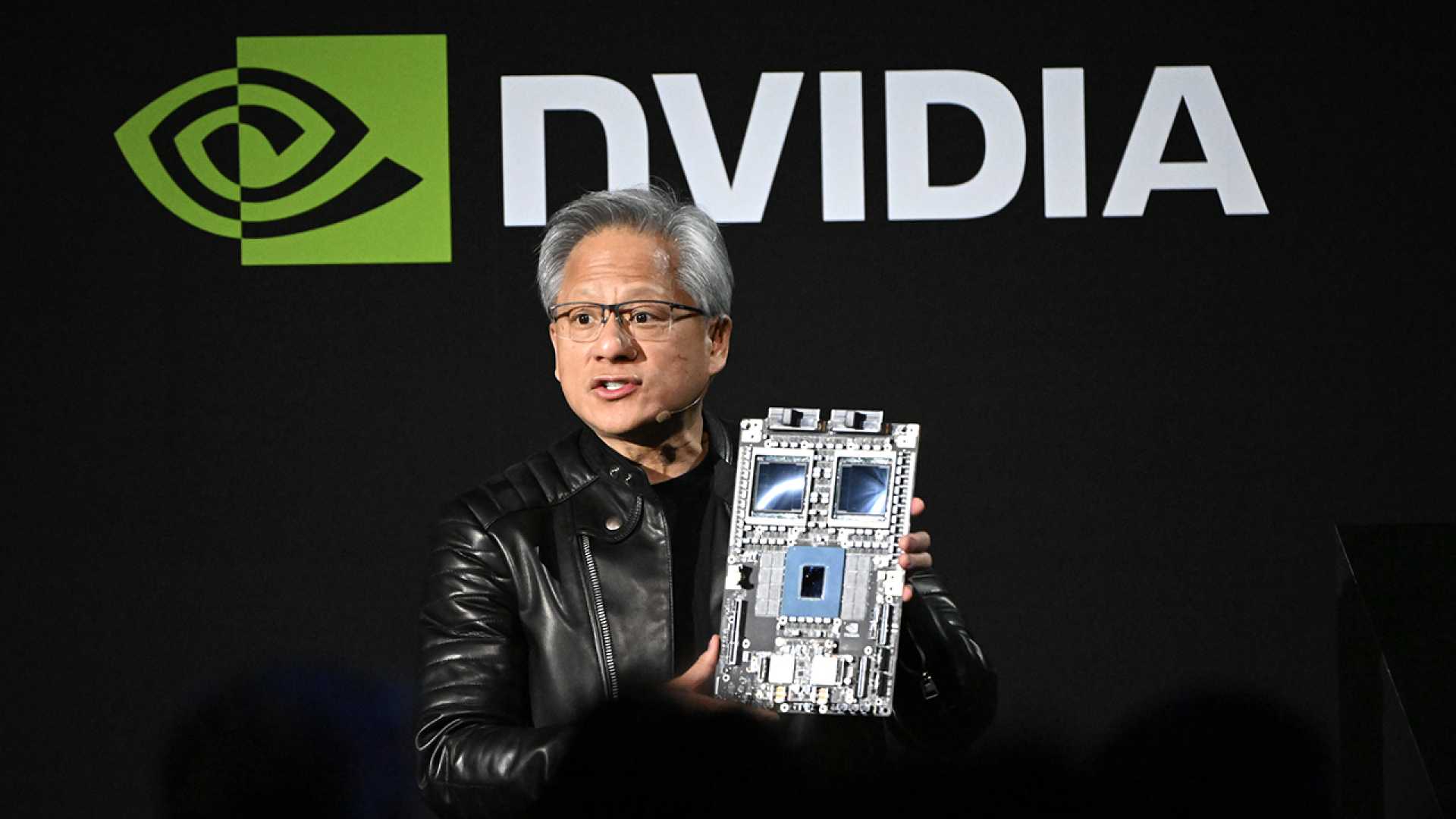

NEW YORK, NY – Gene Munster, managing partner at Deepwater Asset Management, recently shared insights on NVIDIA Corp (NASDAQ:NVDA) CEO Jensen Huang‘s appearance on CNBC. Munster expressed optimism following Huang’s comments on the growing demand for artificial intelligence (AI) and related investment opportunities.

During the interview, Munster addressed concerns regarding corporate debt in the AI sector, emphasizing that companies are not short on organic capital. He stated, “My sense is we’re not running out of organic capital… There are many investors who believe in the core growth story of AI.” Munster highlighted a recent investment in an OpenAI tender offer that drew twice the demand compared to its supply.

Huang indicated that a new generation of companies is poised to emerge as future giants in AI, which he believes will attract significant investment. NVIDIA currently commands about 90% of the GPU market, projected to be worth $3 to $4 trillion by 2030. McKinsey forecasts that data center capital expenditures could reach $6.7 trillion shortly.

The demand for NVIDIA’s next-generation GPU system, Blackwell, remains robust, fueled by the complexities of large language models and advanced reasoning applications. Munster revealed, “Reasoning tasks can require up to ten times more compute power than training a conventional large language model.”

Despite strong growth, NVIDIA reported a 56% revenue increase last quarter, down from nearly 100% year-over-year growth previously. Analysts continue to see NVIDIA benefiting from the ongoing AI infrastructure development.

As investment strategies continue to evolve, experts are noting that some AI stocks may hold more promise in delivering substantial returns. Investors are advised to explore potential opportunities before market trends shift.