Business

Fannie Mae May Exit Conservatorship Soon: What Investors Need to Know

WASHINGTON, D.C. – Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is gaining significant attention from investors as it approaches a potential exit from government conservatorship. This anticipated move has raised questions about how it will impact the value of both common and preferred shares.

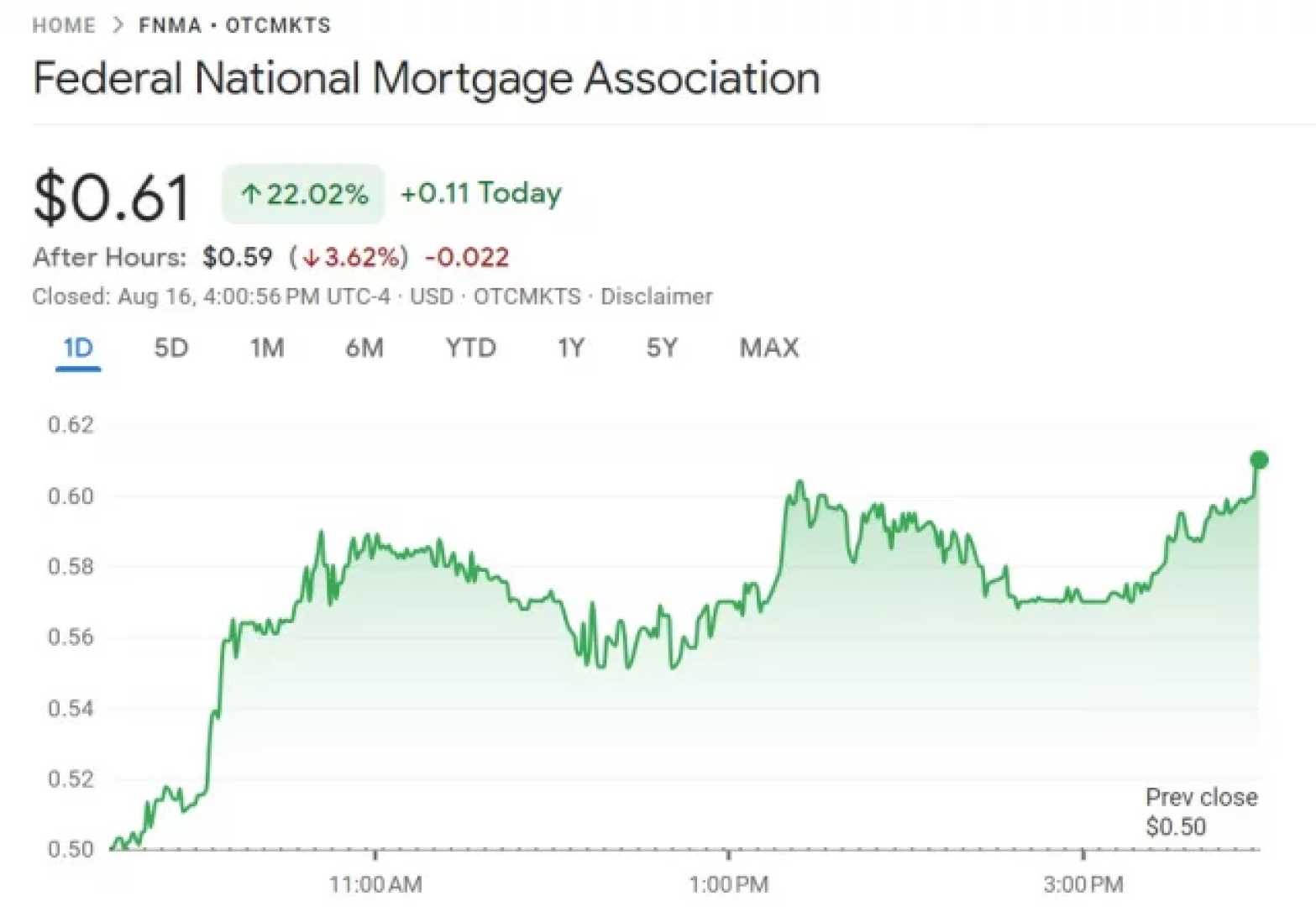

After a remarkable year in which Fannie Mae’s shares have surged 209.3%, the stock recently corrected, trading at $10.64 after a decline of 24.32% over the last month. Despite this short-term setback, experts suggest that the long-term outlook remains strong. Recent board appointments and technological integrations indicate that management is actively maneuvering to shape Fannie Mae’s future.

With shares currently valued below their book value, analysts are debating whether this pullback presents a hidden buying opportunity or if investors have already factored in future growth. Fannie Mae is noted for trading at a price-to-sales ratio of 2.1x, significantly lower than industry and peer averages, suggesting it may be undervalued.

This ratio is pivotal for evaluating a company’s worth, especially for financial services firms where profits may not always be consistent. Compared to the US Diversified Financial industry’s average of 2.5x, FNMA stands out. Regression analysis estimates a potential fair price-to-sales ratio as high as 7.4x, indicating room for revaluation if market sentiment improves.

However, ongoing government involvement and slightly conservative analyst price targets present challenges for immediate upside. Analysts caution that while the long-term looks promising, significant government interaction continues to influence Fannie Mae’s performance.

Investors interested in FNMA are encouraged to conduct thorough research and consider various data points before making financial decisions. Following financial news and using tools like the Simply Wall Street Screener can help investors identify hidden opportunities in the market.

This analysis aims to provide general information and should not be interpreted as financial advice. Readers are urged to analyze their financial situation and objectives before making investment decisions.