Business

Exxon Mobil Stock: Fairly Valued with Potential for Growth

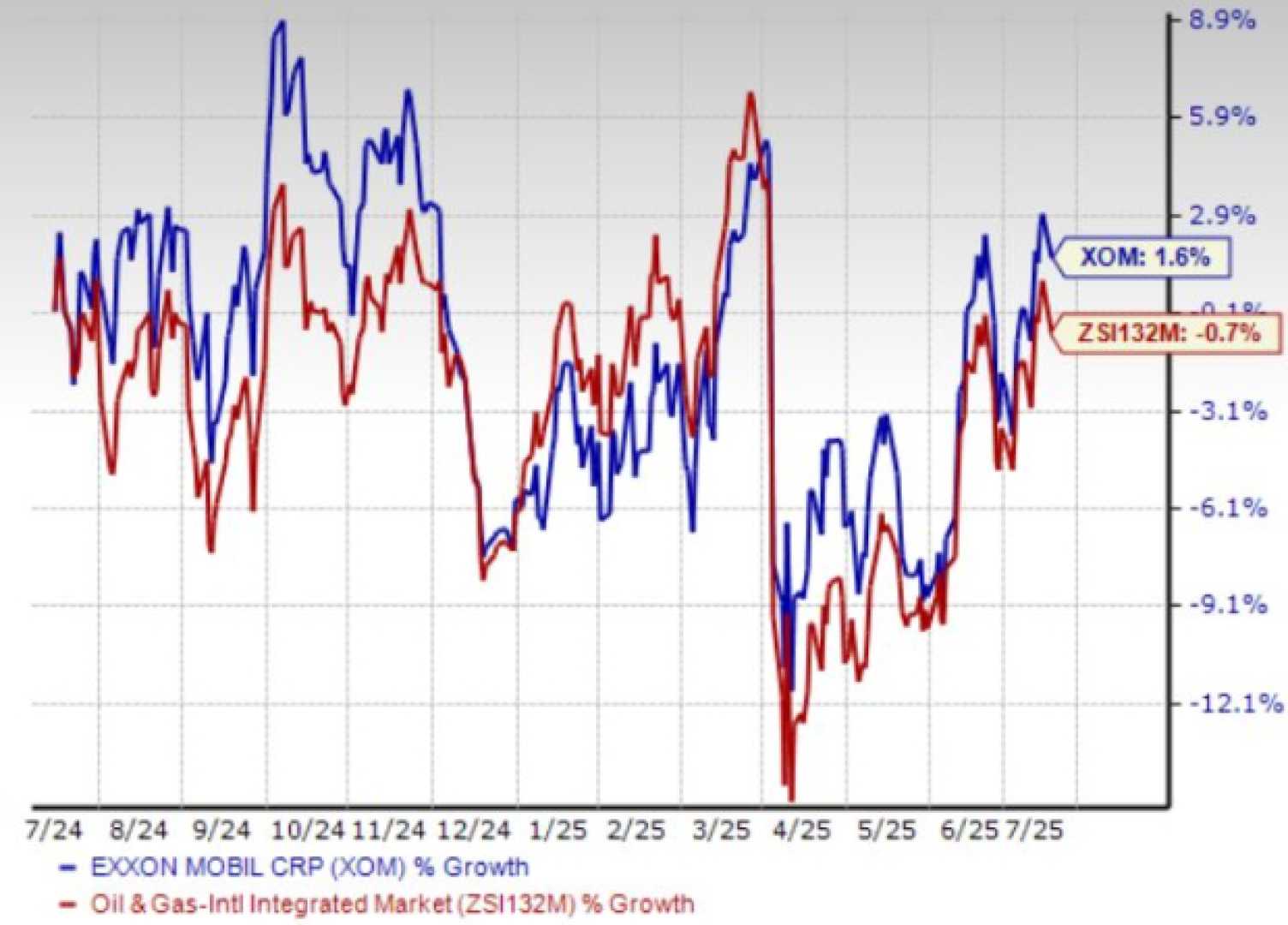

New York, NY – Exxon Mobil’s stock has seen substantial growth since 2021, increasing from around $52 to $80. The author of the analysis, who initially sold their shares at $80, expresses cautious optimism about the stock’s potential despite its recent upswing.

The author based their initial bullish outlook on Exxon Mobil’s strong fundamentals, which include its extensive global operations in oil and natural gas exploration, production, and distribution. Currently, the company’s market capitalization is approximately $489.1 billion, underscoring its significant role in the energy market.

According to Morgan Stanley, Exxon Mobil (NYSE:XOM) holds an “Overweight” rating, with an updated price target of $134, an increase from a previous target of $133. Energy analyst Ben Cook forecasts crude oil prices will reach $60 per barrel by the end of the year and has positive expectations for the following year, bolstered by rising energy demand from the AI sector.

However, Exxon Mobil faces challenges that could impact its production. The company has borrowed up to 1 million barrels of crude from the Strategic Petroleum Reserve (SPR) due to quality issues affecting Mars crude, an oil grade contaminated with high zinc levels. This situation has led to production reductions at Exxon’s Baton Rouge refinery, along with attempts to resell Mars crude cargoes in the spot market. The Department of Energy confirmed the loan to Exxon to prevent potential outages at the refinery.

Despite these logistical hurdles, Exxon Mobil’s strong market position, coupled with a positive outlook on energy prices, suggests that the company is well-positioned for future growth. Recently, the stock traded 988,720 shares on the NYSE, reflecting its active presence in the energy sector.

While Exxon Mobil is experiencing temporary challenges, analysts believe its strong fundamentals and favorable energy market conditions indicate that the stock remains fairly valued and could see renewed growth. Investors are advised to closely monitor the developments surrounding the company.