Business

Fear Grips CEOs Amid Trump’s Rapid Tariff Changes

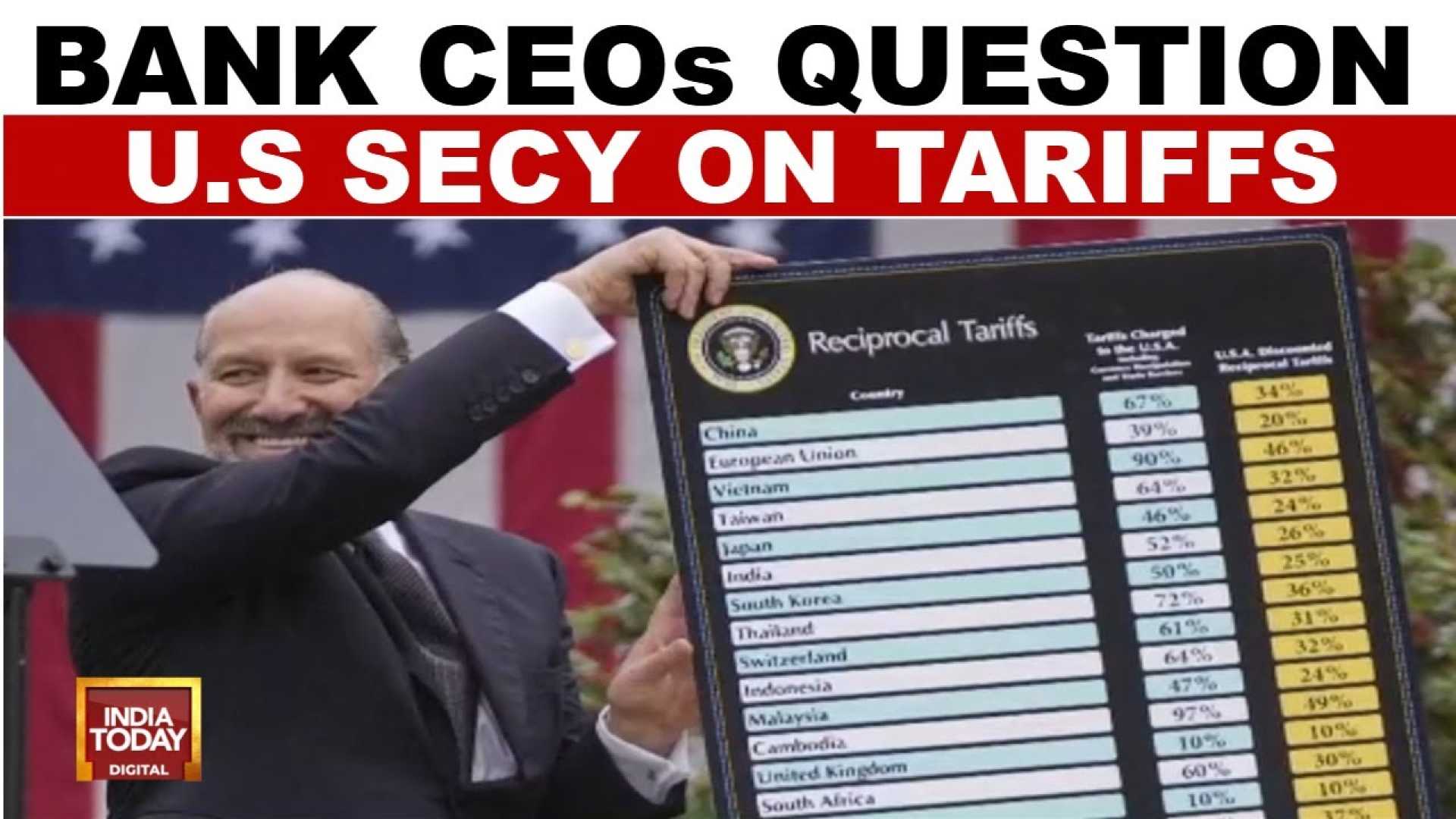

NEW YORK, NY — Uncertainty surrounding President Donald Trump‘s recent tariff announcements has cast a shadow over Wall Street, with corporate executives quietly voicing their concerns. Sources indicate that the magnitude of the tariffs, which could reshape trade dynamics with vital partners like China, the European Union, and Canada, has left CEOs anxious about the coming economic impact.

The discussion of tariffs intensified following an announcement last Thursday that triggered global market selloffs, leading to a surge of meetings among top executives from major banks, including Jamie Dimon of JPMorgan Chase, Brian Moynihan of Bank of America, and David Solomon of Goldman Sachs. These leaders are reportedly gathering insights from corporate clients about their reactions and strategic adjustments amid escalating trade tensions.

“They don’t want to catch the ire of Trump, so they are laying low,” shared a senior executive from one major bank, highlighting the precarious balancing act between public relations and political realities.

Trump’s announcement of substantial tariffs — initially seen as a temporary measure — has prompted businesses to reconsider budgets and expenditures drastically. Even before the tariff rollout, many companies were already cutting back spending. Now, with potential tariffs exceeding initial expectations of 20%, increased market volatility looms.

The implications are dire. Economists warn of a risk of stagflation resembling the 1970s, where higher prices lead to diminished consumer purchasing power, this issue exacerbated by tariffs that affect both imports and exports. “We could get stagflation like we had in the 1970s — slower growth combined with more inflation,” one analyst noted.

The senior leadership’s public optimism starkly contrasts with the private apprehension expressed to clients. Jamie Dimon, who is usually outspoken, has adopted a more reserved tone, while Moynihan and Solomon have also muted their criticisms of Trump, likely fearing repercussions from the administration.

Despite the silence from major financial players, discontent is brewing within the Republican Party. Seven GOP senators, including Senate President pro tempore Chuck Grassley, have proposed bipartisan legislation to curb the unilateral tariff powers of the president, arguing that tariffs should require Congressional approval — a constitutional requirement that they believe Trump is bypassing.

“It is time they take a vote and show their constituents whether or not they support the ‘economic pain’ President Trump is inflicting on American families,” stated Representative Gregory Meeks, advocating for a decisive vote on Trump’s tariff measures.

Business owners are already feeling the pinch. An influx of small business owners has taken to social media platforms like Reddit to express fears over potential closures due to the tariffs. Many are struggling to cope with the added costs of imported goods and are seeking advice on how to adapt.

“I created my small business selling bamboo products, but these tariffs could drive me to closure,” one user lamented.

Additionally, the complexity of international trade means businesses are grappling with unexpected disruptions; for instance, one entrepreneur learned that a major Chinese distributor would cease supplying products to the U.S. market altogether.

Amid all this turmoil, the pressure mounts. The White House maintains that these tariffs will ultimately benefit the economy, but the economic damage already being reported questions that assertion. As trade conflicts deepen, CEOs will likely face mounting pressure to navigate their companies through these uncertain waters.